|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Hashnote's USYC Token Zooms Past BUIDL to Top $3.4B Tokenized Treasuries Market

Dec 21, 2024 at 05:05 am

There's been a change of guard at the rankings of the $3.4 billion tokenized Treasuries market. Asset manager Hashnote's USYC token zoomed over $1.2 billion in market capitalization

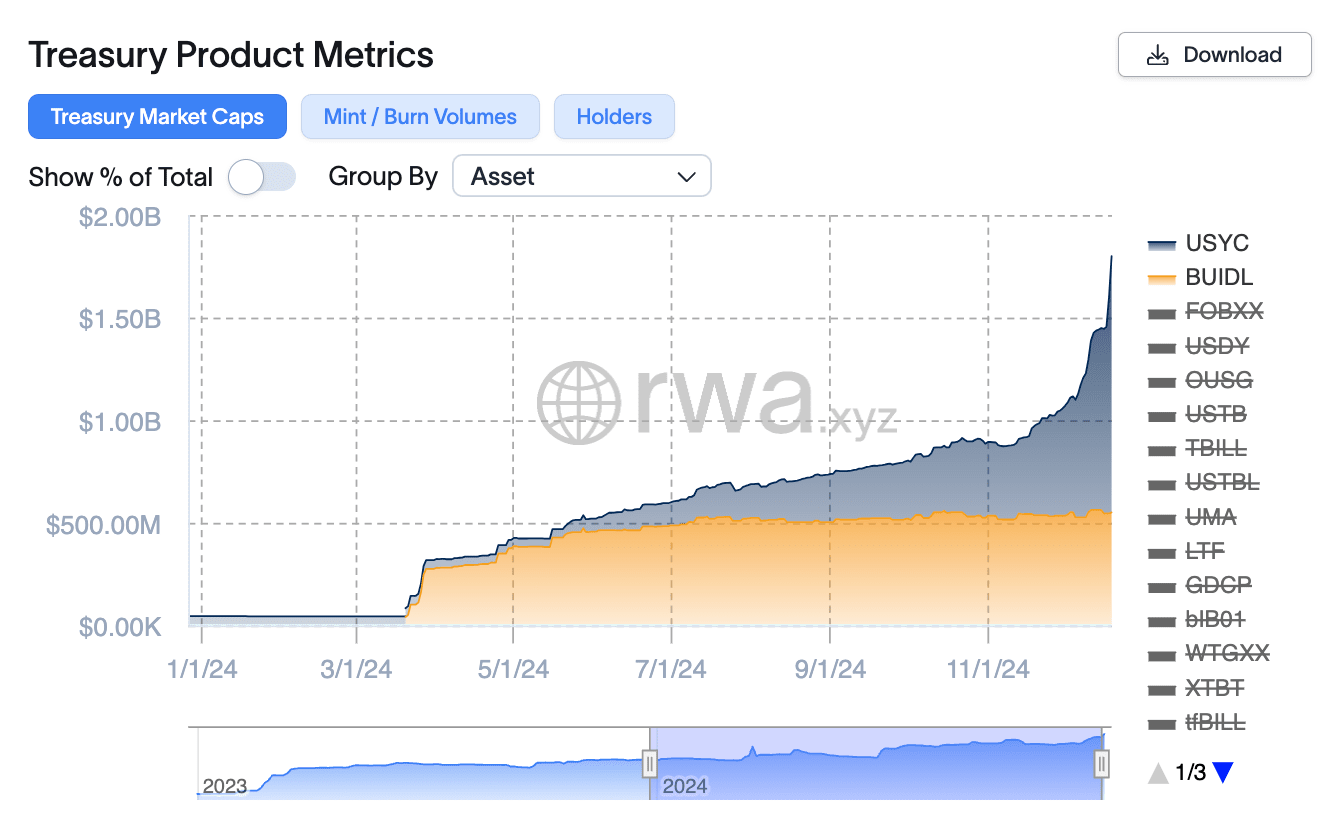

The $3.4 billion tokenized Treasuries market has seen a shift in rankings, with Hashnote's USYC token experiencing remarkable growth to become the largest product by size, according to data from rwa.xyz.

The USYC token, which had a market capitalization of $450 million in April, has now surged past BUIDL, a product of asset management giant BlackRock and tokenization firm Securitize. BUIDL was previously the largest product in the market since April.

The rapid growth of Hashnote's product highlights the significance of interconnecting tokenized products with decentralized finance (DeFi) applications and presenting their tokens as building blocks for other products — a concept known as composability in the crypto lexicon — to scale and achieve wider adoption.

Moreover, it showcases crypto investors' preference for yield-generating stablecoins, which are increasingly being backed by tokenized products.

For instance, USYC has benefited significantly from the swift ascent of Usual, a budding decentralized finance (DeFi) protocol, and its real-world asset-backed, yield-generating stablecoin, USD0.

In a bid to capture the market share of centralized stablecoins such as Tether's USDT and Circle's USDC, Usual is designed to redistribute a portion of the revenues from its stablecoin's backing assets to holders. Currently, USD0 is predominantly backed by USYC, although the protocol aims to incorporate additional RWAs into its reserves in the future. Recently, it announced the integration of Ethena's USDtb stablecoin, which is built on top of BUIDL.

"The bull market has seen a huge amount of inflows into stablecoins, but the core problem with the largest stablecoins remains: they don't offer any rewards for end users and don't give access to the yield that they generate," said David Shuttleworth, partner at Anagram. "Furthermore, users don't get any access to the protocol's equity by holding USDT or USDC."

"The appeal of Usual is that it's designed to redistribute the yield and ownership in the protocol back to users," he added.

Over the past few months, the protocol and its USD0 stablecoin have attracted over $1.3 billion in crypto investors' funds as they pursue on-chain yield opportunities. Another key growth driver was the exchange listing and airdrop of the protocol's governance token (USUAL) on Wednesday.

According to CoinGecko, USUAL began trading on Binance and outperformed the broader crypto market, which has been experiencing turbulence. The token has appreciated by around 50% since its launch, as reported by CoinGecko.

Earlier this year, BlackRock's BUIDL also experienced rapid growth after DeFi platform Ondo Finance made the token the primary reserve asset of its own yield-earning product, the Ondo Short-Term US Government Treasuries (OUSG) token.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- Coin Name: #ADA

- Apr 09, 2025 at 04:05 pm

- t

-

- In This Crypto World Filled with Excessive Hype and Influencer-Driven Pump-and-Dump Schemes, the BROCCOLI Project Undoubtedly Stands Out

- Apr 09, 2025 at 04:05 pm

- This project is entirely community-driven, with the core goal of engaging in charitable activities around 'dogs', which is also the main theme of Broccoli.

-

-

-

-

-

-

-