|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

GameStop (GME) Announces Plan to Raise Up to $1.3 Billion Through a Private Offering of Convertible Senior Notes

Mar 27, 2025 at 02:00 pm

The five-year notes will be issued with a 0% coupon rate, signaling GameStop's strategic move to further diversify its assets.

GameStop (NYSE:GME) has announced its intention to raise up to $1.3 billion through a private offering of convertible senior notes, the proceeds of which will be used for a variety of corporate purposes, including investing in Bitcoin (CRYPTO: BTC).

What Happened: GameStop disclosed in a filing with the Securities and Exchange Commission on Thursday that it plans to issue the 5%-year notes with a 0% coupon rate. The offering also features a greenshoe option for underwriters to purchase up to an additional $200 million in notes.

The company said the net proceeds from the offering will be used primarily for general corporate purposes, which may include, but are not limited to, investing in Bitcoin in accordance with its investment guidelines.

The announcement comes as GameStop is looking to further diversify its assets and invest in new opportunities. The company has been making headlines recently for its foray into the digital asset space.

Earlier this year, GameStop applied to launch exchange-traded funds (ETFs) that will invest in digital assets, according to a report by The Block. The company is planning to launch ETFs focused on cryptocurrencies, Web3 and metaverse.

The news of the convertible notes offering generated immediate reactions in the market. GameStop’s stock rose sharply during regular trading hours.

Investor Optimism: The announcement was met with optimism among investors, who pushed up the company’s shares.

However, after the initial excitement, some cautious sentiment emerged, leading to a decline in the stock price during after-hours trading.

This development marks another bold move in GameStop’s ongoing evolution as it navigates the rapidly changing digital asset landscape and seeks out new avenues for growth and expansion.

See More: Best Cryptocurrency ETFs

GME Price Action: GameStop shares rose by 11.7% during regular trading hours on Thursday to close at $16.78. In the after-hours session, the shares dropped by 7%.

The post GameStop Plans To Sell Convertible Notes To Raise Up To $1.3B, Invest In Bitcoin

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

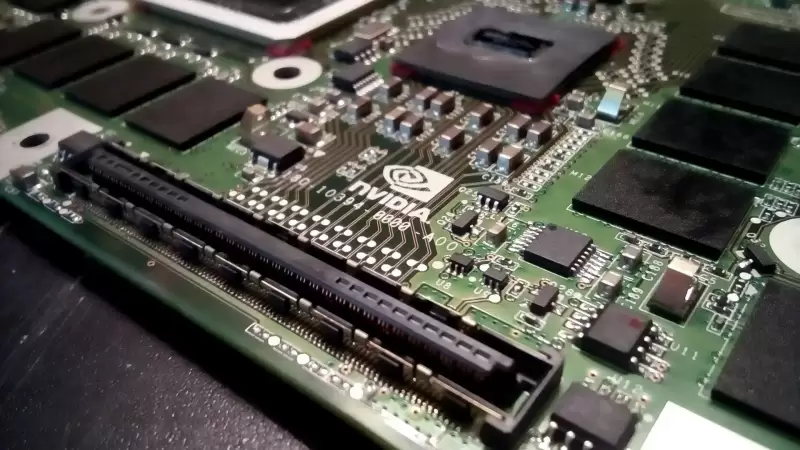

- Nvidia (NASDAQ:NVDA) shares drop by over 6% in after-hours trading after it revealed in a Form 8-K filing yesterday that the US government has mandated it to secure a license for exporting its H20 product line to China

- Apr 17, 2025 at 02:05 am

- Nvidia (NASDAQ:NVDA) shares dropped by over 6% in after-hours trading after it revealed in a Form 8-K filing yesterday that the US government has mandated it to secure a license for exporting its H20 product line to China, Hong Kong, Macau, and D:5 countries.

-

-

- Troubled decentralized finance (DeFi) platform Mantra releases an official statement addressing the reasons for a 92% flash crash of its OM token

- Apr 17, 2025 at 02:00 am

- An April 16 announcement titled “Statement of Events: 13 April 2025” reiterates that the crash did not involve any token sales by the project itself, and the Mantra team remains fully functional and continues investigating the incident.

-

-

-

-

-