Dogecoin has struggled to surpass the $0.2 mark, with whale selling and a bearish pattern emerging. Despite recent gains, short-term holders' increased holdings could lead to selloffs. On-chain data shows a decline in whale holdings and an increase in the number of short-term traders, indicating potential downward pressure on the cryptocurrency.

Dogecoin Stalls as Whales and Short-Term Traders Cast Bearish Shadows

The Dogecoin (DOGE) community is facing a reckoning as the cryptocurrency hovers at the $0.2 barrier, with bullish momentum dwindling among whales and other influential traders. Despite briefly surpassing this crucial threshold on March 31, DOGE has since retraced, plunging as low as $0.1719 in early April.

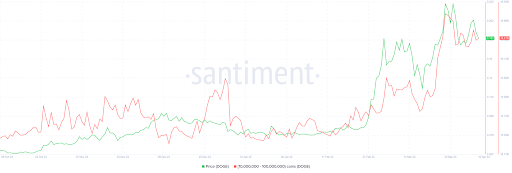

Concerningly, on-chain data reveals an ominous trend that casts a bearish cloud over the digital asset's future prospects. According to the analytics platform Santiment, whales—entities holding between 10,000,000 and 100,000,000 DOGE—have been offloading their holdings at an alarming pace. Since the beginning of April, these wallets have reduced their collective balance by a staggering 333 million DOGE.

This whale exodus has dire implications for DOGE's price action. Historical evidence suggests that whales exert a significant influence on market sentiment and price movements in the cryptocurrency realm. Notably, the recent decline in whale holdings coincides with an 18% drop in DOGE's value, falling from $0.2262 on March 28 to $0.1854 within a 24-hour span.

Further fueling bearish concerns, data from IntoTheBlock indicates a surge in holdings among short-term traders over the past 10 days, amounting to a 6% increase. While this may initially appear bullish, the impulsive nature of short-term traders poses a threat to DOGE's stability. Unlike whales and long-term investors, short-term traders typically hold their assets for brief durations of one to three months, making their holdings vulnerable to rapid selloffs. This could potentially trigger a downward spiral in DOGE's price.

At press time, DOGE is trading at $0.1970, showing a modest 4% gain over the past 24 hours. However, the bullish momentum is waning, and a sustained upward trajectory is unlikely without a shift in sentiment among whales. If large traders continue to sell off their DOGE holdings, it could ignite a wave of fear and uncertainty, leading to a further decline in price.

IntoTheBlock has identified a formidable resistance level at $0.20—a price point that has prevented DOGE from achieving a new yearly high. Notably, over 32,000 addresses are currently holding 3.78 billion DOGE at a loss at this critical level. Surpassing this barrier could trigger a mass selloff, sabotaging the cryptocurrency's prospects for a sustained price increase.

In conclusion, the current market dynamics surrounding Dogecoin raise serious concerns about its near-term trajectory. The departure of whales, coupled with the influx of short-term traders, paints a bearish picture. Unless whales regain confidence and reverse their selling trend, DOGE faces an uphill battle to break through the psychological barrier of $0.2 and reclaim its former glory.