|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Gary Gensler Exits the SEC with a Doomsday Prediction: A Crypto Crash Is Imminent

Apr 23, 2025 at 07:51 pm

Days before his official exit, Gensler weighed in with a bold and sobering prediction: that not only is a crypto crash likely, but a crypto crash is imminent

The crypto market may face volatile seas–at least that was the clear conviction of Gary Gensler, now exiting head of the U.S. Securities and Exchange Commission (SEC). Days before his official exit, Gensler weighed in with a bold and sobering prediction: that not only is a crypto crash likely, but a crypto crash is imminent for the large majority of tokens currently in the market.

His warning wasn’t just a passing comment. It was a clear and pointed message to investors, regulators, and the broader financial world. According to Gensler, while Bitcoin (BTC) may have carved out a relatively stable position as a form of “digital gold,” most other crypto tokens are walking a tightrope, and many are about to fall. With Paul Atkins preparing to step in as the new SEC chair, the timing of this message couldn’t be more significant.

Why Is Gensler Predicting a Crypto Collapse?

In an interview with CNBC, Gensler didn’t mince his words. He asserted that most digital tokens have “no value intrinsically” and that they exist only on hype, speculation, and sentiment. Gensler estimated there were 10,000-15,000 cryptocurrencies and that the majority serve as little more than speculative assets with little or no utility in the real world.

“This sector is based almost entirely upon situational sentiment, having very little fundamental value,” he said. He described that sentiment-filled market structure as dangerously flimsy and a contributor to what could very well be a cryptocurrency crash.

What Makes Bitcoin Different According to Gensler?

While the outgoing SEC chief had largely upbeat commentary on the crypto market in recent months, he did make a distinction between Bitcoin and altcoins. He saw potential for BTC to become a store of value similar to gold, mostly because it has a global identity and is more established than many of its rivals. Bitcoin also has some serious staying power, and to date, there is no real competitor, as its first-mover advantage and a decentralized model make it so.

However, this phrase was still measured. Gensler noted that even if Bitcoin survives the storm, it does not mean the market will survive. The main concern remains too much speculation and not enough for all but a few tokens.

SEC and Crypto Regulation: A New Chapter Begins

With Gensler stepping aside, the SEC now finds itself at a crossroads. The incoming chair, Paul Atkins, will inherit a financial landscape in which crypto has become too large and influential to ignore but also too volatile to leave unchecked. How he chooses to regulate this industry will be a defining aspect of his leadership.

Digital asset regulation has long been a subject of heated debate, and Gensler’s comments may be seen as an indirect challenge to the incoming chair to act decisively and quickly. Without stronger oversight, Gensler suggests, the next crypto crash may be closer than anyone realizes.

This statement also comes amid increasing pressure from both lawmakers and the public to bring clarity to crypto laws. Several bills are currently being discussed in Congress, aiming to set up a comprehensive regulatory framework for digital assets, covering everything from exchange oversight to stablecoin regulation.

Should Investors Be Worried?

Gensler’s warning isn’t just a regulatory statement; it’s a signal to everyday investors as well. The message is clear: proceed with caution. While digital assets have made millionaires overnight, they’ve also wiped out portfolios just as fast. Investors need to understand this as a critical sign to reassess their strategies.

“Speculative assets like these can end badly,” Gensler said, reminding everyone that hype-driven markets rarely hold up in the long term. It’s a lesson echoed through past market bubbles, from the dot-com crash to the housing market collapse. History doesn’t always repeat itself, but it often rhymes.

A Turning Point for The Crypto Market

The cryptocurrency market is standing at a pivotal moment. The tide of optimism that swept through the industry in recent years may be turning, signaled by Gensler’s stark message. Whether or not his prediction of a crypto crash in the near future comes true, it’s clear that the industry is due for a major reckoning.

With Paul handling the transition into the SEC’s top role, the pressure to bring regulation, transparency, and legitimacy to digital assets has never been higher. Will he push for tighter controls, or will he adopt a lighter touch? Either way, the choices made in the coming months will shape the future of crypto for years to come.

For now, Gensler’s final statement lingers like a storm cloud over the market: “Most tokens don’t have fundamentals, and sentiment alone won’t save them.”

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

- Bitcoin (BTC) Faces Critical Test: Will the Yearly Open Flip from Support to Resistance?

- Apr 24, 2025 at 03:00 am

- Bitcoin's price has recently found itself near a critical juncture, as it trades close to its yearly open. This level, which was once a robust support, could now play a pivotal role in determining the next phase of Bitcoin's market trajectory.

-

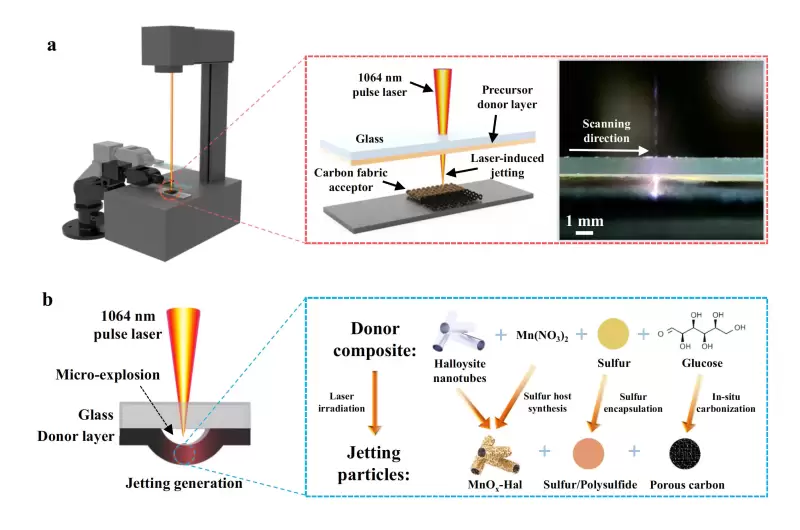

- A research team has developed an innovative single-step laser printing technique to accelerate the manufacturing of lithium-sulfur batteries.

- Apr 24, 2025 at 02:55 am

- Integrating the commonly time-consuming active materials synthesis and cathode preparation in a nanosecond-scale laser-induced conversion process, this technique is set to revolutionize the future industrial production of printable electrochemical energy storage devices.

-

-