|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Mantra DAO's OM token crashes 90% in a single day, wiping out nearly $6 billion from its market capitalization

Apr 14, 2025 at 05:28 pm

Trading at approximately $6 before the collapse, the token hit a low of $0.37 on April 13, 2025, before recovering slightly to around $0.80

Part of the cryptocurrency world was left reeling after the OM token, issued by Mantra DAO, suffered a staggering 90% decline in value over the course of a single day.

After reaching a high of around $6, the token plummeted to a low of $0.37 on April 13, 2025, before recovering slightly to trade at approximately $0.80, according to data from CoinMarketCap.

This rapid price collapse resulted in a nearly $6 billion wipeout from the token’s market capitalization, leaving investors in disbelief and sparking widespread alarm within the crypto community.

The CEO of Mantra DAO, JP Mullin, has attributed the crash to forced liquidations initiated by centralized exchanges.

In a statement released on Friday, Mullin strongly contested claims that the OM token sell-off was connected to token sales by the Mantra team or its investors.

He asserted that the OM tokens remain locked in accordance with the project’s vesting schedule, adding that no changes have been made to the token’s economic structure.

Despite the turbulent period, Mullin expressed Mantra DAO’s unwavering long-term commitment to the ecosystem and called for community support during this challenging time.

“We have determined that the OM market movements were triggered by reckless forced closures initiated by centralized exchanges on OM account holders,” Mullin explained.

“The timing and depth of the crash suggest that sudden account closures were carried out without adequate warning, particularly during low-liquidity hours on a Sunday evening UTC (early morning Asia time). This points to negligence at best—or perhaps intentional market manipulation by centralized exchanges.”

However, some analysts have presented a differing perspective on the events leading up to the OM token crash.

Max Brown, a respected crypto analyst, reported that the sell-off commenced when 3.9 million OM tokens were deposited on OKX by a wallet allegedly linked to the Mantra team.

This move sparked concerns among traders, considering the team’s reported control of nearly 90% of the total OM token supply.

As a result, traders panicked and initiated a mass sell-off, leading to a rapid decline in the token’s price.

In response to these claims, Mullin remained adamant in his denial, stating, “To be clear, this dislocation was not caused by the team, the MANTRA Chain Association, its core advisors, or Mantra’s investors selling tokens. Tokens remain locked and subject to the published vesting periods. OM’s tokenomics remain intact, as shared last week in our latest token report. Our token wallet addresses are online and visible.”

The crash has left many investors questioning the stability and transparency of the OM token and its ecosystem.

Analysts believe that the incident exposed the vulnerabilities of cryptocurrencies to the practices of centralized exchanges, particularly forced liquidations during periods of low liquidity.

In the aftermath of the events, Mantra DAO’s leadership has promised to conduct a thorough investigation and ensure that any necessary corrective actions are taken to mitigate the situation and regain the trust of the community.

Amid a flurry of allegations and contradicting reports, the primary focus now lies on restoring confidence in the project and stabilizing the performance of the OM token in the market.

Meanwhile, the broader crypto industry continues to observe the situation closely, as this event serves as a stark warning about the potential risks of market manipulation and the crucial importance of safeguarding decentralized financial ecosystems from external interference.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- Ripple Eyes a Landmark SEC Settlement Paid in XRP as CEO Brad Garlinghouse Boldly Forecasts Bitcoin Hitting $200,000

- Apr 16, 2025 at 01:25 pm

- Ripple Chief Executive Brad Garlinghouse said the company’s settlement with the U.S. Securities and Exchange Commission (SEC) could potentially involve payment in XRP. He also offered a bullish outlook on bitcoin’s future price during an April 10 interview with Fox Business.

-

-

-

- Fresh From Convincing GameStop to Buy Bitcoin, Strive Asset Management CEO Matt Cole Now Wants Intuit to Do the Same

- Apr 16, 2025 at 01:20 pm

- input: Fresh from successfully convincing game retailer GameStop to add Bitcoin to its balance sheet, Strive Asset Management CEO Matt Cole has now set his sights on fintech firm Intuit to do the same.

-

-

- Bitcoin (BTC) Faces a Critical Test as Global Markets Remain Volatile and Macroeconomic Tensions Escalate

- Apr 16, 2025 at 01:15 pm

- Bitcoin is facing a critical test as global markets remain volatile and macroeconomic tensions escalate. After weeks of price swings and uncertainty, BTC is trading above the $85,000 level — a psychological and technical threshold that bulls have managed to defend.

-

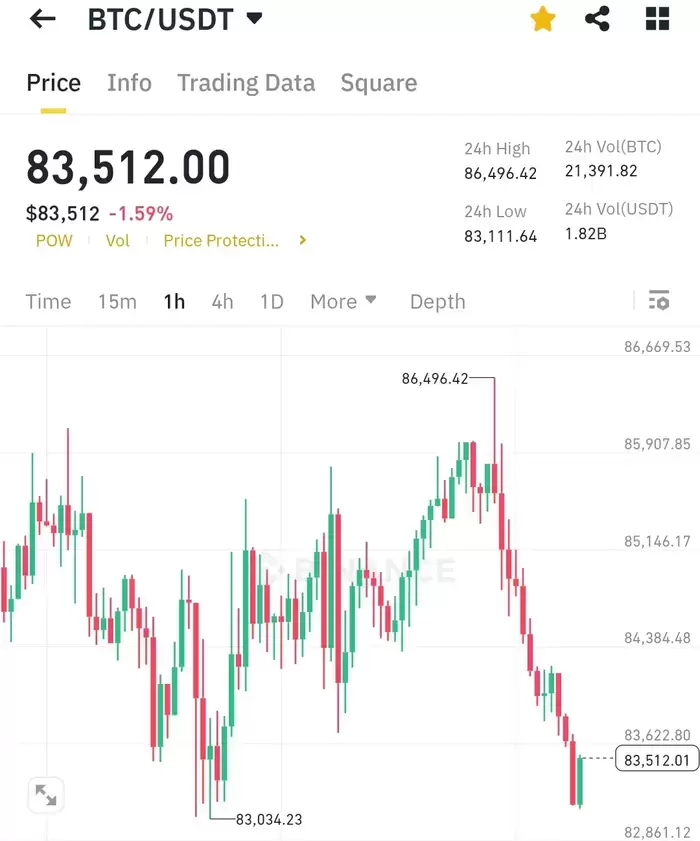

- Bitcoin (BTC) has been moving between $80,00 and $85,00 for the fourth day as the uncertain market for the U.S.-China trade dispute continues.

- Apr 16, 2025 at 01:10 pm

- In the meantime, most of the world's transactions are from de facto kimchi coins from Korean exchanges. All of the top coins in the upbit growth rate over the past week were also taken up by coins with a high share of Korean transactions.