|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Elite Analyst Warns Bitcoin Holders: ‘Little to No Support’ Until $70k

Apr 01, 2025 at 06:55 am

The Bitcoin price entered April at around $83.2k after dipping around 4% in month. However, what's worrying is that the sentiment on the market is not good.

Elite Analyst Warns Bitcoin Holders: ‘Little to No Support’ Until $70k

Bitcoin's price started April at around $83.2k after a roughly 4% decline from March. However, what's concerning is that the sentiment on the market is not good, to say the least. In any case, let's see whether April and Q2 could potentially be better for BTC and broader crypto market.

Meanwhile, crypto veteran ‘Ali Martinez' highlighted an interesting Bitcoin indicator.

The Concerning “Air Gap” in Bitcoin’s Support Structure

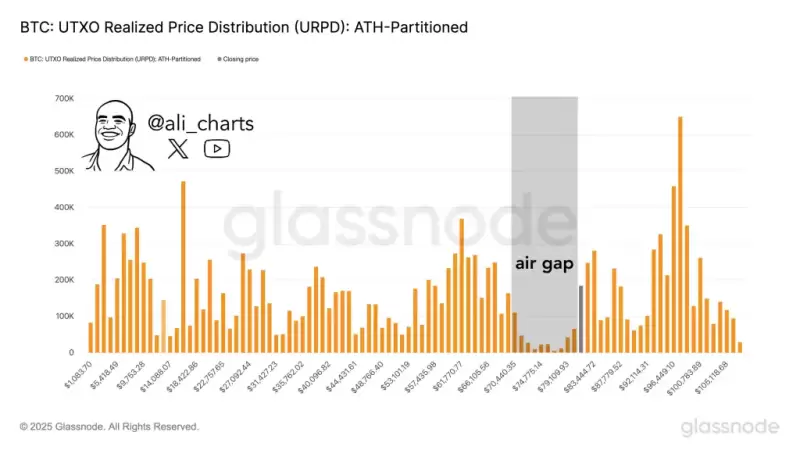

Martinez shared a critical Glassnode chart displaying Bitcoin’s UTXO Realized Price Distribution (URPD). This key metric reveals where current Bitcoin holders acquired their coins. It provides insight into actual support zones. It relies on transaction history rather than speculative analysis.

The most alarming aspect of the chart is what Martinez calls an “air gap” between $70,000 and $80,000. This gray-shaded zone shows remarkably low UTXO activity. Very few holders acquired Bitcoin in this price range. Without substantial historical transactions in this zone, there’s minimal on-chain support to prevent rapid price movement.

This is concerning for current holders. If Bitcoin falls below $80k, there’s little to prevent it from sliding quickly down to $70k. There would be no significant buying pressure to slow the descent.

Bitcoin’s Strong Support Levels

Dense clusters of activity appear below $70k, particularly around $60k, $50k, and $40k levels. These zones represent stronger areas of historical accumulation. Many UTXOs were created at these levels. They potentially form solid on-chain support where previous buyers might step in again.

The BTC chart also shows huge recent Bitcoin volume in the $100k-$105k range. This suggests new market participants are entering at current highs. This area could act as a resistance zone if prices drop and retest from below.

Martinez's tweet summarizes the chart: "Below $80,000, $BTC faces an air gap! There’s little to no support until $70,000.” This serves as a warning for short-term BTC price action. The current price structure lacks historical backing in the $70K–$80K range.

Read also: Bitcoin Price Prediction: Analyst Maps Out 3 Price Targets For BTC in 2025

Implications for Traders and Investors

Traders should be aware of several key points:

The UTXO Realized Price Density is a powerful metric for Bitcoin analysis. It helps determine support and resistance zones based on actual transaction history. When Bitcoin enters a price range with little historical activity, there’s less incentive for holders to buy or defend that price. This makes the price more volatile within that range.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.