|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Gryphon Digital Mining Emerges as Mining Leader Amid Bitcoin Halving Shakeup

May 21, 2024 at 12:07 am

Despite pessimistic projections before the Bitcoin halving, the cryptocurrency has remained resilient. However, the halving has significantly impacted the mining sector, creating uncertainty and potential bankruptcy for less efficient miners. Gryphon Digital Mining (NASDAQ: GRYP) stands out as a stable player, prioritizing revenue-generating assets over expensive facilities and achieving gross profit every month of operation. With an asset-light approach and a focus on efficiency, Gryphon positions itself as a potential beneficiary of the industry's current shakeout.

Bitcoin Halving Reshapes Mining Industry: Gryphon Digital Mining Emerges as a Leader

Prior to the highly anticipated Bitcoin halving event in April, industry experts predicted a potential market downturn, with JPMorgan forecasting a drop in Bitcoin prices to $42,000 due to an overbought market. Others believed that any potential gains post-halving were already factored into the market value.

However, despite these predictions, Bitcoin has maintained its strength in the weeks since the halving, while the mining sector has undergone a significant shift. With the halving event reducing mining rewards by 50%, many previously profitable mining operations have faced financial uncertainty or even bankruptcy.

This has created an opportunity for well-positioned mining companies like Gryphon Digital Mining (NASDAQ: GRYP) to capitalize on the industry shakeout and emerge even stronger than before.

Industry Consolidation and Gryphon's Advantage

The halving has triggered a wave of consolidation in the mining market, with publicly traded companies using their access to capital to acquire smaller, struggling miners. Gryphon stands to benefit from this trend as the industry approaches a crucial juncture.

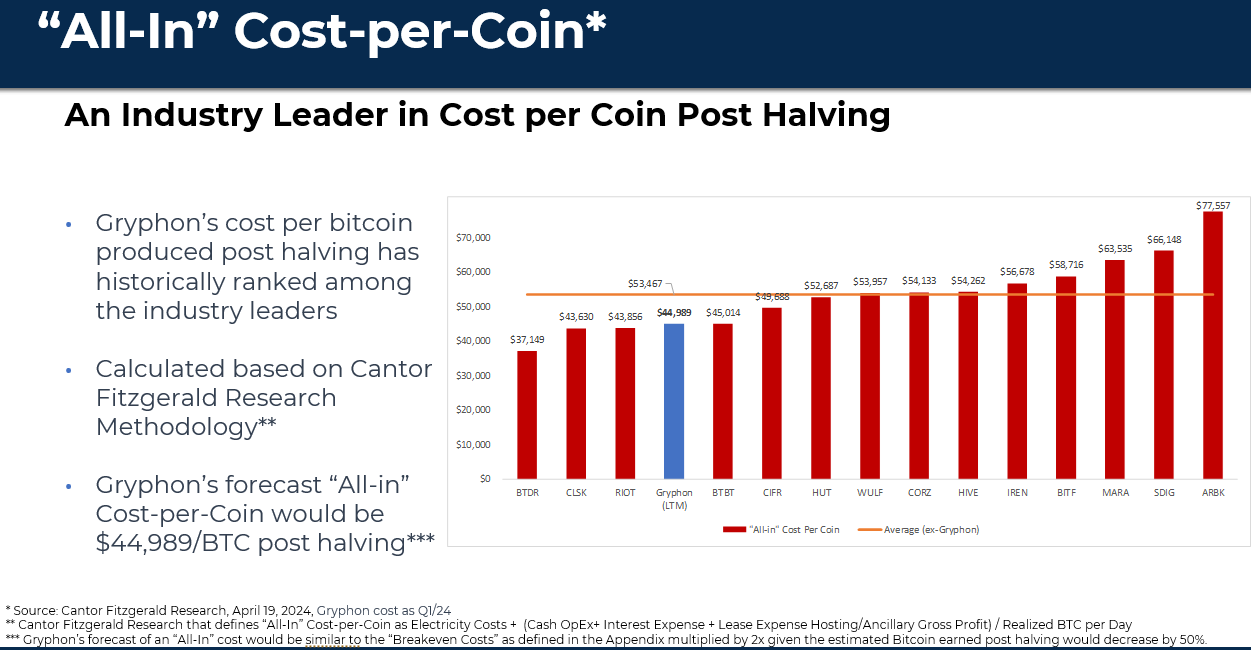

Gryphon's CEO, Rob Chang, has observed the challenges faced by even the largest mining companies during pivotal market moments. For publicly traded companies with average costs of $54,000 per Bitcoin mined, profitability has been challenging when Bitcoin trades below $50,000, as it did for much of the past few years.

