|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Crypto Market Roars with Bullish Sentiment as Bitcoin Halving and Spot BTC ETFs Surge

Apr 02, 2024 at 05:16 pm

As the cryptocurrency market navigates consolidation, anticipation builds towards April's Bitcoin halving event and technical indicators suggest bullish potential for Ethereum and Ripple's XRP. Bitcoin's halving event and the influx into Spot BTC ETFs could fuel increased demand and broader market optimism, while Ethereum's inverse head and shoulders pattern and XRP's consolidation above the trend line indicate potential uptrends.

Cryptocurrency Market Outlook: Bullish Sentiment Emerges Amid Bitcoin Halving and Positive Influx into Spot BTC ETFs

As the month of April approaches, the cryptocurrency market is abuzz with anticipation for the highly awaited Bitcoin halving event, a significant development that could potentially alter the current consolidation trend and propel prices on a bullish trajectory. This event, coupled with a positive influx into Spot BTC ETFs, is likely to stoke increased demand for Bitcoin and influence broader market sentiment, potentially leading to a surge in cryptocurrency prices.

Ethereum's Resilience Amid Consolidation

Ethereum, widely recognized as a decentralized platform that facilitates the creation and operation of smart contracts and decentralized applications (DApps) without the need for third-party intermediaries, has demonstrated resilience amidst the market's recent consolidation. While uncertainty initially cast a shadow over investors, recent price movements suggest a potential bullish pattern in the making.

At the time of writing, Ethereum is trading at $3,610, reflecting a 2.9% increase for the day. With a market value of $433 billion and a 24-hour trading volume of $10.18 billion, Ethereum's performance is closely scrutinized by traders and enthusiasts alike. Analysts point to an inverse head and shoulders pattern on the 4-hour chart, which signals a possible breakout above the $3,675 resistance level and a subsequent push towards the $4,300 target.

Ripple's Steady Uptrend Amid Fluctuations

Meanwhile, Ripple's cryptocurrency, XRP, designed for efficient cross-border payments, has experienced its fair share of fluctuations in recent weeks. Despite the market's uncertainty, XRP has maintained steady consolidation above the two-month trend line, indicating an ongoing uptrend backed by buyer support.

Currently, XRP boasts a market value of $34.3 billion, securing its position as the sixth-largest cryptocurrency by market capitalization. Should bullish sentiment prevail, XRP could surpass the $0.667 barrier and revisit its previous high of $0.744. However, a break below the formation's lower trend line could trigger a notable correction in this altcoin.

Bitcoin's Halving Event and Its Potential Impact

As the Bitcoin halving event draws near, excitement is palpable within the cryptocurrency community. This event, scheduled to occur in April, involves a 50% reduction in the block reward for Bitcoin miners, thereby limiting the supply of new Bitcoins entering the market. Historically, halving events have been associated with significant price increases for Bitcoin, as reduced supply and increased demand push prices higher.

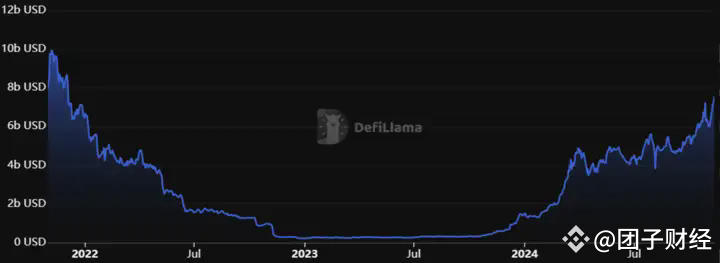

Positive Influx into Spot BTC ETFs

Spot BTC ETFs, which provide investors with exposure to the price of Bitcoin without having to directly own the underlying asset, have recently witnessed a surge in inflows. This trend suggests growing institutional interest in Bitcoin and could further fuel demand for the cryptocurrency, contributing to the bullish sentiment surrounding the upcoming halving event.

Market Dynamics and Investor Sentiment

As the cryptocurrency market continues to evolve, investors and enthusiasts alike are closely monitoring market sentiment, trading volumes, and upcoming events in search of potential opportunities. The Bitcoin halving event, combined with the positive influx into Spot BTC ETFs, has created a fertile ground for bullish expectations and could potentially shift the market's trajectory.

However, it is important to note that cryptocurrency investing carries inherent risks and volatility. Investors should conduct thorough research, understand their risk tolerance, and diversify their portfolio accordingly before committing funds to any cryptocurrency.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- The Optimism Cryptocurrency: Opportunities and Challenges Beyond the Charts

- Nov 13, 2024 at 02:25 am

- In recent discussions about cryptocurrency, much attention has been directed towards Optimism, particularly due to its intriguing ascending triangle chart pattern. While this pattern suggests a potential price surge, there's a significant amount of uncharted territory that investors must navigate beyond mere technical analysis.

-

- The Russian government has approved a bill to tax cryptocurrencies in the country

- Nov 13, 2024 at 02:15 am

- According to the bill, digital currency is given the status of property, and a separate calculation of the tax base is introduced, which is defined as the excess of the value of the asset over the costs of its purchase or extraction.

-

-

- Solana (SOL) Outperforms Altcoin Market, Targeting New Highs as Bitcoin (BTC) Eyes $260K

- Nov 13, 2024 at 02:15 am

- Solana's token (SOL) rose 35% from November 5 to 11, reaching a peak of $222, the highest since December 2021. This rebound has led traders to speculate whether Bitcoin will rise to an all-time high of $260, especially as institutional capital stabilizes and expectations for clearer U.S. regulation grow, following Bitcoin's approach to $90,000.

-

- The Quantum Revolution: Unveiling Unforeseen Impacts on Society and Technology

- Nov 13, 2024 at 02:15 am

- The ascension of quantum computing promises to reshape numerous sectors, sparking both excitement and trepidation across the globe. This burgeoning technology is set to have far-reaching consequences, potentially upending current encryption systems that safeguard sensitive information ranging from financial transactions to government communications.

-

-