|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Grayscale Bitcoin Trust Outflows Spark Concerns in US ETF Market

Apr 02, 2024 at 11:01 am

The crypto market faced unexpected outflows in the US BTC-spot ETF market, as evidenced by Grayscale Bitcoin Trust's (GBTC) $303 million net outflow on Monday. Meanwhile, the ongoing SEC vs. Ripple case and recent rulings in SEC vs. Coinbase (COIN) continue to influence investor sentiment, with the latter potentially setting legal precedents that could impact the outcome of the SEC vs. Ripple lawsuit.

Grayscale Bitcoin Trust (GBTC) Outflows Raise Concerns Among Market Participants

Outflows from the Grayscale Bitcoin Trust (GBTC) have reached unexpected levels, casting a pall over the US Bitcoin-spot exchange-traded fund (ETF) market. On Monday, GBTC experienced a significant net outflow of $303 million, challenging the underlying demand for Bitcoin (BTC) and the broader cryptocurrency market.

These outflows coincide with persistent uncertainty surrounding the ongoing legal proceedings between the Securities and Exchange Commission (SEC) and Ripple. The SEC's lawsuit against Ripple, alleging the sale of unregistered securities, has been closely monitored by the cryptocurrency community.

While Monday's trading session did not witness any developments in the SEC vs. Ripple case, the legal landscape has witnessed important shifts in recent weeks. On March 27, Judge Katherine Failla granted a partial Motion to Dismiss (MTD) filed by Coinbase (COIN) in a separate case brought by the SEC. However, Judge Failla declined to dismiss charges against Coinbase for allegedly operating as an unregistered securities exchange.

The outcome of the SEC vs. Coinbase case may set a legal precedent that could impact the SEC's ongoing appeal against the "Programmatic Sales of XRP" ruling. Amicus Curiae attorney John E. Deaton has suggested that the SEC may be compelled to settle the Ripple case if Judge Failla grants a full MTD to Coinbase.

The recent outflows from GBTC have raised concerns among investors and analysts. Some analysts believe that these outflows indicate a decline in investor confidence in the Bitcoin-spot ETF market. Others argue that the outflows are simply a response to the heightened regulatory uncertainty surrounding the cryptocurrency industry.

The SEC's continued scrutiny of crypto-related companies has undoubtedly created a sense of apprehension among market participants. The agency's pursuit of enforcement actions against Coinbase and Ripple has raised questions about the regulatory framework governing digital assets.

The cryptocurrency market has been grappling with a period of volatility in recent months. The collapse of the Terra ecosystem and the ongoing turmoil surrounding the Celsius Network have shaken investor confidence. The regulatory uncertainty surrounding the SEC's actions has further exacerbated these concerns.

As the legal battles between the SEC and crypto companies continue to unfold, it remains to be seen how the regulatory landscape will evolve. Investors and analysts are closely monitoring these developments, as they have the potential to significantly impact the future of the cryptocurrency industry.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- 3 Altcoins Positioned to Challenge Ethereum and Solana, Offering Early Investors the Chance to Turn $1,000 Into a Life-Changing Fortune

- Nov 09, 2024 at 04:25 am

- While Ethereum and Solana are choices, in the industry there are intriguing platforms valued at less, than $1 that are gaining attention for their strong utility, innovative technology, and promising development plans

-

-

-

-

-

-

-

-

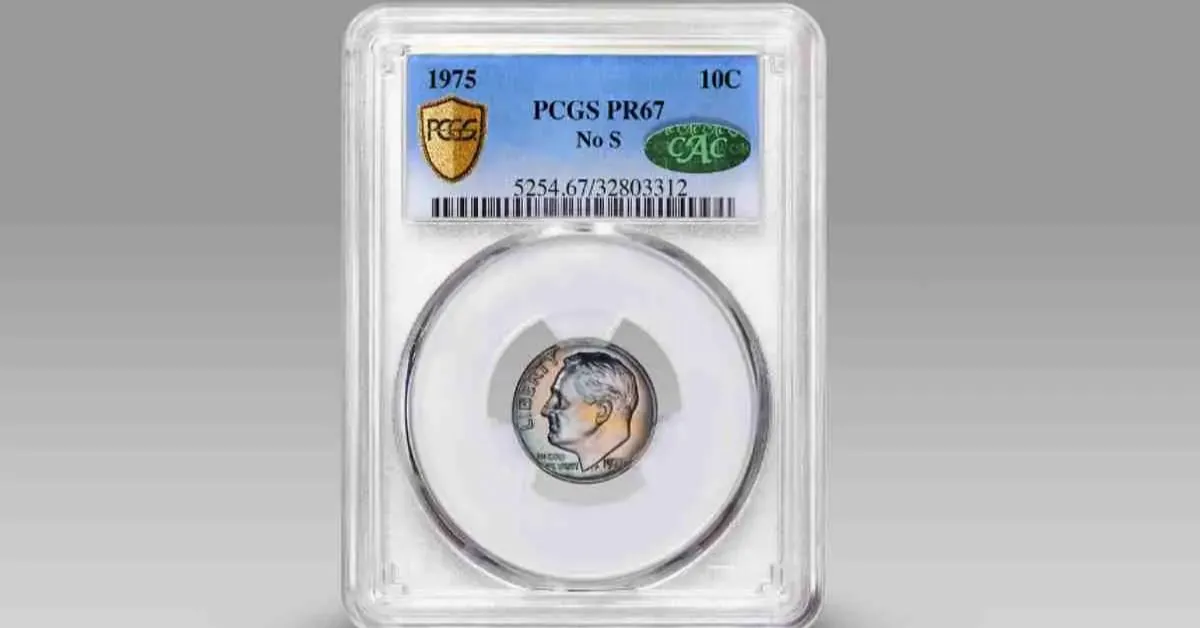

- The 1975 ‘No S’ Proof Dime: A Coin with a Remarkable Error

- Nov 09, 2024 at 04:25 am

- Minted in San Francisco, the 1975 proof dime was part of a larger collection that includes proof sets issued by the United States Mint. However, two of the dimes in this set were discovered to be missing their “S” mint mark—a feature that usually indicates the San Francisco Mint’s origin.