In contrast, Gryphon has maintained gross profit-positive operations every month since its inception and projects an all-in cost of only $44,989 per Bitcoin post-halving. This competitive advantage is largely attributed to Gryphon's asset-light approach.

Asset-Light Approach and Operational Efficiency

Over the past year, Gryphon has mined approximately $21 million worth of Bitcoin with a lean team of only three employees. The company's focus on revenue-generating assets, such as mining machines rather than expensive facilities, has significantly reduced its fixed costs.

As a result, Gryphon has consistently ranked among the top four most efficient mining companies and has held the number one spot for efficiency throughout much of the past year. This high level of operational efficiency positions Gryphon to navigate the industry headwinds created by the halving event.

ESG Focus Opens Doors to Institutional Investors

In addition to its operational efficiency, Gryphon's competitive advantage stems from an unexpected source for a cryptocurrency company: its environmental, social, and governance (ESG) focus.

Unlike many other Bitcoin miners, Gryphon utilizes 100% renewable energy from a hydro-powered facility in upstate New York. CEO Chang recognizes that ESG considerations are increasingly important for institutional investors, who are only permitted to invest in companies that meet certain ESG benchmarks.

With the global ESG market projected to reach $40 trillion by 2030, Gryphon's commitment to renewable energy opens up investment opportunities that may be unavailable to other Bitcoin miners.

Green Proofs Certification and Carbon Negative Strategy

Gryphon recently became one of the first miners to be awarded the Green Proofs for Bitcoin certification, further demonstrating its commitment to clean energy use. The company is also pursuing a carbon negative strategy through the acquisition of carbon credits.

Gryphon's transparency on ESG issues, including its public disclosure of full carbon emissions reports for the past two years, sets it apart from the competition. This commitment to sustainability is likely to appeal to ESG-conscious investors looking to gain exposure to the Bitcoin mining industry.

Capital Raising and Acquisition Opportunities post-Halving

As Bitcoin prices remain near all-time highs and investor interest surges, public companies like Gryphon have an advantage in accessing capital to upgrade equipment and acquire struggling miners at discounted valuations.

Gryphon's positive gross profit history and ESG focus provide a strong foundation for its growth. The company's leadership team boasts extensive experience in the Bitcoin mining industry, with former executives from Riot Blockchain and Marathon Digital among its ranks.

Conclusion

The Bitcoin halving has reshaped the mining landscape, creating both challenges and opportunities. Efficient and well-capitalized miners like Gryphon Digital Mining are poised to capitalize on the industry consolidation and the increasing importance of ESG considerations.

Gryphon's asset-light approach, ESG focus, and operational efficiency provide a competitive advantage that sets it apart from the competition. As the Bitcoin market continues to evolve, Gryphon's strategic positioning and commitment to sustainability position it to emerge as a leading player in the industry.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- Qubetics ($TICS): The Best Crypto to Buy Now, Blending Innovation, Usability, and Explosive Growth Potential

- Nov 24, 2024 at 12:25 pm

- The cryptocurrency world is buzzing with endless possibilities, where innovation meets opportunity every single day. From Tezos, revolutionizing governance with self-amending protocols, to Bittensor, shaking up AI-powered blockchain concepts, the crypto space is thriving with groundbreaking ideas.

-

-

-

-

-

-

-

-

- AirSwap Will Host a Community Call on December 5th at 19:30 UTC

- Nov 24, 2024 at 12:20 pm

- AirSwap is a decentralized token exchange platform based on the Ethereum blockchain. AirSwap technology powers peer-to-peer networks using de facto standard RFQ and LastLook protocols making it the top choice for traditional market makers entering the decentralized financial system.