|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Is the Liquid Staking Market Poised for a KYC Revolution?

Mar 23, 2024 at 12:02 pm

The liquid staking market is poised for a revolution with the introduction of KYC upgrades. B2C2, in collaboration with Blockdaemon and Stakewise, offers liquidity for staked ether (sETH). As the sole OTC spot liquidity provider for sETH-h, B2C2 is shaping the future of liquid staking. sETH-h, a digital receipt token, represents staked ether on the Ethereum blockchain, enabling users to earn rewards and exit positions. With liquid staking gaining popularity, users can maximize their ETH investments while participating in the proof-of-stake ecosystem.

Is the Liquid Staking Market Ready for a KYC Upgrade?

In a bold move, crypto market maker B2C2 has partnered with Blockdaemon and Stakewise to offer liquidity for staked ether (sETH). This is not your ordinary liquidity provider, though. B2C2 is stepping up as the sole over-the-counter (OTC) spot liquidity provider for the sETH-h token, built on Portara's liquid staking platform.

What's the Deal with sETH-h?

sETH-h is a digital receipt token that represents staked ether on the Ethereum blockchain. Users can use these tokens to exit their staked positions or earn rewards elsewhere in the crypto realm. Liquid staking is all the rage right now, as it allows users to put their ETH to work while it's locked up in proof-of-stake.

Who's Dominating the Liquid Staking Game?

Lido, a decentralized finance (DeFi) app, has been the king of the liquid staking hill. With a whopping $7.8 billion in locked assets, Lido's native token, LDO, has been on a tear. But B2C2 is betting that Portara's unique KYC and AML compliance integration will set sETH-h apart.

KYC in the Wild West of Crypto?

Portara's KYC checks ensure that sETH-h tokens can only be transferred between addresses that have passed the compliance gauntlet. This is a significant innovation in the often-unregulated crypto space.

Why B2C2?

B2C2's OTC expertise will provide instant liquidity for sETH-h holders, allowing them to trade their tokens without the hassle of decentralized exchanges. This could be a major advantage, especially in volatile market conditions.

What's Next?

As Ethereum's Shanghai upgrade looms, liquid staking is expected to take off. B2C2's partnership with Portara could position sETH-h as a key player in this growing market. Only time will tell if KYC will be the secret ingredient that takes liquid staking to the next level.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

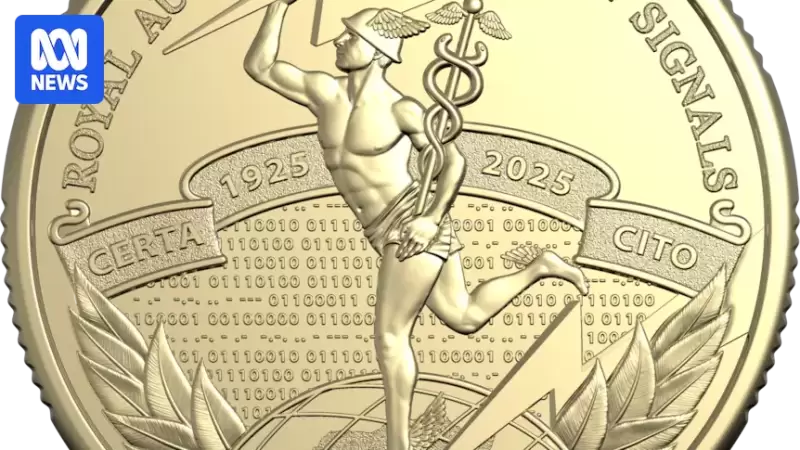

- New coin released by the Royal Australian Mint celebrates the Centenary of the Royal Australian Corps of Signals — but not all is as it seems.

- Apr 03, 2025 at 12:25 pm

- Beneath its golden facade, the $1 commemorative coin features a hidden message in code, just waiting to be cracked. By Tenzing Johnson.

-

-

-

-

- Coincodex's machine learning algorithm predicts Dogecoin (DOGE) price surge to $0.57

- Apr 03, 2025 at 12:15 pm

- The machine learning algorithm predicted that the Dogecoin price could surge $0.57 by April 28, later this month, representing a 229.55% gain for the foremost meme coin. This bullish prediction comes despite DOGE's decline, thanks to the broader crypto market crash, led by Bitcoin, which is attempting to test new lows.

-