|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Glassnode Analytics Spotlight Buying Patterns of Bitcoin Holder Groups

Apr 17, 2024 at 05:31 pm

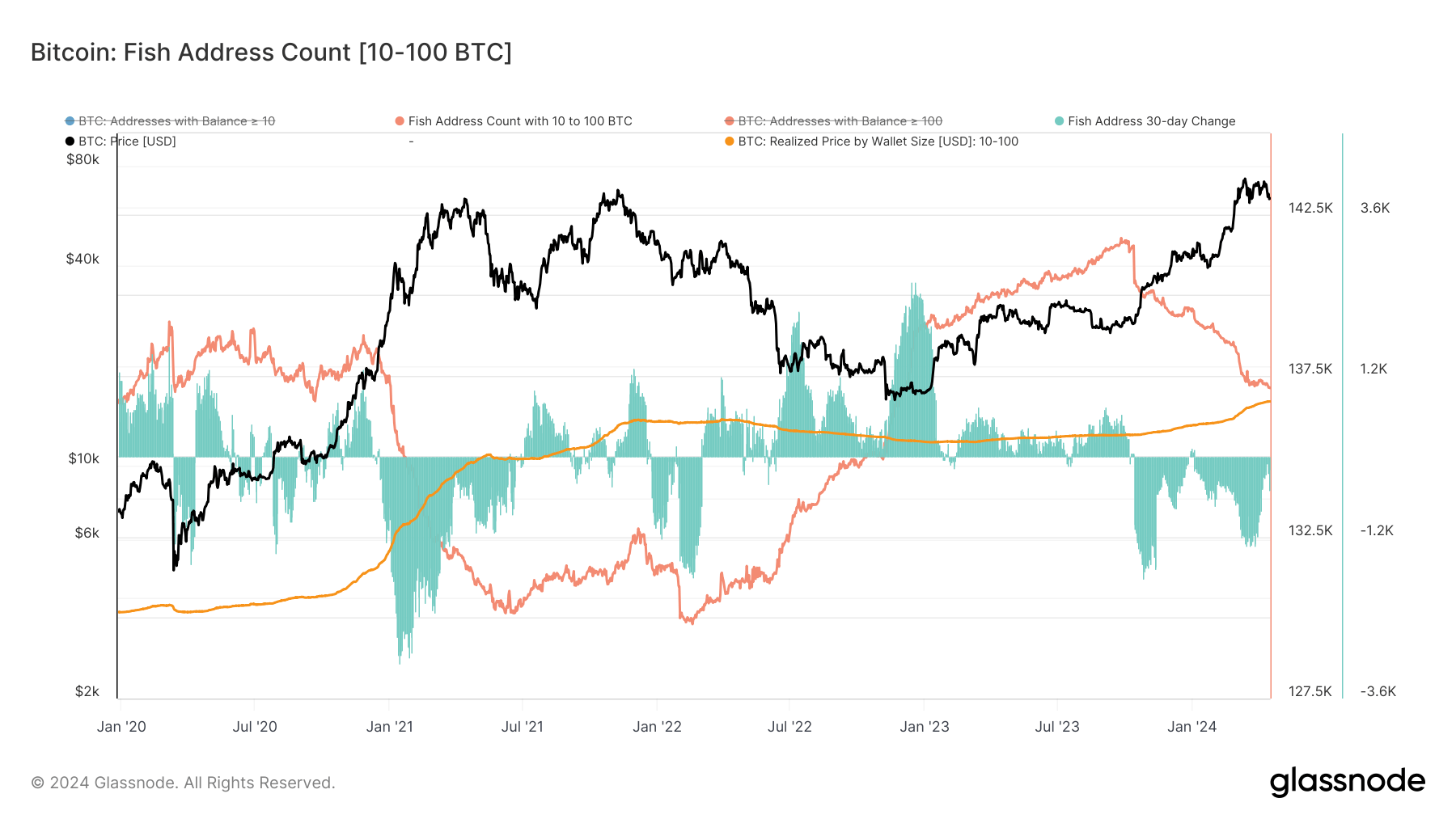

Glassnode data reveals that OG Bitcoin holders ("Fish") possess the lowest realized price at $15,630, significantly lower than Whales' $35,290. Historically, when Bitcoin's price reaches the Fish realized price, it has often marked market bottoms, as observed in 2011, 2014, and 2018. Fish have consistently accumulated Bitcoin during bear markets, indicating their savvy investment strategies.

