|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Crypto Exodus: Bitcoin Reserves on Exchanges Hit 3-Year Low, Signaling Decentralization Shift

Apr 05, 2024 at 05:21 pm

In 2024, Bitcoin reserves held by centralized exchanges have plummeted to their lowest since 2021. Over 90,700 Bitcoins have been withdrawn, despite rising cryptocurrency prices. This exodus may stem from increased risk awareness and the recent wave of hacking and bankruptcies within the industry. The trend suggests a potential shift towards decentralized finance, as investors opt for non-custodial storage and the use of decentralized protocols, aligning with the original ideals of crypto assets.

Bitcoin Exodus: Centralized Exchange Reserves Plummet to Three-Year Low, Signaling a Paradigm Shift in Crypto

In a remarkable development, Bitcoin reserves held by centralized crypto exchanges have plunged to their lowest level since early 2021. This exodus, exceeding 90,700 Bitcoin in the past month alone, has raised eyebrows and sparked speculation about its underlying causes and implications for the future of cryptocurrency.

Dwindling Reserves: A Clear and Present Trend

The data paints a clear picture: Bitcoin reserves on major exchanges have been steadily declining, mirroring a broader trend of capital outflows. This phenomenon is particularly striking given the recent surge in crypto asset prices, which typically attracts investors to exchanges seeking to capitalize on market gains.

Unveiling the Motives: A Confluence of Factors

While the exact reasons for this mass exodus remain somewhat elusive, several plausible hypotheses have emerged. One prevailing theory points to growing concerns among investors regarding the risks associated with storing their funds on centralized platforms. The recent spate of high-profile hacks and bankruptcies within the industry has undoubtedly exacerbated these fears.

Another contributing factor could be a shift towards decentralized finance (DeFi), which offers greater autonomy and control over digital assets. The rise of decentralized exchanges (DEXs) and non-custodial wallets has provided investors with alternative avenues to trade and store their cryptocurrencies, minimizing the reliance on centralized intermediaries.

Decentralization Ascendant: A Return to Crypto's Roots

Beyond the alarming figures, this exodus could signal a major paradigm shift in the Bitcoin ecosystem. Investors seem to be embracing the decentralized ethos of cryptocurrencies, moving away from centralized platforms towards autonomous management of their assets. This trend reflects a desire to reconnect with the foundational principles that ignited the crypto revolution.

Self-Custody and DeFi: Pillars of a New Crypto Era

In this pursuit of decentralization, individual storage in non-custodial wallets (cold wallets) has gained significant traction. These decentralized custody solutions grant users complete control over their Bitcoin, removing the inherent risks associated with centralized exchange platforms.

Concurrently, the rapid evolution of decentralized financial protocols has opened up new avenues for investment and risk management. DeFi protocols offer a wide range of financial services, such as lending, borrowing, and trading, all without the need for centralized intermediaries.

A New Dawn for Cryptocurrencies: Autonomy and Innovation

This sharp decline in Bitcoin reserves on exchanges could be a harbinger of a new era for cryptocurrencies. Beyond short-term speculative fluctuations, it reveals a grassroots movement towards greater financial autonomy. Whether through personal management of private keys or the adoption of decentralized protocols, investors are seeking to reclaim the original vision of crypto assets as a decentralized and self-empowering financial system.

Conclusion: Embracing the Future of Crypto

The plummeting reserves of Bitcoin on centralized exchanges represent a watershed moment for the crypto sector. It underscores growing concerns about centralization and a surge in demand for decentralized solutions. As the industry continues to evolve, it is likely that this trend will only intensify, shaping the future landscape of cryptocurrencies and empowering individuals to take control of their financial destinies.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

- Bitcoin and Ethereum in Trouble, Ripple Going Against the Tide

- Nov 18, 2024 at 09:40 pm

- The crypto market experienced a widespread decline at the end of the week. Bitcoin fell by 2%, Ethereum dropped by 4%, and Solana by 3%. This weakness among the leaders was accompanied by an uncertain macroeconomic context, marked by regulatory pressures and massive BTC sales by miners. Despite this gloomy atmosphere, Ripple (XRP) surprised with a spectacular increase of over 20%. Investors remain alert and are looking to adapt to this extreme volatility.

-

-

- Big Time Studios Announces New Marketplace Utility Token $OL

- Nov 18, 2024 at 09:35 pm

- The token won't be sold or distributed to investors or even the Big Time Studios team. Instead the fair launch will be distributed via a points system that users of Big Time's Open Loot marketplace will earn as they complete various activities on the platform.

-

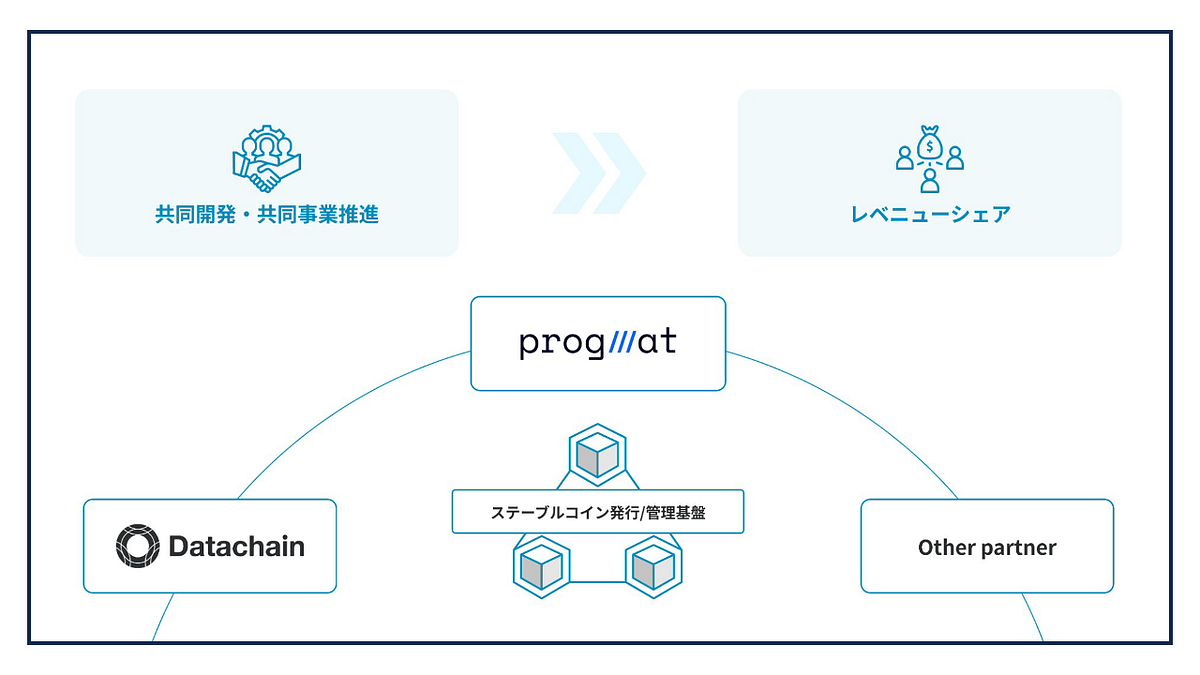

- Datachain & Progmat agree on revenue share for stablecoin business

- Nov 18, 2024 at 09:35 pm

- Datachain Corporation has reached an agreement with Progmat on a revenue sharing contract in the stablecoin business. Under this contract agreement, Datachain will receive a portion of the revenue generated from stablecoins issued through “Progmat Coin,” Progmat’s stablecoin issuance management platform.