|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Crypto Market Outlook Hinges on Halving Event, ETF Approvals, and Waning Concerns

Mar 31, 2024 at 02:56 pm

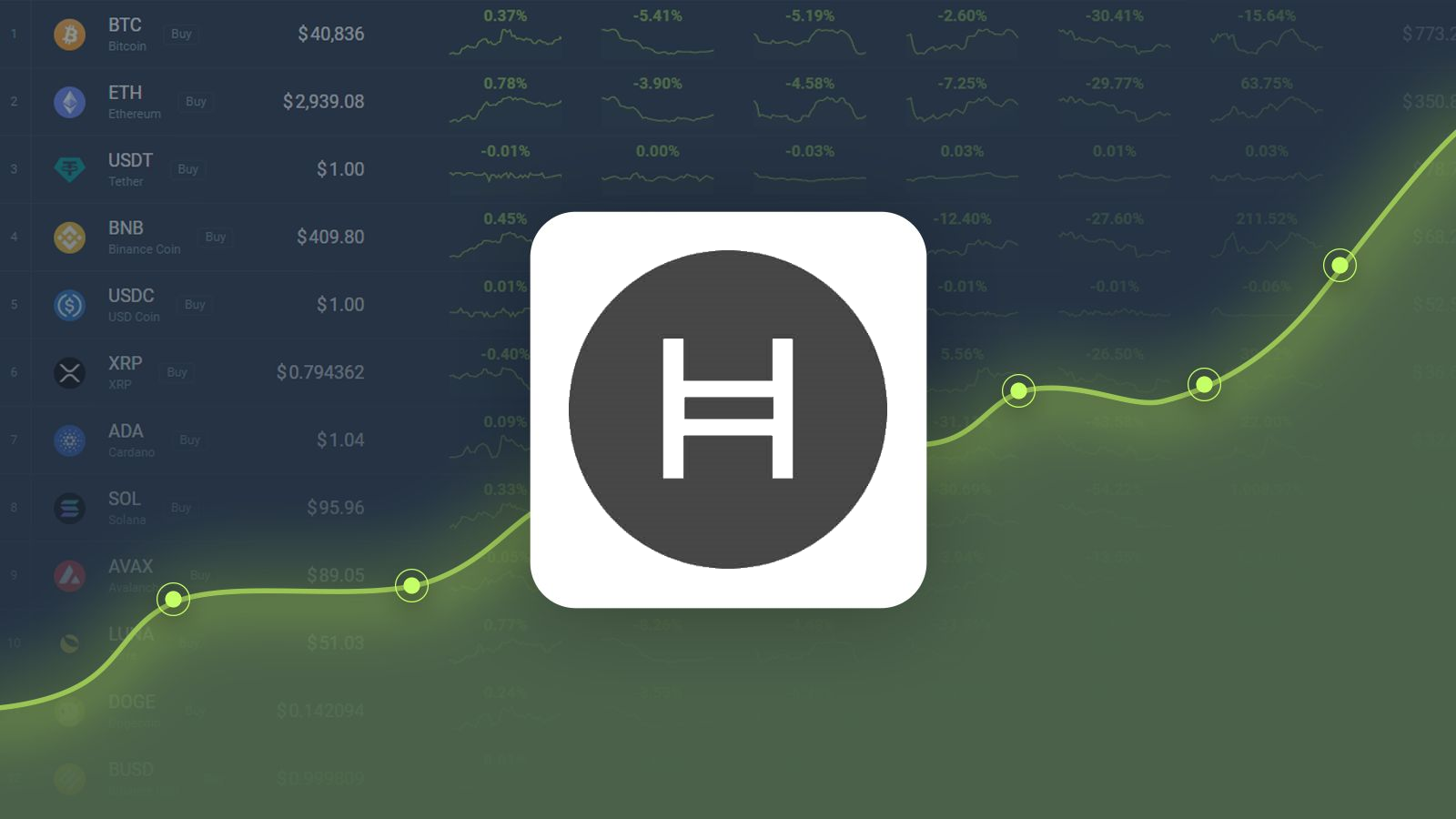

Despite ongoing challenges, a cautious optimism prevails in the crypto market. Stability amid recent holidays and corporate adjustments indicates resilience, but tax season may lead to short-term price fluctuations. Speculative trading strategies and concerns surrounding short MicroStrategy vs long Bitcoin trades have contributed to volatility, which is gradually waning. The upcoming halving event and potential conclusion of spot Bitcoin ETFs review may stimulate demand and positively impact Bitcoin's supply-demand balance. Institutional interest remains elevated, with leveraged short positions in CME Bitcoin futures reaching record highs.

