|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Franklin Templeton Lauds Bitcoin Ordinals, Reshaping Crypto Landscape with NFT Surge

Apr 06, 2024 at 02:04 am

Global asset manager Franklin Templeton acknowledges the transformative impact of Bitcoin Ordinals on the cryptocurrency industry, highlighting its role in driving Bitcoin-centric innovation and increased prominence in the NFT market. The firm's recent briefing outlines the surge in Bitcoin NFT trading activity and market visibility, noting the leading roles of collections like NodeMonkes and Runestone.

Bitcoin Ordinals Reshape Cryptocurrency Landscape: Franklin Templeton Acknowledges Transformative Impact

Global asset management giant Franklin Templeton has become the latest institutional heavyweight to recognize the transformative impact of Bitcoin Ordinals on the cryptocurrency industry. In a recent briefing titled "The Rise of Bitcoin Ordinals," Franklin Templeton's digital assets arm highlighted the meteoric rise of Bitcoin non-fungible tokens (NFTs) as a catalyst for a resurgence of activity within the Bitcoin network.

The report underscores the growing prominence of Bitcoin in the NFT market, evidenced by a surge in trading activity and market visibility for Bitcoin Ordinals. Franklin Templeton specifically identifies collections such as NodeMonkes and Runestone as leading the charge in terms of trading volume and market capitalization within the NFT realm.

"The rise of Bitcoin Ordinals has marked a significant uptick in Bitcoin-centric innovation," stated Franklin Templeton in its briefing. "These NFTs are capturing the attention of collectors and speculators alike, driving a new wave of engagement with the Bitcoin network."

The firm's observations align with the stellar performance of the Bitcoin network in the NFT market last month. In March, Bitcoin led all blockchains in monthly NFT sales, raking in over $514 million and surpassing $3 billion in all-time sales, becoming only the fourth network in history to achieve this milestone.

However, Franklin Templeton also issued a cautionary note to investors, emphasizing the inherent risks associated with these assets. "Investing in Bitcoin Ordinals should be approached with a thorough understanding of the potential risks," the briefing states. "These risks include potential loss in value and the lack of traditional financial protections."

Franklin Templeton has consistently demonstrated a proactive stance towards educating its clients about various segments of the cryptocurrency market. The firm has previously delved into the prospects and hazards of memecoins and has ventured into the Bitcoin ETF arena with the launch of the Franklin Bitcoin ETF (EZBC) for American investors.

The endorsement of Bitcoin Ordinals by Franklin Templeton is a testament to the growing recognition of their disruptive potential within the cryptocurrency industry. As NFTs continue to gain traction and find new use cases, Bitcoin Ordinals are poised to play a pivotal role in driving innovation and engagement within the Bitcoin ecosystem.

Implications for Cryptocurrency Market

The rise of Bitcoin Ordinals has profound implications for the cryptocurrency market:

- Increased Attention for Bitcoin: Bitcoin Ordinals have brought renewed focus to the original cryptocurrency, highlighting its potential for innovation and expansion beyond its traditional use cases.

- Diversification of NFT Market: Bitcoin Ordinals offer a unique alternative to NFTs built on other blockchain networks, providing collectors and speculators with a wider range of options.

- Potential for New Applications: The technology underlying Bitcoin Ordinals has the potential to enable innovative applications beyond collectible NFTs, such as digital art, gaming, and decentralized finance.

- Regulatory Uncertainties: As Bitcoin Ordinals continue to evolve, regulators will need to address their classification and potential impact on financial markets.

Conclusion

Franklin Templeton's acknowledgment of the transformative impact of Bitcoin Ordinals underscores the increasing maturity and sophistication of the cryptocurrency industry. As NFTs gain widespread adoption and new use cases emerge, Bitcoin Ordinals are poised to play a significant role in shaping the future of digital assets and the broader cryptocurrency landscape.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

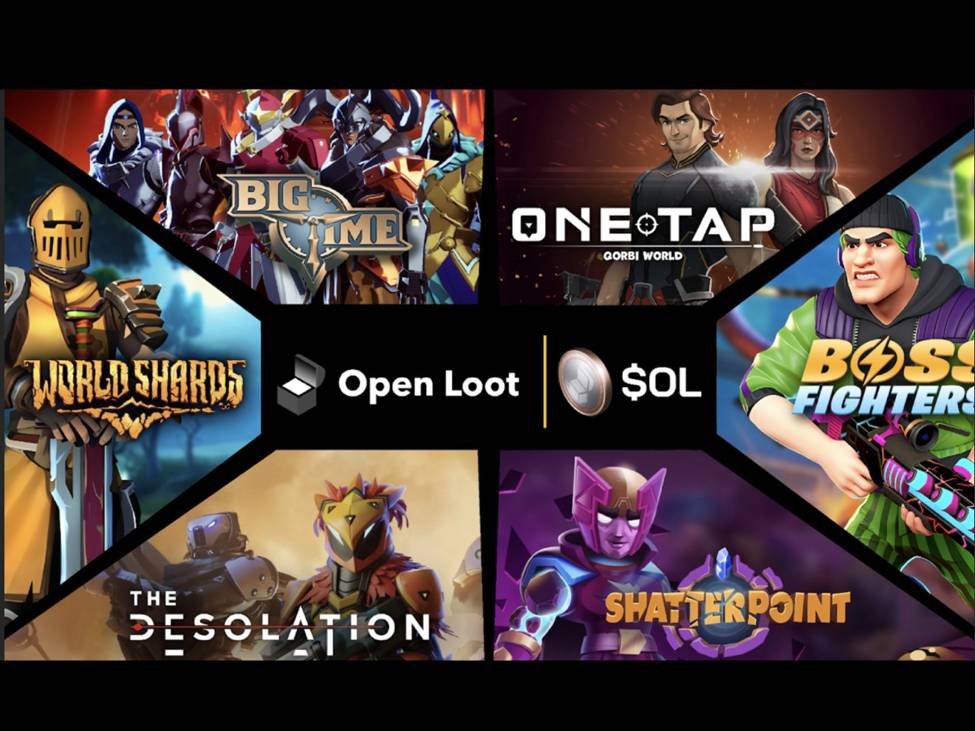

- Big Time Studios Introduces $OL Token to Supercharge Its Open Loot Web3 Gaming Platform and Marketplace

- Nov 19, 2024 at 06:30 pm

- Big Time Studios, a Web3 gaming trailblazer and creator of the Open Loot platform and hit game Big Time, which has already processed a half billion dollars in total transaction volume, is making waves again.

-

- The Next Shiba Inu? 5 Promising New Meme Coins to Watch in 2023

- Nov 19, 2024 at 06:30 pm

- Attention is turning to new digital coins that might match the spectacular rise of tokens like Shiba Inu. Innovative projects with strong communities are emerging, capturing interest with their unique ideas. These assets hold the potential for significant growth, sparking excitement among investors seeking the next big opportunity.

-

-

-

-

-