|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Dogwifhat and BONK Face Market Liquidity Challenges Amidst Waning Interest

Apr 17, 2024 at 01:30 am

Solana's DOGWIFHAT (WIF) has fallen behind rivals SHIB and PEPE in market liquidity, with daily trading volume decreasing by 33%. Despite reaching an all-time high of $4.83 on March 31, WIF has since retreated to $3.29. Additionally, Bonk (BONK) has witnessed a significant decline, dropping below a $1 billion market cap for the first time since February 2024 and facing an early exit from the top 100 cryptocurrencies by market capitalization. Both WIF and BONK have suffered a 17% hit over the past 24 hours, influenced by rising tensions in the Middle East and the US tax-day crypto selloff.

Dogwifhat: Market Liquidity Woes Hinder Growth Amidst Plummeting Interest in BONK

Dogwifhat (WIF) and Bonk (BONK) have witnessed a sharp decline in their market liquidity, raising concerns about their long-term viability. The memecoins, which enjoyed a surge in popularity during the recent memecoin rally, are now facing significant headwinds as interest wanes.

Dogwifhat's Liquidity Woes

Dogwifhat's daily trading volume has experienced a dramatic 33% drop, highlighting a significant decline in market activity. This decrease is particularly concerning given the memecoin's lofty aspirations to exceed $5.00. The combined liquidity books for Dogwifhat show an imbalance between pending sales and bids, with both orders hovering around 10 million. This is significantly lower than the $40 million in combined orders for competing memecurrency Pepe (PEPE), according to blockchain research platform CoinPaprika.

BONK's Market Cap Tumble

Bonk, once a darling of the memecoin market, has suffered a precipitous decline, dropping below the coveted $1 billion market cap for the first time since February 2024. The memecoin's daily trading volume has also plummeted to $7,725,900, putting it firmly on track for an early exit from the global market cap's top 100.

Technical Indicators Point to Bearish Sentiment

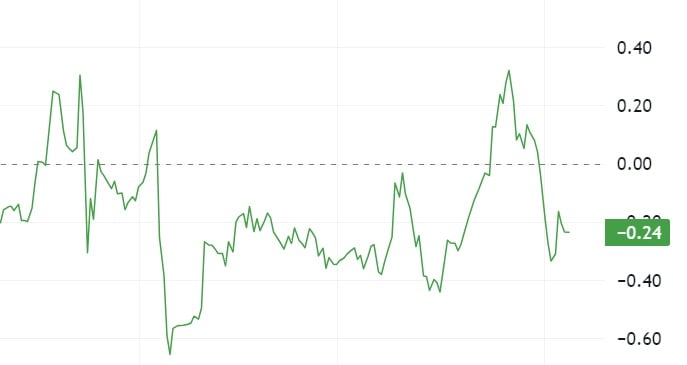

Technical indicators for both BONK and WIF suggest a bearish outlook. The Chaikin Money Flow (CMF) for BONK has dropped heavily below zero, indicating that whales and retail investors are distributing rather than accumulating the memecoin. A negative CMF index is often interpreted as a sign of institutional retreat. Binance, which accounts for nearly 40% of BONK's daily trading volume, shows an RSI (Relative Strength Index) of just above 20, suggesting that the memecoin is strongly oversold.

Whale Abandonment and Diminishing Hype

The sharp decline in BONK's market liquidity and price can be attributed to a combination of factors, including whale abandonment and diminishing hype. While the memecoin had a strong initial run, its momentum has waned as traders seek out more promising investments. The lack of sustained market interest has led to a significant outflow of funds, further exacerbating the liquidity crisis.

Derivatives Market Resilience

Despite the bearish sentiment in the spot market, derivatives crypto markets have shown resilience. BONK's trading volume has surged 22% in the derivatives market, with $190 million in trading volume across BONK's Perpetuals and 1000BONK contract. This indicates that some traders are still bullish on BONK, believing that the recent downturn presents an opportunity for accumulation.

Conclusion

Dogwifhat and BONK's market liquidity woes are a stark reminder of the volatility and unpredictability of the memecoin market. While these tokens may experience temporary surges in popularity, their long-term viability is highly dependent on sustained market interest and liquidity. As the hype surrounding these memecoins wanes, it remains to be seen whether they can regain their former glory or fade into obscurity.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.