|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Litecoin ETF Gains Traction, Co-Founder Expresses Confidence

May 01, 2024 at 05:46 pm

Litecoin co-founder Charlie Lee is optimistic about the crypto market after the SEC approved a Litecoin ETF. Lee believes that a Litecoin ETF will be approved but expects demand to be lower than for Bitcoin ETFs. He compares Litecoin's proof-of-work mechanism to Bitcoin's and sees Litecoin as a similar commodity.

Litecoin ETF Gains Traction: Co-Founder Expresses Optimism

In a significant development for the cryptocurrency market, Litecoin (LTC) co-founder Charlie Lee has expressed optimism about the prospects of a Litecoin exchange-traded fund (ETF). Speaking during a recent interview with Bitcoin Bros, Lee emphasized his belief that the U.S. Securities and Exchange Commission (SEC) will approve an ETF for Litecoin.

SEC's Green Light for Litecoin ETF

Lee's confidence stems from the SEC's recent approval of a spot ETF for Bitcoin, paving the way for similar products for other digital assets. He draws parallels between Litecoin and Bitcoin, noting their shared proof-of-work mechanisms and classifying Litecoin as a commodity similar to Bitcoin. Given the success of Bitcoin ETFs in the United States, Lee believes Litecoin has a favorable opportunity to gain a foothold in this investment vehicle.

Demand Comparison with Bitcoin ETFS

While acknowledging that the demand for a Litecoin ETF may be lower than that for Bitcoin ETFs, Lee remains optimistic about its prospects. He notes the challenges facing Ethereum spot ETFs due to Ethereum's transition from proof-of-work to proof-of-stake, which has raised regulatory concerns.

Ethereum ETFs: Regulatory Uncertainties

Lee anticipates increased interest in an Ethereum ETF if it receives regulatory approval, citing its wide utility and ecosystem. However, recent court filings indicate that the SEC is investigating whether Ethereum should be classified as a security. The SEC's delay in approving Ethereum spot ETFs and the potential for rejection in May 2024 further highlight the regulatory hurdles involved.

Hong Kong Embraces Ethereum ETFs

In contrast to the regulatory uncertainties in the United States, Hong Kong has taken a different approach. On April 30, 2024, Hong Kong institutions announced the launch of spot Ethereum ETFs, indicating a global demand for cryptocurrency investment instruments.

Litecoin's Resilient Community

Despite the market volatility, Litecoin holders have remained steadfast in their support. Recent data indicates that a significant portion of the community is holding their LTC tokens, with profitability levels remaining low. This behavior suggests a reluctance to sell at current prices, providing support for a potential LTC recovery.

Technical Analysis

At the time of writing, LTC is trading at $75, showing an 8% decline in the past 24 hours. Despite the recent price dip, Lee's optimism and the potential for a Litecoin ETF approval paint a positive outlook for the cryptocurrency's future.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

-

-

-

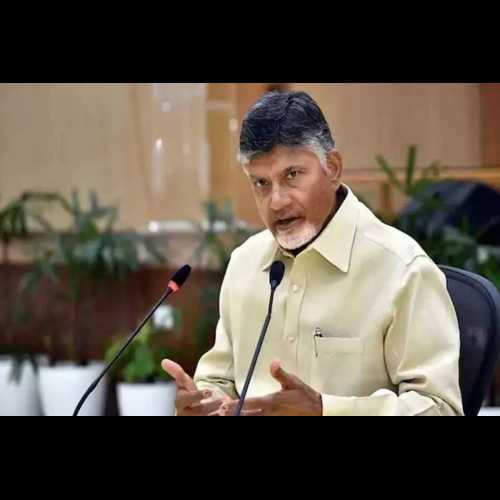

- Andhra CM Orders Judicial Probe, Suspends Officials After Tirupati Stampede That Claimed 6 Lives

- Jan 10, 2025 at 12:45 am

- Andhra Pradesh Chief Minister N Chandrababu Naidu has ordered a judicial inquiry, suspended two officials, and transferred three others, including Superintendent of Police Subbarayudu and TTD Joint Executive Officer Gouthami