|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Marc Zeller Unveils Aave's Tokenomics Revamp Proposal, Including a New Revenue Redistribution Model

Mar 05, 2025 at 02:28 am

Marc Zeller, the founder of Aave Chan Initiative (ACI), unveiled a proposal for Aave's tokenomics revamp on March 4, which would include a new revenue redistribution model

Marc Zeller, the founder of Aave Chan Initiative (ACI), has unveiled a proposal for Aave's tokenomics revamp, which would include a new revenue redistribution model, an “Umbrella” safety system to protect against bank runs, and the creation of the “Aave Finance Committee” (AFC). The proposal is part of Aave's ongoing tokenomics overhaul and is subject to community approval.

On Saturday, Zeller, a prominent member of the Aave community, took to X, formerly Twitter, to highlight the significance of the proposal.

"The MOST IMPORTANT proposal in Aave's history has been put forth today. This proposal is the culmination of several months of work and discussion with many community members," he said.

The proposal aims to keep the previous distribution for GHO stakers, also called the “Merit” program, and adds a new token called Anti-GHO, which is a non-transferrable ERC-20 token. As the proposal notes, “Anti-GHO will be generated by all AAVE and StkBPT Stakers.”

Zeller said that the current cash reserves in Aave's decentralized autonomous organization (DAO) should cover both the Merit program rewards and Anti-GHO generation.

According to the proposal, the cash portion of the Aave DAO has increased by 115% since August 2024. As a lending protocol, Aave generates revenue from interest fees incurred from loans and liquidations.

Umbrella, a new version of the Aave safety module, would be able to protect users from bad debt “up to billions,” according to the proposal. It would also create a commitment of liquidity that would remain in the protocol until “cooldown maturity.” In Zeller’s view, this will make bank runs “less harmful” and allow for the building of new products and revenue streams.

In addition, Zeller proposed a token buyback and redistribution plan. “While staying extremely conservative with Aave treasury funds, the ACI considers this proposal can mandate the AFC to start an AAVE buyback and distribute program immediately at the pace of $1M/week for the first 6 months of the mandate,” Zeller said.

The proposal would allow the AFC “to execute and/or work with market makers to buy AAVE tokens on secondary markets and distribute them to the ecosystem reserve.” TokenLogic, a financial services provider for the Aave DAO, would “size these buybacks according to the protocol's overall budget, with the objective to eventually match — and even surpass — all protocol AAVE spending.”

DeFi lending protocols have $39.5 billion in total value locked (TVL), according to DeFi analytics platform DefiLlama. The data shows that TVL in DeFi lending protocols has decreased from $10.6 billion on Dec. 30, 2022.

Aave, which runs on 14 blockchains, ranks No. 1 for TVL with $17.5 billion and has amassed $8.3 million in fees in the past seven days. In January 2025, the protocol hit $33.4 billion in net deposits, surpassing 2021 levels.

JustLend ranks a distant No. 2 in TVL with $3.5 billion locked.

DeFi has been on the rise for a couple of years, with various companies betting on this sector of crypto for the future. Uniswap unveiled its Ethereum layer-2, Unichain, which caters to DeFi users, while Kraken launched its own Ethereum L2 called Ink, which is seeking market share in the same sector.

Lending protocols serve a particular function, permitting loans in the form of crypto between different users in a peer-to-peer format. This allows borrowers to customize the terms of their loans, the loan amounts and even the interest rates.

Various DeFi protocols are starting to engage with buybacks in order to increase investor confidence and allow stakeholders to share in revenue. In December 2024, Ether.fi pitched buybacks for ETHFI stakers, and in February 2025, it was revealed that Jupiter, a DeFi exchange on Solana, is projected to buy back $100 million in tokens annually, creating demand.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- The Lazarus Group has already laundered all the unfrozen funds it stole from the recent Bybit hack

- Mar 05, 2025 at 10:25 am

- Arkhaim Intelligence, the blockchain analytics platform, revealed a new development in the recent Bybit hack. The firm posted a bounty for information about the incident, discovering that the Lazarus Group was responsible.

-

-

-

![Bitcoin's [BTC] price has been 'extremely' volatile lately, and exchange flows reveal why Bitcoin's [BTC] price has been 'extremely' volatile lately, and exchange flows reveal why](/assets/pc/images/moren/280_160.png)

- Bitcoin's [BTC] price has been 'extremely' volatile lately, and exchange flows reveal why

- Mar 05, 2025 at 10:25 am

- Bitcoin's [BTC] price has been 'extremely' volatile lately, and exchange flows reveal why. On the 25th of February, approximately 8.4K BTC moved into exchanges, signaling sell pressure.

-

-

-

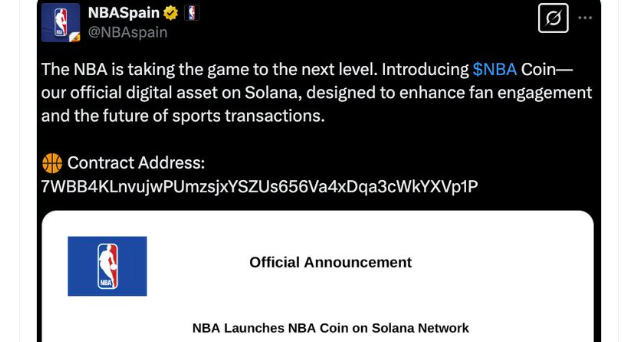

- NBA and NASCAR Coins Were Red Hot, but Buzz About New Coins Was Quickly Attributed to Hacked Social Media Accounts

- Mar 05, 2025 at 10:25 am

- Crypto coins and digital currency are red-hot, but buzz about new NBA and NASCAR coins Tuesday was quickly attributed to their respective social media accounts being hacked.

![Bitcoin's [BTC] price has been 'extremely' volatile lately, and exchange flows reveal why Bitcoin's [BTC] price has been 'extremely' volatile lately, and exchange flows reveal why](/uploads/2025/03/05/cryptocurrencies-news/articles/bitcoin-btc-price-extremely-volatile-exchange-flows-reveal/img-1_800_480.jpg)