|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Cryptocurrency prices are down across the board

Apr 16, 2025 at 07:17 pm

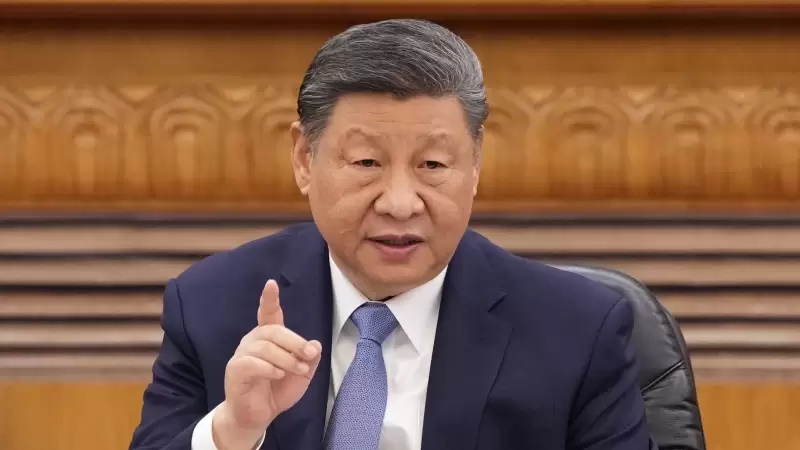

Cryptocurrency prices are down across the board over the last 24 hours amid a wider risk asset sell-off triggered by deepening U.S.-China trade tensions.

Cryptocurrency prices are down across the better part of the board over the last 24 hours amid a wider risk asset sell-off triggered by deepening U.S.-China trade tensions.

The White House said China now “faces up to a 245% tariff on imports” and imposed new restrictions on chip exports to the country. Bitcoin (BTC) fell more than 2.2% while the broader market, measured by the CoinDesk 20 (CD20) index, declined 3.75%.

Nasdaq 100 futures are also down, losing more than 1% while S&P 500 futures dropped 0.65%.

While bitcoin has remained notably stable as the trade war escalated, some metrics suggest the bull run may have ended.

The largest cryptocurrency slipped below its 200-day simple moving average on March 9, suggesting “the token’s recent steep decline qualifies this as a bear market cycle starting in late March,” Coinbase Institutional said in a note

A risk-adjusted performance measured in standard deviations known as the Z-Score shows the bull cycle ended in late February, with subsequent activity seen as neutral, according to Coinbase Institutional’s global head of research, David Duong.

“The chart pattern and Z-Score both suggest that the crypto bull market, which began in December 2022, has ended,” Duong said.

Still, the resilience cryptocurrency prices have shown is “undoubtedly good for the market,” as it lets traders “look more seriously at using premium to hedge — supporting the case for allocating into spot,” said Jake O., an OTC trader at crypto market maker Wintermute.

“In response, several prime brokers have shifted their short-term models from underweight to neutral on risk assets, noting that the next move will likely be driven by ‘real’ data,” Jake O. Said in an emailed statement.

That “real data” is coming in soon enough, with the U.S. Census Bureau set to release March retail sales data, and Fed Chair Jerome Powell delivering a speech on economic outlook.

Tomorrow, the U.S. Department of Labor releases unemployment insurance data and the Census Bureau releases residential construction data, while the ECB is expected to cut interest rates.

The shakiness in risk assets has benefited gold. The precious metal is up around 26.5% year-to-date to above $3,300 per troy ounce, contrasting with the U.S. Dollar Index’s 9% drop. Stay alert!

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

-

-

- OM token crash exposes “critical” liquidity issues in crypto

- Apr 19, 2025 at 09:00 am

- Crypto investor sentiment took another significant hit this week after Mantra's OM token collapsed by over 90% within hours on Sunday, April 13, triggering knee-jerk comparisons to previous black swan events such as the Terra-Luna collapse.

-