Post-merger, Hut 8 Mining boasts a diversified business model with revenue streams spanning self-mining, managed services, hosting, HPC computing, and AI. Benchmark initiates coverage with a buy rating, setting a $12 price target, citing the company's discounted valuation compared to peers and its substantial bitcoin holdings, which provide a liquidity cushion and potential upside.

Hut 8 Mining Charts a Promising Post-Merger Trajectory: Benchmark Initiates Coverage with Buy Rating

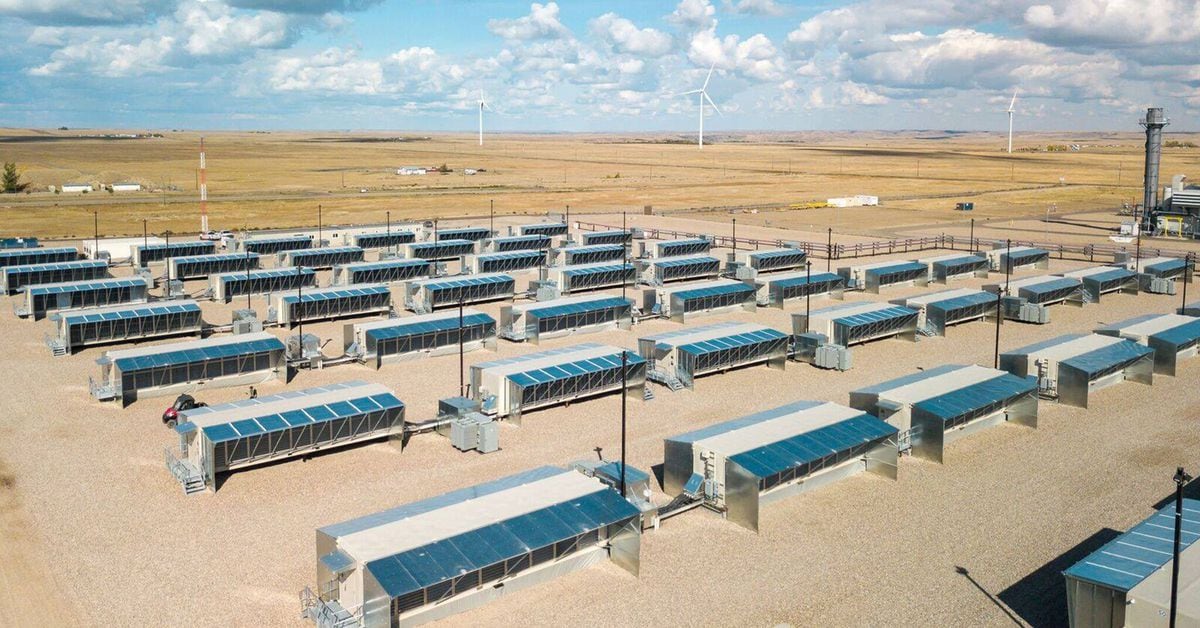

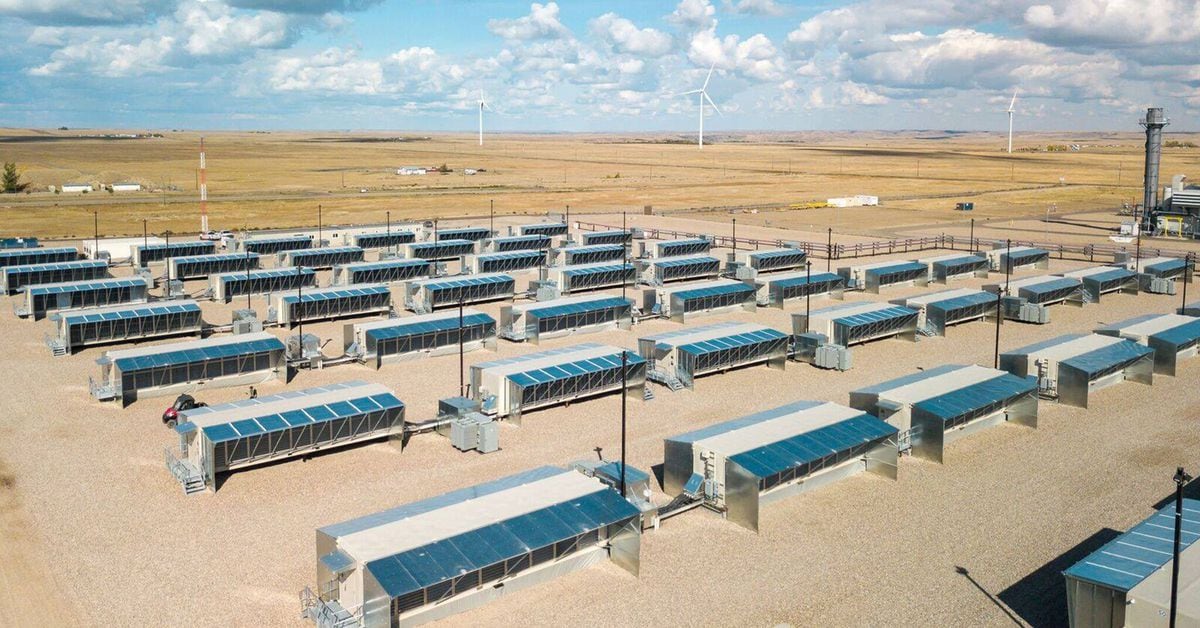

Amidst the evolving landscape of the cryptocurrency industry, Hut 8 Mining Corporation (NASDAQ: HUT) has emerged as a formidable player. Its recent merger with US Bitcoin Corporation (OTC: USBTC) has significantly diversified its business model, positioning it for sustained growth and profitability in the years to come.

Benchmark, a leading financial services firm, has recognized the strategic significance of this merger and has initiated coverage of Hut 8 with a buy rating and a $12 price target. This endorsement reflects a bullish outlook on the company's prospects, driven by its diversified revenue streams and robust liquidity position.

Hut 8's multifaceted business model encompasses bitcoin mining, managed services, hosting, high-performance computing (HPC), and artificial intelligence (AI). This diversification mitigates risks associated with any single revenue stream, ensuring stability and resilience in a volatile market.

As of March 31, 2024, Hut 8 ranked as the second-largest listed bitcoin miner in terms of bitcoin holdings, with 9,102 coins held in reserve. This substantial bitcoin stash provides the company with a substantial liquidity cushion and the potential to capitalize on bitcoin price appreciation. The market value of these holdings currently stands at approximately $592 million, constituting around 82% of Hut 8's market capitalization.

Benchmark analyst Mark Palmer highlights Hut 8's competitive advantages, stating, "Hut trades at a discount to its bitcoin mining peers that we expect to shrink as the company executes on its self-mining expansion plans." The company's focus on reducing its mining costs and optimizing energy efficiency further enhances its profitability outlook.

Post-merger, Hut 8 has implemented strategic initiatives to streamline operations and optimize its financial performance. These measures have resulted in reduced bitcoin mining costs and increased cash flow generation. The company's strong balance sheet, combined with its diversified revenue streams and substantial bitcoin holdings, provides a solid foundation for future growth.

Hut 8's stock has responded positively to these developments, trading 5.2% higher at $8.47 at the time of this writing. Benchmark's buy rating and $12 price target further validate the company's bullish prospects. As Hut 8 continues to execute its strategic initiatives and capitalize on the growth opportunities in the cryptocurrency and blockchain ecosystem, its value proposition is expected to gain traction among investors seeking exposure to this dynamic sector.