|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Indian Cryptocurrency Users Are Having a Tough Time as Centralized Crypto Exchange (CEX) WazirX Struggles to Find a Recovery Plan for Its Customers

Jul 31, 2024 at 05:07 pm

WazirX is one of the leading crypto exchanges in India, with a user base of more than 16 million. On July 18th, it was hacked for $230 million.

Indian cryptocurrency users are having a tough time as centralized crypto exchange (CEX) WazirX struggles to find a recovery plan for its customers.

WazirX is one of the leading crypto exchanges in India, with a user base of more than 16 million. On July 18th, it was hacked for $230 million.

The security breach affected one of WazirX's multi-sig wallets. A multi-sig wallet needs several people to sign a transaction before it can be executed. In WazirX's case, the wallet had five signers to secure user assets.

The attacker drained $100 million in Shiba Inu (SHIB), $52 million in Ether, $11 million in MATIC, and $6 million in PEPE. According to the June 2024 report, these funds represented more than 45% of the exchange's total reserves of $500 million.

According to blockchain tracker Lookonchain, the exploiter converted most of the stolen funds to Ethereum (ETH). Hackers generally use mixing services like Tornado Cash to convert tokens because they can obscure transactional activity.

The exploiter now holds more than 59,097 ETH, worth about $200 million, in various tokens. They have been selling the stolen tokens using the popular DEX Uniswap.

As a result of the attack, tokens listed on the exchange traded at steep discounts to both local and global prices due to a lack of liquidity. The exchange then halted all trading and crypto and fiat withdrawals on the platform. It's been almost two weeks since WazirX was hacked, and the activities remain paused.

With everything frozen on the exchange, BTC/USDT is trading at 64,052 on WazirX compared to 66,687 on CoinDCX. Meanwhile, USDT/INR is trading at 88.64 on CoinDCX while it's 68.40 on WazirX. The exchange's native token, WZX, meanwhile, has dropped by 36.24% ever since the exchange was attacked.

As for what occurred, the exchange blamed a “mismatch” between the information displayed on Liminal Custody's digital interface and the actual contents of the transaction signed. The exchange said in a post:

“We suspect the payload was replaced to transfer wallet control to an attacker.”

Meanwhile, Liminal Custody blamed WazirX for the attack, saying its infrastructure wasn't breached.

“Unfortunately three of the victims machines have been found injecting malicious payloads into the transaction indicating a sophisticated, well planned and targeted attack on one specific Gnosis Smart Contract Multi-Sig wallet.”

– Liminal on X

However, not everyone is satisfied with the explanations and the blame game. According to Pankaj Tanwar, a popular crypto YouTuber on X:

“This mistake will damage #Crypto in India beyond imagination.”

WazirX Blasted for its “Socialized Loss Strategy”

Given the proportion of stolen funds to total reserves, there's little expectation of getting any of them back, which, combined with the fact that the exploiter has been linked to North Korea, has severely squashed any hopes for recovery.

While the exchange has released a $23 million bounty for a resolution that received over 130 entries, it has begun to explore the distribution of intact funds.

For that, WazirX is looking into returning 55% of the crypto holdings while locking the remaining in USDT-equivalent tokens, notwithstanding whether the users' tokens were stolen or not. This means that even those users who did not suffer losses in the hack would have access to only 55% of their assets while the rest will be converted to stablecoins and locked.

The exchange is now facing further scrutiny and heat from not just its customers but also the broad industry due to this “Withdrawal Management Programme: Opinion Poll.”

The poll was conducted on July 27th, during which the exchange introduced a “socialized loss strategy to distribute the impact equitably among all users.” This strategy allows users “instantaneous access to the majority of their assets” while “maintaining the possibility of further recovery for those who choose to wait.”

Under this poll, customers were asked to vote on two different options. In one option, users get access to the majority of their funds for trading, but they can also withdraw them. However, they get second priority to any recovered funds. In contrast, the other option does not allow withdrawals, but users get first priority for recovery proceeds.

This suggestion resulted in WazirX receiving criticism from its users, with one saying, “socialized loss, privatized profits.” Another one questioned why users with non-stolen tokens should be penalized.

Rival crypto exchanges also expressed their opinions on WazirX's latest move, with CoinDCX co-founder

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

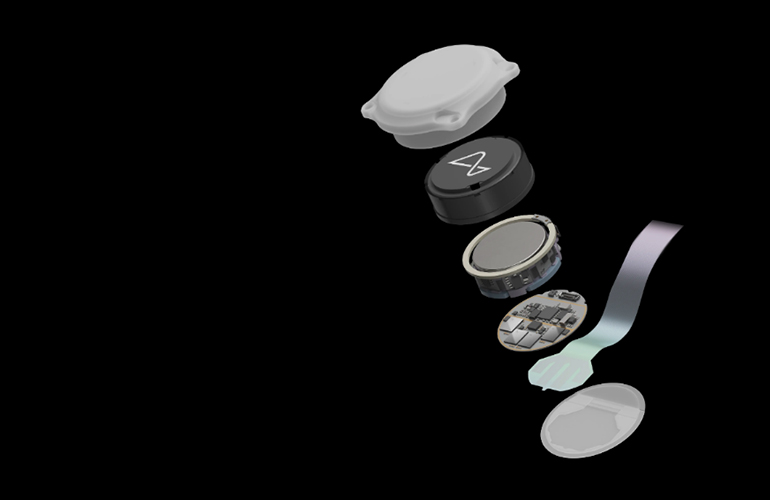

- Neuralink Begins CAN-PRIME Study, Its First International Trial of Its Fully Implantable BCI

- Nov 22, 2024 at 12:25 am

- The Elon Musk-backed BCI maker can now begin the CAN-PRIME study, its first international trial. It evaluates the company's fully implantable, wireless BCI, building upon the ongoing PRIME study in the U.S.

-

-

-

-

- Bitcoin (BTC-USD) Jumps to a Record High as Investors Eye Targets of $100,000

- Nov 22, 2024 at 12:25 am

- Bitcoin (BTC-USD) jumped to a record high Thursday morning, trading just north of $98,000 before paring gains as investors remain bullish on pro-crypto policies from the incoming Trump administration.

-

- Bitcoin ATH Again, ETH/BTC Pair Weakens, Delaying Altcoin Season?

- Nov 22, 2024 at 12:25 am

- Bitcoin prices rose again today, immediately setting a new record high of all time (ATH). The world's largest crypto asset by market cap jumped 6%, setting an all time high record at the level of 97,457 US dollars (around Rp1.54 billion) based on CoinMarketCap data.

-

- MicroStrategy (MSTR) Stock Was on Another Wild Ride Early Thursday, Rising as Much as 11%

- Nov 22, 2024 at 12:25 am

- MSTR) stock was on another wild ride early Thursday, rising as much as 11% before forfeiting a chunk of those gains after short-seller Citron Research said it had taken a new bet against the stock, which has gained over 600% this year.