|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Dogecoin (DOGE) Shows Signs of Bullish Momentum as It Rebounds

Mar 13, 2025 at 05:08 am

Dogecoin (DOGE) has shown signs of bullish momentum as it rebounds from a critical support level of $0.143, forming a lower wick at $0.14297 on its daily chart.

Dogecoin (CRYPTO: DOGE) has shown signs of bullish momentum as it’s currently rebounding from a critical support level at $0.143, forming a lower wick at $0.14297 on its daily chart. The latest price action suggests possible accumulation at this level.

However, for DOGE to establish a more stable upward trend, it needs to break through the $0.175 resistance. Despite this, the outlook remains uncertain, as the ongoing delay by the U.S. Securities and Exchange Commission (SEC) on approving an ETF proposal for DOGE could affect its trajectory.

Key Levels To Watch

The $0.143 support level has proven to be crucial in the recent price action. Dogecoin’s daily candle closed above this level, marking a potential reversal from its previous downward movement.

If the coin can maintain its position above $0.143, it could signal accumulation, setting the stage for a potential rally. However, despite the rebound, recent red candles show that DOGE still faces downside pressure, suggesting that the coin may test lower support levels before a more significant price reversal.

In terms of key resistance, DOGE needs to reclaim the $0.17542 level to confirm a more stable upward trend. If it fails to hold the $0.143 support, further downside testing could push the price down to $0.134.

However, should it manage to hold the support and rise above $0.168, it may gain momentum and target the next resistance level at $0.175.

Key Liquidation Areas And Market Dynamics

The strongest liquidation area for Dogecoin lies between the $0.16 and $0.17 range. This price zone could attract additional liquidity, which may fuel a short-term move toward these levels.

A spike in buying activity could drive the price to these liquidations, causing stop hunts and triggering volatile price swings. However, any failure to push beyond $0.17 could lead to a sell-off and create further liquidity pools around the $0.155 region, which could act as a bear trap.

On the other hand, if Dogecoin establishes higher lows and increased trading volume, it would signal growing strength in the market, potentially leading to a more significant rally.

If new liquidity pools form below $0.16, Dogecoin may attempt to break through this level before challenging the $0.17 resistance again.

SECs ETF Delay: A Crucial Factor In Dogecoin’s Short-Term Price Action

A crucial factor in Dogecoin’s short-term price action is the SEC’s delayed decision on the approval of an ETF for DOGE. While the decision was expected sooner, the SEC has pushed the deadline to April 4, 2025.

ETF approvals have historically been a bullish catalyst for crypto assets, and analysts remain optimistic about DOGE’s prospects.

Bloomberg ETF analyst James Seyffart recently pointed out that the delay is likely to result in mixed reactions. However, Polymarket assigns a 75% probability to the approval of the Dogecoin ETF.

Should the SEC approve the ETF, it could provide a significant boost to DOGE’s price, potentially driving it toward $1 or higher, as institutional demand and broader market acceptance would likely follow.

However, the uncertainty surrounding the SEC’s decision leaves room for volatility. If the ETF is rejected or further delayed, DOGE could experience additional downward pressure.

Currently, Dogecoin is testing support at $0.14, and any further delay or negative news regarding the ETF could exacerbate volatility, potentially leading to a dip in price.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- Fears of a sharp economic downturn due to President Donald Trump’s ever-changing tariff policies are pervading Wall Street

- Apr 18, 2025 at 03:00 am

- Kristalina Georgieva, the managing director of the United Nations agency IMF, said Thursday the fund made “notable markdowns” to its global economic growth forecasts due to trade disruptions

-

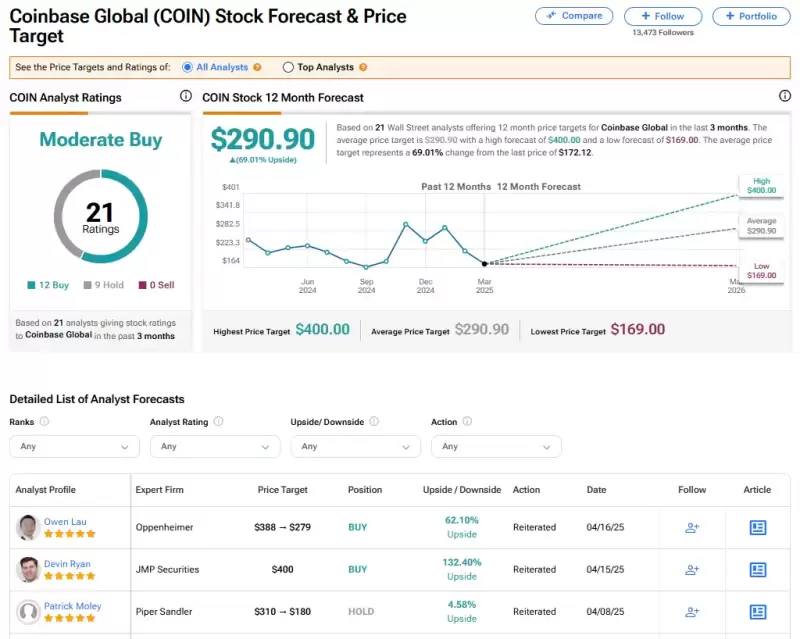

- The stock of cryptocurrency exchange Coinbase Global (COIN) has been downgraded by U.S. investment bank Oppenheimer (OPY) over fears that investors are moving to the sidelines.

- Apr 18, 2025 at 02:55 am

- Owen Lau, a top five-star rated analyst at Oppenheimer, cut his share price target on Coinbase’s stock to $279 from $388, saying he expects trading by retail investors to remain weak amid ongoing market uncertainty caused by U.S. President Donald Trump's import tariffs and trade wars.

-

-

![Melania Meme [MELANIA] remains one of the most underperforming tokens Melania Meme [MELANIA] remains one of the most underperforming tokens](/assets/pc/images/moren/280_160.png)

-

-

-

- Japan's ANAP Acquires $70 Million in Bitcoin as Part of Investment Strategy

- Apr 18, 2025 at 02:45 am

- Japan's ANAP has announced the purchase of millions worth of Bitcoin as part of its investment strategy. The company follows in the footsteps of companies like MicroStrategy and fellow Japanese company MetaPlanet.

-

![Melania Meme [MELANIA] remains one of the most underperforming tokens Melania Meme [MELANIA] remains one of the most underperforming tokens](/uploads/2025/04/18/cryptocurrencies-news/articles/melania-meme-melania-remains-underperforming-tokens/middle_800_480.webp)