|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

MakerDAO's $1B Tokenized Treasury Investment Plan Draws Interest from BlackRock's BUIDL, Ondo, Superstate

Jul 13, 2024 at 01:02 am

MakerDAO's competition to allocate funds will open next month, and would give a big boost for the $1.8 billion tokenized real-world asset space.

Crypto lending platform MakerDAO, the protocol behind the $5 billion stablecoin DAI, is planning to invest $1 billion of its reserves in tokenized U.S. Treasury products. Top players in the space including BlackRock's BUIDL, Superstate and Ondo Finance are lining up to apply for the proposal.

"We think this is a very good move from MakerDAO and we are excited to participate with Blackrock's BUIDL," Carlos Domingo, CEO of tokenization platform Securitize, BlackRock's issuance partner, said in an email to CoinDesk. "As the leading tokenized treasury issuer, we will certainly apply.”

"Superstate's USTB is an ideal partner for MakerDAO," Robert Leshner, founder of Superstate, told CoinDesk. "We're excited that MakerDAO is creating an open process where we can introduce USTB to the community."

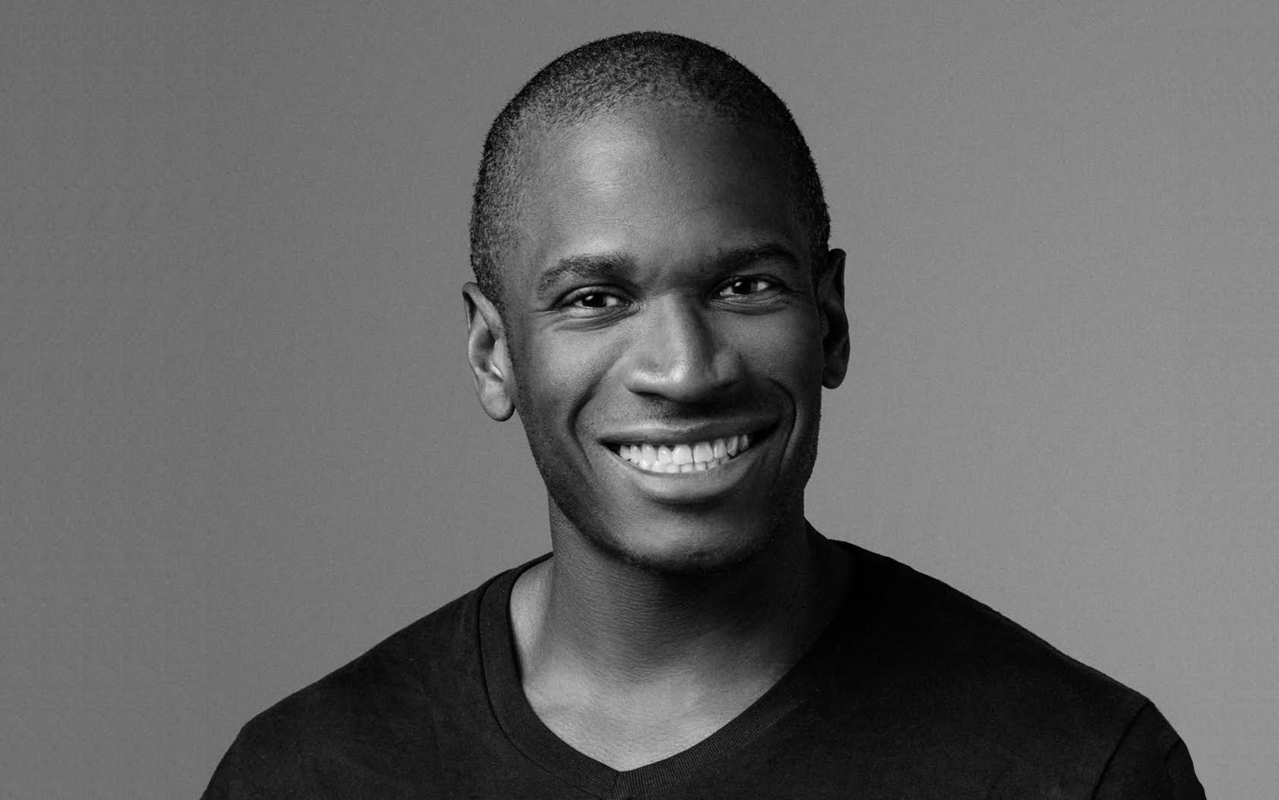

Ondo Finance (ONDO), the $550 million RWA platform, also plans to participate. "It's a natural fit in our mission of bringing institutional-grade financial products and services to everyone," Nathan Allman, founder of Ondo Finance, said in a Telegram message. "We look forward to participating."

MakerDAO's plan marks a significant reshuffle of its reserve strategy as the protocol, one of the first movers in decentralized finance (DeFi), ushers into a next era under founder Rune Christensen's Endgame Plan. The protocol has spearheaded crypto's real-world asset (RWA) trend, backing its decentralized stablecoin in part by U.S. government bonds and bills held off-chain with a range of partners.

Read more: Rune Christensen Explains Why He Wants to Remake Maker and Kill DAI

The open competition to allocate $1 billion to tokenized offerings was announced on Thursday at ETHCC in Brussels, Belgium and also outlined in a Spark SubDAO governance post.

Spark Protocol is a lending platform build on top of Maker, and is "poised to become the central hub for RWAs on Maker and Ethereum," the announcement said. It's led by the Spark SubDAO, a smaller decentralized autonomous organization within MakerDAO.

Applications will open on August 12 with more details about the competition coming in the next weeks, the post said.