Crypto Market Outlook Hinges on Halving Event, ETF Approvals, and Subsiding Concerns

Despite persistent challenges and fluctuations within the cryptocurrency landscape, Duong Nguyen, a respected industry analyst, maintains a guarded optimism regarding the road ahead. While the full extent of favorable market shifts may not manifest until later in April, several encouraging signs indicate a conducive environment for crypto performance.

Market Stability and Potential Tax-Driven Sell-Offs

One striking observation highlighted by Duong is the market's unexpected stability amidst recent holidays in the United States and adjustments in corporate financials. However, he cautions that the impending tax season could trigger a temporary price dip as investors seek to divest holdings to fulfill tax obligations.

Speculative Trading and Emerging Optimism

Delving into the dynamics of market activity, Duong attributes recent volatility to speculative trading strategies, particularly the prevalence of a "short MicroStrategy versus long Bitcoin" trading approach, which has influenced market sentiment. Nevertheless, concerns that loomed earlier in the year appear to be gradually dissipating, offering hope to crypto proponents.

Bitcoin's Supply-Demand Dichotomy and Institutional Interest

A pivotal aspect of Duong's analysis revolves around Bitcoin's supply-demand dynamics, which are molded by significant events such as the impending halving event and the review process for new financial products like spot Bitcoin exchange-traded funds (ETFs). He emphasizes that the conclusion of major financial institutions' review period for spot Bitcoin ETFs could unleash a surge in demand.

"Institutional interest in the cryptocurrency space remains high," Duong asserts, referencing data indicating a record surge in leveraged short positions in CME Bitcoin futures, a sign of sustained institutional involvement. Additionally, he highlights the approaching halving event, which is anticipated to slow the rate at which new Bitcoin enters the market, potentially shifting the supply-demand equilibrium in favor of price appreciation.

Alleviating Concerns and Positive Market Outlook

One of the main catalysts for the anticipated market upturn is the gradual abatement of concerns that had overshadowed the market earlier in the year. Speculative trading strategies, particularly the contrasting of short positions in MicroStrategy with long positions in Bitcoin, have contributed to recent bouts of instability. However, Duong maintains optimism as these apprehensions appear to be fading, creating a more stable market environment.

Intricate Play of Supply and Demand Dynamics

Probing deeper into the market dynamics, Duong emphasizes the intricate interplay between supply and demand, particularly in the context of Bitcoin. The upcoming halving event, designed to reduce the rate of new Bitcoin issuance, serves as a testament to the inherent scarcity of this digital asset. Combined with the ongoing review process for spot Bitcoin ETFs by major financial institutions, the stage is set for a potential influx of institutional capital into the market.

Anticipated Spot Bitcoin ETF Approvals and Continued Institutional Interest

The culmination of the 90-day review period for spot Bitcoin ETFs, scheduled to conclude around April 10th, holds the promise of unlocking significant capital for these offerings, thereby bolstering demand for Bitcoin. Furthermore, Duong underscores the sustained interest from institutional players, evidenced by the surge in leveraged short positions in CME Bitcoin futures.

Medium-Term Optimism and Cautious Outlook

Looking ahead, Duong expresses measured optimism regarding the medium-term prospects for US-based spot Bitcoin ETFs, anticipating a potential influx of capital following the conclusion of the review period. This, coupled with continued institutional interest, could provide a significant boost to Bitcoin's market dynamics.

While uncertainties persist, Duong's analysis serves as a beacon of hope for crypto enthusiasts, suggesting that the groundwork for a positive turnaround in the market is being laid. As the second quarter of 2024 unfolds, all eyes will be on how these projections materialize and shape the future of digital assets on a global scale.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

-

- A rare US dime, an unstamped dime, has been auctioned for $506250, nearly 30 times the price it sold for 46 years ago.

- Nov 07, 2024 at 10:20 am

- GreatCollections, which auctioned the 1975 Ten without an S, said the coin was purchased by an Ohio collector and his mother for $18200 in 1978 and remained in the family for nearly 50 years.

-

-

- Rollblock ($RBLK): The Web3 Casino Bringing Blockchain Benefits to the Enormous Casino Market

- Nov 07, 2024 at 10:15 am

- With a bullish Q4 upon us, now is the time for utility-based projects to shine and rise to the top of the crypto pile. Read on to find out why the Web3 casino Rollblock ($RBLK) has attracted nearly $5 million of investment from Fantom and Toncoin holders and what the future holds for this potential 100x gaming gem.