|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Mantra's OM Token Experiences a Catastrophic Crash, Plunging 90%

Apr 14, 2025 at 05:17 pm

On Sunday evening, Mantra's OM token experienced a catastrophic crash, plunging more than 90% in a matter of hours and triggering over $71.8 million in liquidations.

On Sunday evening, Mantra's OM token experienced a catastrophic crash, plunging more than 90% in a matter of hours and triggering over $71.8 million in liquidations. The token, which was trading around $6.30 yesterday, now sits at approximately $0.70, with its market capitalization drastically reduced from nearly $6 billion to just $683.09 million.

Source: CoinMarketCap Mantra Price

OKX Exchange Issues Statement on Price Collapse

The exchange noted that the initial price drop occurred around 2:28:32 am (UTC+8) on April 14, with "a rapid price drop and increased trading volume first appearing on other exchanges, followed by a sharp drop of more than 80% in the entire market in a short period of time."

In response to these risks, OKX has "adjusted a series of risk control parameters" and added risk warnings on the OM token page. The exchange emphasized that "recent market risks are relatively high, and some tokens may have significant changes in token supply, which will have substantial fluctuations and impacts on token prices."

Forced Liquidations Blamed

Mantra's co-founder, John Patrick Mullin, quickly addressed the situation through the project's official channels, attributing the collapse to "reckless forced closures by central exchanges on OM account holders" rather than any action by the team.

According to data from Coinglass, the crash resulted in more than $74.7 million in liquidations over the past 24 hours, with ten positions each experiencing liquidations exceeding $1 million.

Source: Coinglass

Team Denies 'Rug Pull' Allegations

Market investor Gordon compared the situation to previous crypto disasters, writing: "[The] team needs to address this or OM looks like it could head to zero, biggest rug pull since LUNA/FTX?"

Mantra executives have firmly denied these allegations, with Mullin providing verification addresses for the team's token holdings to prove they remain locked as scheduled. "To be clear, this dislocation was not caused by the team, the MANTRA Chain Association, its core advisors, or MANTRA's investors selling tokens. Tokens remain locked and subject to the published vesting periods," the team stated in their community update.

Arkham Intelligence data indicates Mantra DAO had burned approximately 21 million OM tokens in separate transactions on April 2, although this appears unrelated to the current crisis.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- Bitcoin (BTC) Faces a Critical Test as Global Markets Remain Volatile and Macroeconomic Tensions Escalate

- Apr 16, 2025 at 01:15 pm

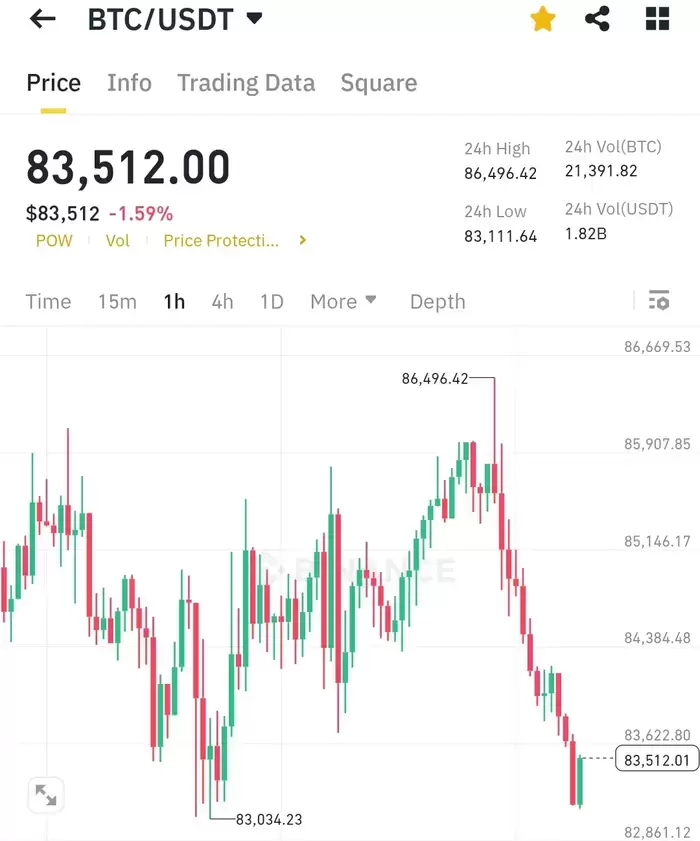

- Bitcoin is facing a critical test as global markets remain volatile and macroeconomic tensions escalate. After weeks of price swings and uncertainty, BTC is trading above the $85,000 level — a psychological and technical threshold that bulls have managed to defend.

-

- Bitcoin (BTC) has been moving between $80,00 and $85,00 for the fourth day as the uncertain market for the U.S.-China trade dispute continues.

- Apr 16, 2025 at 01:10 pm

- In the meantime, most of the world's transactions are from de facto kimchi coins from Korean exchanges. All of the top coins in the upbit growth rate over the past week were also taken up by coins with a high share of Korean transactions.

-

- MicroStrategy (Formerly ) Doubles Down on BTC After a Performance in Q1 2025

- Apr 16, 2025 at 01:10 pm

- Bitcoin price consolidates above $83,500 on Tuesday as MicroStrategy doubles down on BTC after a lull performance in Q1 2025. With institutional confidence as analysts forecast a parabolic BTC rally toward $90,000.

-

-

- Semler Scientific Files to Issue $500M in Securities Following $30M DOJ Settlement

- Apr 16, 2025 at 01:05 pm

- Semler Scientific has filed with the U.S. Securities and Exchange Commission (SEC) to issue $500 million in securities. This move follows the company’s announcement of a $30 million settlement with the Department of Justice (DOJ).

-

-

-