|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Ondo Finance Governance Token Soars Following Seamless Integration with BlackRock's BUIDL Token

Apr 12, 2024 at 06:05 am

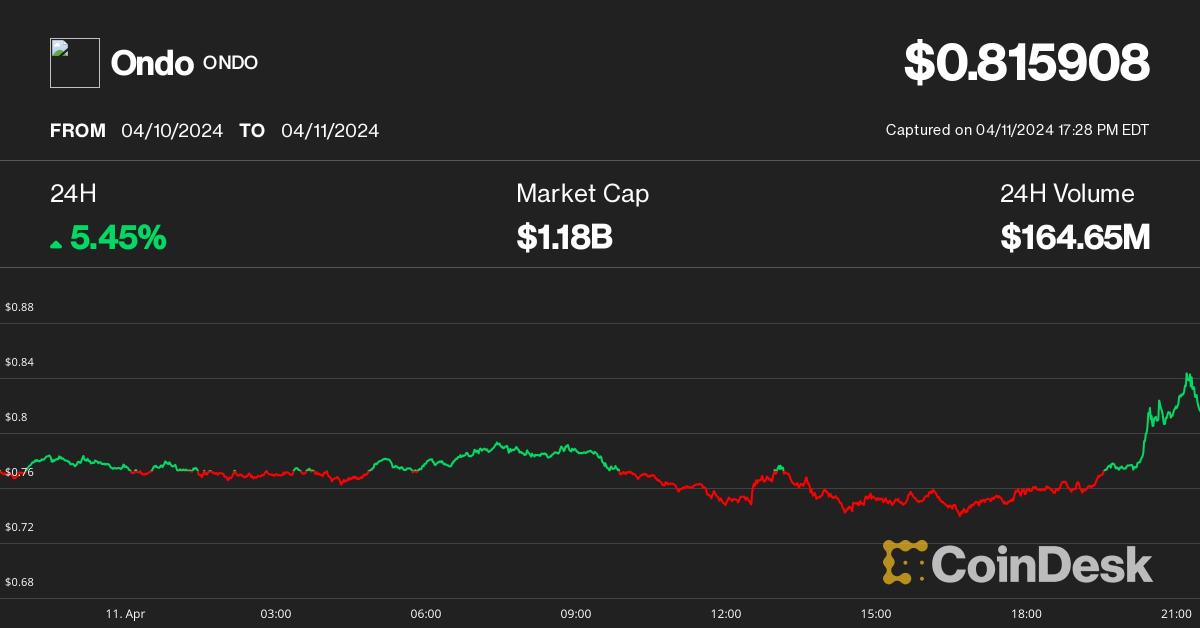

In a recent development, Ondo Finance's governance token (ONDO) experienced an upward trend following the platform's successful testing of instant conversions between USDC and BlackRock's BUIDL tokens. As part of the test, an Ondo wallet on Ethereum converted $250,000 worth of BUIDL tokens to USDC, demonstrating the compatibility between Circle's stablecoin and BlackRock's tokenized fund.

Ondo Finance's Governance Token Spikes After Successful Tokenization Integration

On Thursday, April 11, 2024, the governance token of Ondo Finance (ONDO) experienced a significant rise in value following the platform's successful implementation of near-instant conversions between Circle's USDC stablecoin and BlackRock's newly launched BUIDL token.

According to data from Etherscan, an Ethereum block explorer, an Ondo wallet redeemed $250,000 worth of BUIDL tokens in exchange for USDC. This transaction marked the first official utilization of the USDC-to-BUIDL conversion feature announced by Circle earlier that day.

"We are employing this feature to facilitate instant and continuous redemptions of OUSG tokens into USDC," stated Nathan Allman, CEO of Ondo Finance, via Telegram. OUSG refers to the Ondo Short-Term U.S. Government Treasuries token, an asset-backed token secured by U.S. government securities.

The news of the successful transaction quickly spread through social media platforms within the cryptocurrency community, leading to a surge in ONDO's value. The token initially gained 8%, retracing slightly thereafter.

"From Blackrock to Ondo Finance," exclaimed Pedro DC, a prominent cryptocurrency influencer, in a tweet accompanied by a screenshot of the transaction.

BlackRock, a global financial behemoth, entered the asset tokenization arena last month, attracting significant attention within the cryptocurrency sector. Asset tokenization involves converting traditional financial instruments, such as bonds, credit, and commodities, into blockchain-based tokens.

The BlackRock USD Institutional Digital Liquidity Fund, established in collaboration with Securitize, a tokenization firm, comprises cash, U.S. Treasury bills, and repurchase agreements. Investments in the fund are represented by the Ethereum-based BUIDL token, which distributes yield to token holders daily via blockchain infrastructure.

Ondo Finance was among the early adopters of the BlackRock fund, integrating it as an underlying asset for its OUSG token. The successful implementation of near-instant conversions between USDC and BUIDL further underscores the transformative potential of tokenization and its ability to enhance liquidity and efficiency in traditional financial markets.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- A Response to the Crypto Bloodbath: How Aureal One Stands Out

- Dec 27, 2024 at 07:25 pm

- As Bitcoin and other altcoins experienced significant liquidations due to leveraged trades, $1.38 billion came from long positions. Amid this downturn, Aureal One quietly gained momentum, standing out in the crypto space.

-

-

-

-

-

-

- The Next Crypto Bull Run Is Just Around the Corner and Will Present Opportunities No One Has Ever Seen

- Dec 27, 2024 at 07:15 pm

- Since Bitcoin is on a bullish trend, other altcoins are also set to join the party. Out of all the top choices, the Aureal One (DLUME) is the one that is positioned as the ultimate future winner and racking up huge returns.

-