|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

JPMorgan: Bitcoin's Pre-Halving Drop Creates Potential Investment Opportunity

Apr 17, 2024 at 07:56 pm

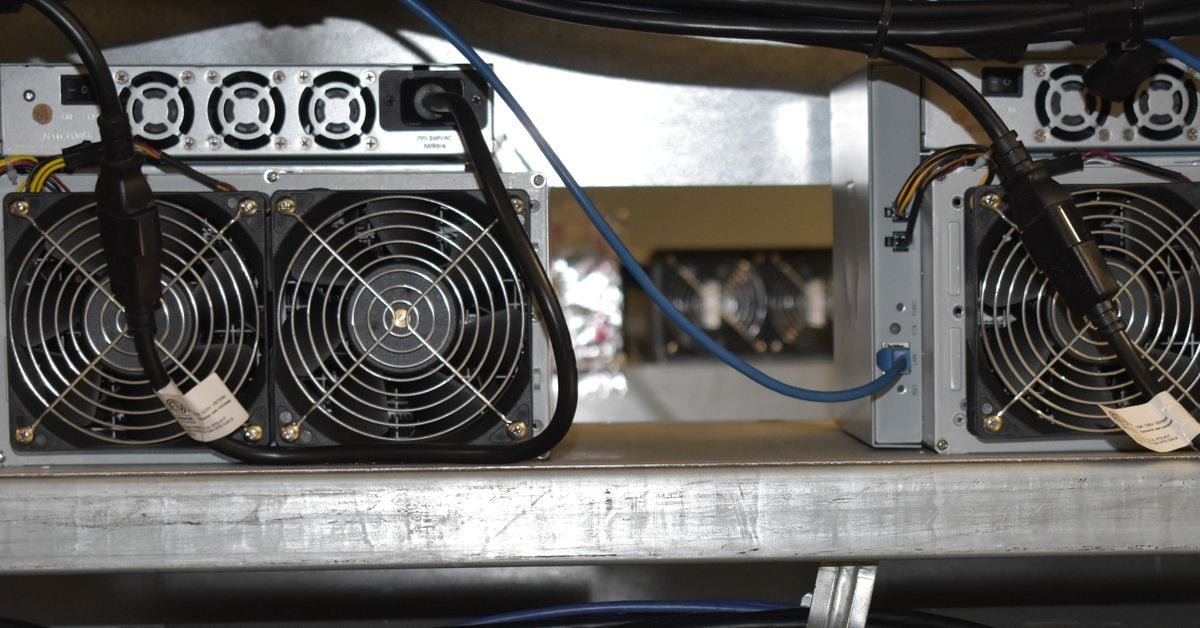

Due to the below-average performance of bitcoin mining stocks prior to the reward halving, JPMorgan (JPM) has declared that now is an opportune moment for investors to enter the market. Since March 31st, the combined market capitalization of the 14 bitcoin miners that the bank tracks has decreased by $5.8 billion to $14.2 billion, or 28%. Given that bitcoin has grown by 43% so far this year and 130% over the past six months, the study claims that "a section of the typical post-halving rally seems to have been pulled forward."

Bitcoin's Surprising Pre-Halving Performance: Potential Entry Point for Investors, Says JPMorgan

In a recent research report, global investment bank JPMorgan (JPM) has highlighted the potential implications of recent weakness in bitcoin mining stocks ahead of the upcoming halving event.

According to the report, the total market capitalization of 14 U.S.-listed bitcoin miners tracked by JPMorgan experienced a significant decline of 28% between March 31 and April 15, shedding a total of $5.8 billion to reach $14.2 billion. Notably, all of these stocks underperformed bitcoin during this period, with each losing at least 20%.

Intriguingly, this decline in mining stock valuations comes amidst a period of strong performance for bitcoin itself. The report observes that bitcoin has gained an impressive 43% year-to-date and 130% in the past six months. JPMorgan suggests that this outperformance may have "pulled forward" a portion of the price appreciation typically associated with the post-halving rally.

For context, the quadrennial halving event, expected to occur on April 19-20, will reduce the block reward for bitcoin miners by half, effectively slowing the rate of growth in bitcoin's supply. Historically, this event has marked a significant milestone in bitcoin's lifecycle, often accompanied by price rallies.

Amidst this unusual pre-halving market dynamic, JPMorgan analysts Reginald Smith and Charles Pearce maintain a bullish outlook on two particular mining companies: Riot Platforms (RIOT) and Iris Energy (IREN). They believe these stocks offer attractive valuations relative to their peers.

"With the bitcoin halving on the horizon, we expect heightened volatility and trading volume in both bitcoin and mining stocks," the analysts wrote in the report.

However, it is important to note that recent network conditions have impacted mining profitability. JPMorgan acknowledges that, during the first two weeks of April, mining profitability declined as "network hashrate growth outpaced bitcoin price appreciation."

Despite this temporary setback, JPMorgan's report suggests that the upcoming halving event remains a significant catalyst for the bitcoin industry. Investors seeking exposure to the potential price rally may consider the current weakness in mining stocks as an opportune entry point, with Riot Platforms and Iris Energy being favored by the bank's analysts.

As the halving approaches, it is crucial for investors to conduct thorough research and carefully evaluate the risks and rewards associated with investing in bitcoin mining stocks. The market's performance in the lead-up to and following the halving remains uncertain, and investors should exercise caution and make informed decisions.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

- MicroStrategy Schedules Shareholder Meeting to Discuss Expanding Its Equity-Issuance Plan and Increasing Its Bitcoin Holdings

- Dec 26, 2024 at 02:35 am

- Business intelligence and software company MicroStrategy has scheduled a special shareholder meeting to discuss expanding its equity-issuance plan and increasing its Bitcoin

-

-

-

- Race to a Billion: A New Platform That Combines Virtual Games, Meme Culture, and Cryptocurrencies

- Dec 26, 2024 at 02:35 am

- Participants can earn large prizes by correctly predicting the results of virtual meme races. With the growing popularity of gaming and meme-based assets, this platform presents a chance to take part in entertaining activities and win prizes.

-

- Race to a Billion: A Revolutionary Blend of Virtual Racing and Blockchain Technology

- Dec 26, 2024 at 02:35 am

- Picture this: real-time race predictions that earn you digital rewards. That's exactly what Race to a Billion brings to the table, blending high-stakes racing excitement with blockchain technology.

-