|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Ethereum's Paradox: Solid Revenue Amidst Criticism

Apr 06, 2024 at 05:00 pm

Amidst market volatility, Ethereum (ETH) faces mixed signals. Despite concerns raised by Peter Brandt, who labeled it a "junk coin," many experts remain optimistic about Ethereum's future. The altcoin's price has experienced fluctuations, showing both gains and losses over the past quarter.

Ethereum's Mixed Signals: Promising Revenue Amidst Criticism

In the volatile crypto market of the first quarter of 2024, Ethereum (ETH) has emerged as a subject of both praise and scrutiny. While its price movements have been marked by fluctuations, Ethereum's revenue stream has shown promising signs, particularly in the context of ongoing developments surrounding its ecosystem.

At the time of writing, ETH had gained 1.71% over a 24-hour period, trading at $3,334.77. This upward movement, however, is tempered by a broader monthly decline of 11.94%, accompanied by a 5.18% decrease in trading volume to $13.87 billion.

Peter Brandt's Critical Assessment

Renowned trader Peter Brandt, expressing his skepticism towards Ethereum, labeled it a "junk coin" due to perceived flaws. In his view, ETH's value as a store of value falls short, resembling a "BTC pretender." Moreover, he criticized its functionality, citing the complexities associated with Layer 2 solutions (L2s) and exorbitant gas fees. Brandt maintained that the cryptocurrency's appeal to investors persists despite these shortcomings.

Positive Outlook from JP Morgan and Others

Conversely, other commentators hold a more optimistic outlook on Ethereum's prospects. JP Morgan, for example, has pointed to Lido's reduced stake in Ethereum as a factor that could mitigate the risk of the altcoin being classified as a security. Nikolaos Panigirtzoglou, a JP Morgan analyst, believes this decline could enhance Ethereum's regulatory standing.

Industry Reactions to Brandt's Critique

Brandt's criticisms of Ethereum have elicited diverse responses within the crypto community. Some have echoed his sentiments, while others have defended the platform. Notably, Adam Back, CEO of Blockstream, aligned with Brandt's remarks, highlighting the ongoing security vulnerabilities and complexities of Ethereum's script.

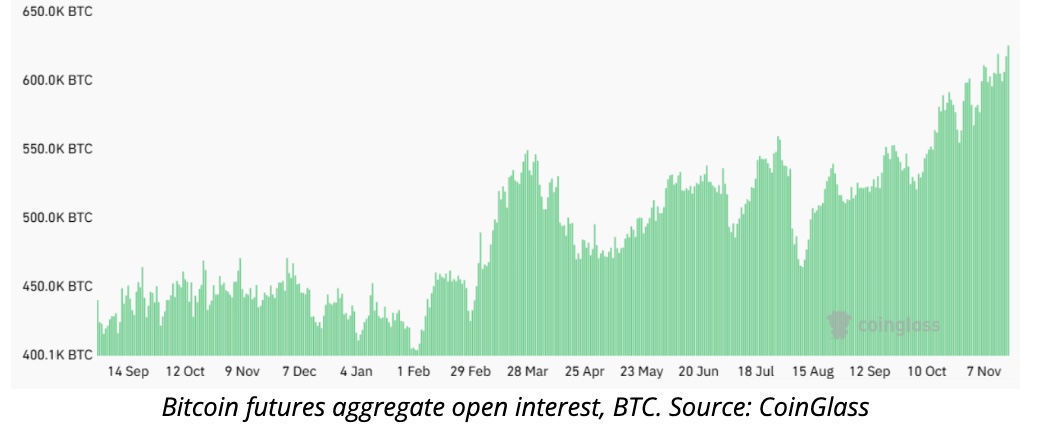

Derivative Market Signals Optimism

Despite these criticisms, many analysts remain bullish on Ethereum's long-term outlook. The derivatives market, in particular, suggests a positive sentiment. Ethereum's Funding Rate, an indicator of market dominance, has been consistently in the green zone, indicating a strong presence of long-position traders. This bullish sign suggests that traders are willing to pay short-position traders a premium, a testament to their expectations of Ethereum's price appreciation.

Conclusion

Ethereum stands at a crossroads, marked by both promising revenue streams and lingering concerns. While traders and analysts may debate its long-term value, the platform's enduring appeal to investors remains evident. As the crypto market continues to evolve, Ethereum's trajectory will undoubtedly be shaped by ongoing developments, regulatory decisions, and the evolving landscape of blockchain technology.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

- Two Students from New York University Embark on Their Cryptocurrency Journey

- Nov 20, 2024 at 11:30 am

- Ethan and Maya embarked on their cryptocurrency journey in early 2023. Initially, they each invested $2,000 in Pepe (PEPE) and later an additional $2,000 in Book of Meme (BOME), driven by the allure of quick profits.

-

-

-