|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

On March 20, 2025, Invesco’s Bitcoin ETF had a major outflow of $10.2 million

Mar 21, 2025 at 12:30 pm

Within two hours, a 1.2% drop in the price of Bitcoin from $65,080.25 to $64,320.75 provoked a violent market reaction.

The crypto market experienced a major shift on March 20, 2025, as Invesco’s Bitcoin ETF saw a large outflow of $10.2 million.

Within two hours, the price of Bitcoin dropped by 1.2% from $65,080.25 to $64,320.75, which sparked a violent market reaction. Reflecting the rising volatility, the event also accelerated trade volumes on prominent exchange sites like Coinbase and Binance.

At 14:00 (UTC), the total crypto market capitalization decreased by 0.5%, reaching $2.3 trillion.

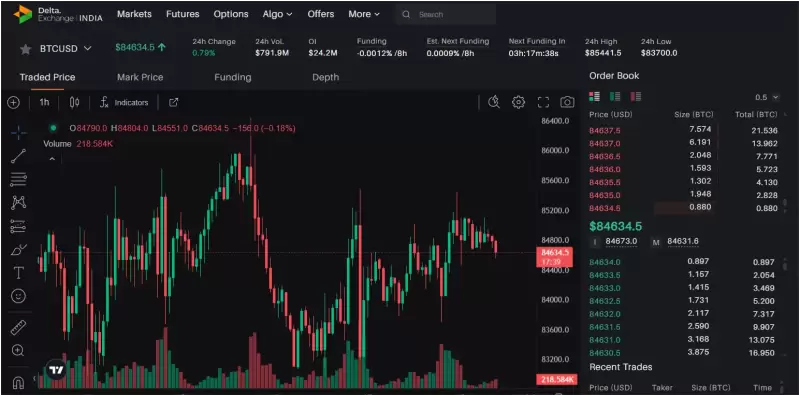

The chart shows that the major outflows from Bitcoin ETFs continued on March 20, with Invesco’s Bitcoin ETF reporting an outflow of $10.2 million.

Farside Investors explained that this was one example of a more sweeping development, as on that same day, Bitcoin ETFs experienced a total of $23.5 million of outflows.

This great exodus significantly affected the value of Bitcoin, causing the price to fall by 1.2%. By 14:00 UTC, CoinMarketCap data showed that Bitcoin traded at $64,320.75, showing the bearish attitude rippling through the market.

At the same moment, notable exchanges’ trading activity soared. Coinbase logged 12,780 BTC over the same period and Binance 32,450 BTC. Given the surge in activity, traders were obviously responding quickly to the ETF news.

As market participants shifted their holdings, the volume on the BTC/USDT and BTC/ETH trading pairs increased by 5% and 3%, respectively.

After the outflow, the crypto market experienced increased volatility throughout. Bollinger Bands grew by 10%, which indicated more volatility in prices.

With an RSI of 45, bitcoin pointed to a possible oversold state that could draw bargain hunters. Moreover, the Moving Average Convergence Divergence (MACD) turned negative at -150, strengthening the near-term bearish perspective.

Forming at 15:30 UTC, a ‘death cross’—normally bearish—occurred when the 50-day moving mean crossed below the 200-day moving average, technical patterns validated the downward trend.

Despite the negative perception, the hash rate of the Bitcoin network remained constant at 250 EH/s, which pointed to no swift alteration in mining activity.

On the other hand, on-chain data from Glassnode indicated a 2% drop in active addresses and a 1.5% decrease in transaction volume, showing less engagement in the network.for all the data and disclaimers visit:https://t.co/04S8jMGSPF

The widespread effects of ETF outflows move beyond the instability of immediate price. The network Value to Transaction (NVT) ratio increased by 5%; Bitcoin seems to be trading at a premium regarding its transaction activity, which is often ahead of further improvements.

Analysts are closely following the AI-powered trading strategy, which can reduce some following pressure by identifying buying opportunities in oversold conditions.

Moreover, AI Market insights increased the AI-powered crypto trading volume by 10% in the past month. This suggests that the algorithm trade can play a major role in stabilizing Bitcoin prices. Cryptocwant’s correlation analysis shows that AI-related tokens maintain a 0.7 correlation coefficient with SingleuretNet (AGIX) and Fech.AI (FET) Bitcoin, potentially offering a hedge against its instability.

Moving forward, market participants will look for more ETF outflows and technical indicators to gauge Bitcoin’s upcoming price movement.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- The Dogecoin price (DOGE) demonstrates readiness for a major recovery as this meme coin draws constant public attention.

- Apr 18, 2025 at 07:10 pm

- Research analysts expect Dogecoin to reach its historical price target of $1 by summer 2025. The present Dogecoin chart shows evidence that predicts price resilience

-

- Bitcoin (BTC) Is Accumulating Liquidity Below Current Range, Setting the Stage for a Potentially Explosive Move

- Apr 18, 2025 at 07:10 pm

- Sometimes, the market just needs a little time to breathe. That’s exactly what Bitcoin has been doing lately—taking its sweet time, accumulating liquidity and quietly setting the stage for a potentially explosive move.

-

-

-