|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

World Liberty Financial Launches USD1 Stablecoin Backed by President Trump

Mar 26, 2025 at 03:17 am

World Liberty Financial, a decentralized finance protocol backed by President Donald Trump, confirmed on Tuesday that it intends to launch its own U.S. dollar-backed stablecoin

World Liberty Financial, a decentralized finance protocol backed by President Donald Trump, confirmed on Tuesday that it intends to launch its own U.S. dollar-backed stablecoin on both Ethereum and Binance’s BNB Chain.

With Trump now back in the Oval Office and congressional Republicans focused on passing a bill to legalize stablecoins, it appears the World Liberty team feels the time is right for the president himself to enter the increasingly crowded—and profitable—stablecoin sector.

World Liberty Financial Unveils USD1 Stablecoin

President Trump’s crypto portfolio continues to expand.

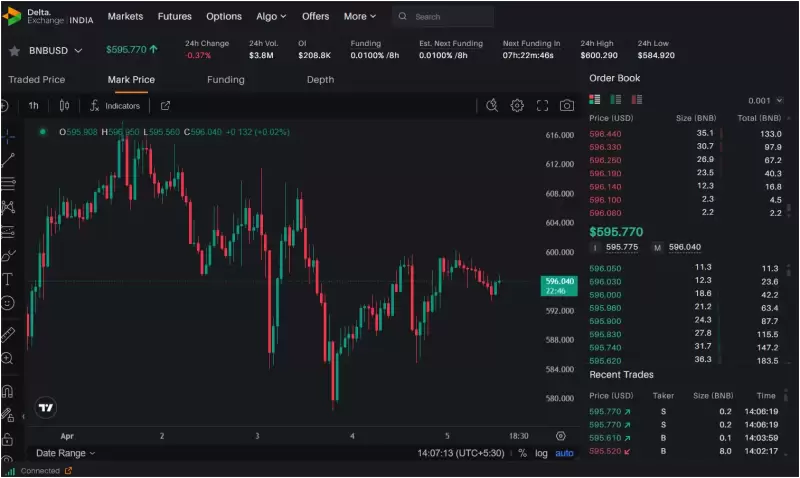

Called World Liberty Financial USD (USD1), the stablecoin is currently compatible with trading on Ethereum, one of the largest blockchain networks for decentralized finance, and on BNB, a blockchain being developed by crypto exchange giant Binance.

USD1 is pegged to $1 and will be fully collateralized with short-term U.S. Treasuries, U.S. dollar deposits, and other cash equivalents. The reserves will be custodied at BitGo, while BitGo Prime, the firm’s brokerage service, will provide liquidity for the token.

“USD1 provides what algorithmic and anonymous crypto projects cannot—access to the power of DeFi underpinned by the credibility and safeguards of the most respected names in traditional finance,” said Zach Witkoff, WLFI co-founder. “We’re offering a digital dollar stablecoin that sovereign investors and major institutions can confidently integrate into their strategies for seamless, secure cross-border transactions.”

Stablecoins typically serve as key on-ramps and off-ramps between crypto and traditional financial markets. They allow users to park on-chain funds in currencies that remain fixed in value even during periods of high volatility in the crypto markets. Stablecoins are also big business. Tether, the world’s largest stablecoin issuer, reported a $13 billion profit last year.

The rollout of USD1 on the BNB Chain follows recent reports that the Trump family held discussions with Binance about an investment in the exchange’s U.S. arm and a presidential pardon for Changpeng Zhao. Zhao, however, recently denied the claims.

Stablecoin Legislation Starts To Take Shape

The launch of the USD1 stablecoin comes as US lawmakers mull passing the Guiding and Establishing National Innovation for US Stablecoins, or the GENIUS Act. The US Senate Banking Committee passed the bill on March 13, but it must still pass in both chambers of Congress before it is forwarded to President Trump to be signed into law.

Bo Hines, the executive director of the President’s Council of Advisers on Digital Assets, recently said he expects the GENIUS bill to be on Trump’s desk in the next two months.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- Bittensor (TAO) Price Prediction: Will the AI-Powered Blockchain Protocol Continue Its Upward Trajectory?

- Apr 18, 2025 at 06:35 pm

- Despite facing a searing takedown from crypto analyst Thinking Weird, who calls Bittensor a “scam” with deeply flawed tokenomics and centralized control, the TAO token has defied gravity.

-

-

-

-

-

-

-