Glassnode Data Reveals Insightful Patterns in Bitcoin Holder Behavior

Recent data from Glassnode, a leading blockchain analytics firm, has shed light on the buying and holding strategies of different Bitcoin investor cohorts. The analysis focuses on the concept of "realized price," which represents the average cost at which Bitcoin holders acquired their coins.

Fish: The "Smart Money" in Bitcoin

According to Glassnode, Fish, categorized as holders possessing 1 to 10 BTC, currently boast the lowest realized price of $15,630, indicating they have acquired Bitcoin at a significantly lower cost compared to other holder groups. Historically, the realized price of Fish has served as a key indicator of market bottoms, as seen during previous bear markets in 2011, 2014, and 2018.

Whales: The Average Cost of Acquisition

In contrast, Whales, holders with 100 to 1,000 BTC, have a realized price of $35,290, indicating they have acquired Bitcoin at a higher average cost than Fish. This suggests that Fish have been more strategic in their buying, potentially accumulating Bitcoin at more opportune times.

Fish: Not Just Lost Coins

Analyzing the number of Fish addresses reveals an intriguing trend. Fish numbers tend to increase during bear markets, indicating that they are not simply lost Bitcoin holders. Additionally, they accumulated significant Bitcoin during the bullish run from November 2022 to October 2023. This suggests that Fish are active participants in the market, taking advantage of market fluctuations.

Evolution in the Bitcoin Ecosystem

However, Fish addresses have declined since October 2023, while the realized price for Fish has increased from $13,282 to $15,530. This suggests that some Fish may be taking profits or evolving into Sharks (holders with 100 to 1,000 BTC).

Shifts in Investor Sentiment

The data also provides insight into the shifting sentiment among Bitcoin investors. The divergence between the realized price of Fish and the trading price of Bitcoin suggests that some Fish are selling their coins, while others are holding onto their investments or even acquiring more. This could indicate a mix of bullish and bearish sentiment within the Bitcoin market.

Conclusion

The Glassnode data offers valuable insights into the buying and holding strategies of different Bitcoin investor cohorts. Fish, with their low realized price and historical role in market bottoms, emerge as the "smart money" in Bitcoin. Whales, with their higher realized price, provide a benchmark for the average cost of acquisition. The dynamic behavior of Fish, coupled with the overall Bitcoin market sentiment, highlights the complexities and opportunities within the cryptocurrency ecosystem.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- Ethereum (ETH) Price Attempts to Stabilize After Dipping Below $1,600. Long-Term Holders Have Entered Capitulation Territory

- Apr 12, 2025 at 11:25 am

- Ethereum price is attempting to stabilize after dipping below $1,600. Long-term holders have entered capitulation territory for the first time in months.

-

-

-

-

![Crypto Otaku - CRYPTO CHAOS! 83K BITCOIN! CRYPTO RALLY!! XCN , JASMY , SWFTC LEAD!!! [Episode 228] Crypto Otaku - CRYPTO CHAOS! 83K BITCOIN! CRYPTO RALLY!! XCN , JASMY , SWFTC LEAD!!! [Episode 228]](/uploads/2025/04/12/cryptocurrencies-news/videos/crypto-otaku-crypto-chaos-k-bitcoin-crypto-rally-xcn-jasmy-swftc-lead-episode/image-1.webp)