The investment will be funded from redirecting reserves from the Clydesdale facility managed by Monetalis and the Andromeda facility by BlockTower, Sebastien Derivaux, co-founder of Steakhouse Financial, a DeFi consulting firm that was also the author of the tokenized treasury proposal.

Monetalis will offboard MakerDAO after community backlash for failing to present adequate reporting about the reserves in a timely manner.

Big Boost for Tokenized Treasuries

MakerDAO's investment would serve as a huge boost for the tokenized real-world asset protocols, given its sheer size.

U.S. Treasuries have been at the forefront of tokenization efforts by both digital asset firms and traditional financial institutions. These products are attractive for protocol treasuries as a low-risk instrument where they can park their blockchain-based cash and earn a stable yield without leaving the blockchain ecosystem.

The market for these products has tripled in a year to $1.85 billion, data provider rwa.xyz shows.

MakerDAO's allocation would mark another 55% growth.

This isn't the first action of its kind, however.

ArbitrumDAO, an ecosystem development organization of the Ethereum layer-2 Arbitrum, on Thursday finalized a similar contest called STEP to allocate the equivalent of 35 million of Arbitrum's native tokens (ARB) – roughly $27 million worth – in tokenized offerings.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- XRP ETF Approval Timeline Emerges as Ripple's Legal Victories Revitalize Market Optimism

- Nov 24, 2024 at 10:50 am

- The landscape of cryptocurrency investment is evolving rapidly, and one digital asset is capturing headlines like never before. While Bitcoin and Ethereum have long dominated the institutional scene, a new contender is stepping into the ring, promising to reshape the crypto market's future.

-

-

-

- XRP Primed For $100 Price Target – Here's Why

- Nov 24, 2024 at 10:20 am

- XRP remains one of the crypto market's current trailblazers rising by 23.21% in the past 24 hours. Over the last two weeks, the prominent altcoin has recorded a 154% price gain establishing itself as the sixth-largest cryptocurrency with a market cap of $89.82 billion.

-

- Bonk (BONK) Is This Solana-Based Meme Coin a Deflationary Gem?

- Nov 24, 2024 at 10:15 am

- Bonk (CRYPTO: BONK) is among the meme tokens that have clearly grabbed investors' attention. This Solana-based meme coin project has seen another impressive daily surge, rising 20.1% over the past 24 hours at 2 p.m. ET to become the 30th most-valuable cryptocurrency by market capitalization today.