|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Ethereum (ETH) Price Dips Below $2,000, Tracking US Non-Farm Payroll (NFP) Report

Mar 10, 2025 at 11:45 pm

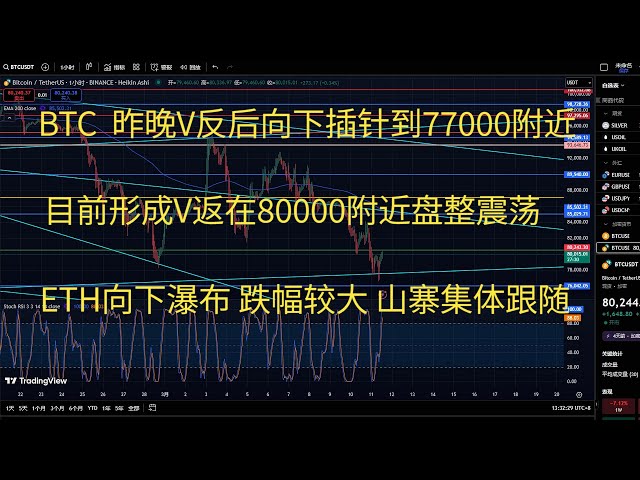

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has faced a major price dip, falling below the critical $2,000 threshold.

![]()

The second-largest cryptocurrency, Ethereum (ETH), faced a major setback on Thursday, plunging below the critical $2,000 threshold as the latest Non-Farm Payroll (NFP) report from the US signaled rising unemployment and heightened inflation pressures.

Despite anticipation surrounding the White House Summit, investor sentiment remained bearish, further exacerbating the decline in ETH prices.

Key Takeaways:

Macro Data Drives Crypto Market Fluctuations

The cryptocurrency market has been highly reactive to macroeconomic data, and Ethereum’s latest plunge underscores the increasing influence of traditional financial indicators on digital asset valuations.

With the Federal Reserve’s potential response to inflation concerns looming, Ethereum’s short-term price trajectory remains uncertain.

Ethereum Price Action: Breaking Below Psychological Support Level

Ethereum’s price decline intensified over the weekend, with ETH tumbling to a low of $1,998 on Binance, marking an 8% daily drop on March 9.

This downturn followed a 4% loss in Bitcoin during the same period, highlighting Ethereum’s amplified bearish momentum.

The selling pressure on ETH appears to be driven by several key factors:

• Non-Farm Payrolls Miss Estimates, Signaling Unemployment Increase

The NFP report for February showed an addition of 203,000 jobs, falling short of the market consensus of 228,000. While the unemployment rate remained unchanged at 3.9%, signaling some positivity, the report also revealed a revision to December’s payrolls, cutting it by 19,000.

• Ethereum ETF Outflows Surge as Institutional Investors Reallocate

Institutional investors have been offloading Ethereum holdings, evidenced by massive ETF outflows.

According to on-chain analytics provider SosoValue, Ethereum ETFs recorded $23 million in outflows on March 8, coinciding with the release of the NFP report.

Among these outflows, BlackRock’s iShares Ethereum ETF led the sell-off with an $11 million capital flight, marking the largest single-day withdrawal in Ethereum-focused funds.

Institutional investors appear to be reallocating capital toward fixed-income securities, driven by concerns over inflation and potential Federal Reserve tightening.

The rapid outflows suggest that Ethereum could face continued downside pressure unless ETF demand rebounds in the coming days. If institutional investors continue to offload ETH holdings, prices may struggle to recover in the short term.

Ethereum Price Forecast: Can ETH Avoid a Drop to $1,850?

Ethereum’s technical outlook has taken a distinctly bearish turn, with multiple indicators pointing to a deeper decline.

A crucial technical development is the emergence of a Death Cross, where the short-term exponential moving average (EMA) crosses below a longer-term EMA. This pattern often signals a prolonged bearish trend.

If ETH fails to regain ground above $2,000, the next key support level is at $1,850. Historical data shows that Ethereum has previously found buying interest at this level, making it a critical area for bulls to defend.

However, the current lack of strong bullish momentum suggests further downside risks.

Key Technical Indicators:

• 100-EMAs crossed below the 200-EMAs on March 7, confirming a Death Cross.

• MACD on the 4-hour chart is in bearish territory and sloped downwards, indicating strong selling pressure.

• RSI (14) is deeply oversold, currently trading below 30.

Key Ethereum Price Levels to Watch This Week

Ethereum’s next price movements will largely depend on institutional demand and macroeconomic developments.

With the upcoming US Consumer Price Index (CPI) report, traders and investors should be prepared for heightened volatility.

Here are some key price levels to monitor this week:

• Resistance: $2,200

• Pivotal Point: $2,000

• Support: $1,850

Here are some potential bullish and bearish scenarios for Ethereum in the coming days:

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- Singapore Exchange (SGX) Lists Bitcoin Perpetual Futures for Institutional Traders in 2H 2025

- Mar 12, 2025 at 12:25 am

- Singapore Exchange Ltd. (SGX) intends to list Bitcoin perpetual futures for institutional traders in the second half of 2025. Listing awaits approval by the Monetary Authority of Singapore but, if approved, would be a milestone for regulated trading of crypto derivatives.

-

-

-

-

-

-