According to Glassnode co-founders Jan Happel and Yann Allemann, the crypto market is poised for a significant upswing. They believe the current market conditions resemble the 2021 correction, which they identify as wave 4 of the market cycle. Based on their proprietary index and Fibonacci levels, they anticipate a substantial rally of approximately 350% from current market levels.

Amidst a period of heightened volatility and uncertainty in the cryptocurrency market, the founders of Glassnode, Jan Happel and Yann Allemann, have posited that the crypto bull market remains intact. Drawing parallels to a significant market correction in early 2021, they foresee a substantial rally in the near term.

Based on proprietary indices and Fibonacci levels, the co-founders project a potential surge of approximately 350% from current market levels. This bullish outlook emerges despite recent turbulence in the wake of Bitcoin's halving event, where block rewards were reduced by 50%.

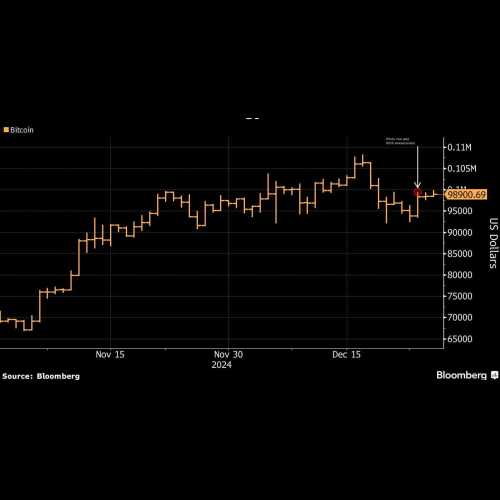

As investors and traders seek indicators of an impending price explosion, it is crucial to note that at the time of writing, Bitcoin was trading at $66,826, a decline of approximately 9.7% from its all-time high of $73,737, yet still up 2.5% in the preceding 24 hours. The broader crypto market also exhibited a positive trend, with the global market capitalization standing at $2.44 trillion, representing a modest 2.7% gain.

One lingering query that remains unanswered is whether the fourth Bitcoin halving has been priced into the market. While the actual impact remains uncertain, historical data reveals a pattern of significant price rallies following previous halving events, though not necessarily immediate.

Analysts and market observers continue to monitor market movements closely, seeking to decipher the potential implications of the halving event and its ramifications for the overall trajectory of the cryptocurrency market. The coming weeks and months will be critical in shaping the narrative and determining the direction of the crypto bull market.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any

investments made based on the information provided in this article. Cryptocurrencies are highly volatile

and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us

immediately (info@kdj.com) and we will delete it promptly.