|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Institutional Investors Are Warming up to Ethereum ETFs, Data from Kaiko Research Suggests

Nov 29, 2024 at 01:30 am

A recent report revealed that several traditional finance firms, including Millenium, have invested in ETH ETFs since their launch in July.

Institutions, including hedge fund giant Millenium, have invested in $ETH ETFs since launching in July.

Institutions are flocking to Ethereum ETFs, with data from Kaiko showing traditional finance firms like hedge fund giant Millennium have invested in the ETFs since their launch in July.

A recent report by Kaiko Research has highlighted the growing interest of institutional investors in Ethereum (ETH) exchange-traded funds (ETFs).

According to the report, investment advisors constitute the majority of the top 15 holders of the BlackRock ETHA ETF, with 11 out of the top 15 positions being held by these institutions. Among them, Millennium stands out as the most prominent institutional investor.

Kaiko’s analysis reveals that the Millenium hedge fund holds over 2% of the total value of BlackRock’s ETHA ETF. In contrast, all other top holders of the ETH ETF product have less than 1% of the volume in their portfolio.

Meanwhile, surging activity from institutional investors has propelled the Ethereum ETF ecosystem, resulting in a substantial increase in the products’ netflow.

The outflow from Grayscale’s ETHE has decreased significantly, coinciding with the reported influx of institutional investors, contributing to the recent resurgence observed within the ecosystem.

Furthermore, there has been a surge in ETH Futures activity on the CME Group, which Kaiko Research identifies as a strong indication of investors warming up to ETF products.

In response to these developments, ETH’s price experienced a surge of nearly 12% on Wednesday.

The recent price upswing saw the flagship altcoin climb above $3,600 for the first time in the last five months. It’s important to note the growing optimism around Ethereum, as evidenced by the altcoin’s recent performance.

Being the leading altcoin, crypto analysts often use Ethereum’s price action to project the commencement of altcoin season. In light of the recent uptrend in the ETH/BTC pair, coupled with rising Ethereum dominance, the possibility of an altseason emerging is being suggested by some.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

- BingX Teams Up with SafePal to Boost Liquidity and Enhance User Experience

- Nov 29, 2024 at 04:30 am

- BingX has revealed that it has joined forces with SafePal, a non-custodian crypto wallet suite known for supporting decentralized finance (DeFi) and centralized finance (CeFi) across over a hundred blockchains.

-

-

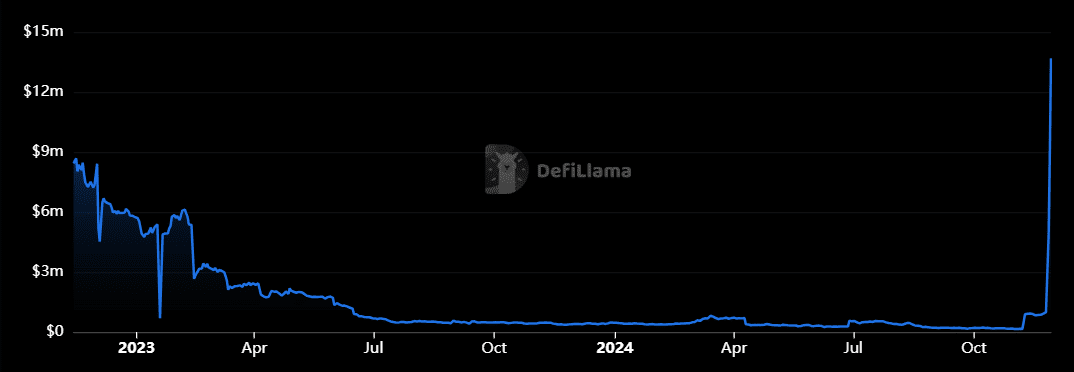

- Quoll, a Yield Farming Platform on the BNB Smart Chain (BSC), Saw Its Total Value Locked (TVL) Soar From Nearly $1 Million on November 26 to the Current Level of $13.7 Million

- Nov 29, 2024 at 04:25 am

- The platform is promoting itself as a yield booster and on-chain incubator. It leverages multi veTOKENS (from voting escrow tokens, which represent staked

-

-

-