On March 21, 2024, Gokul Rajaram, a director at Coinbase Global Inc (NASDAQ:COIN), sold 1,145 shares, totaling $297,700, at $260 per share. This sale is part of a larger pattern of insider transactions at the company, with 108 insider sales and 1 insider buy in the past year.

Insider Transactions: Director at Coinbase Global Inc Disposes of Substantial Stake

New York, March 23, 2024 - Gokul Rajaram, a director at Coinbase Global Inc (NASDAQ: COIN), has divested a significant portion of his holdings in the company, according to a recent Securities and Exchange Commission (SEC) filing. The transaction, executed on March 21, 2024, involved the sale of 1,145 shares of Coinbase Global Inc stock at a price of $260 per share, resulting in total proceeds of $297,700.

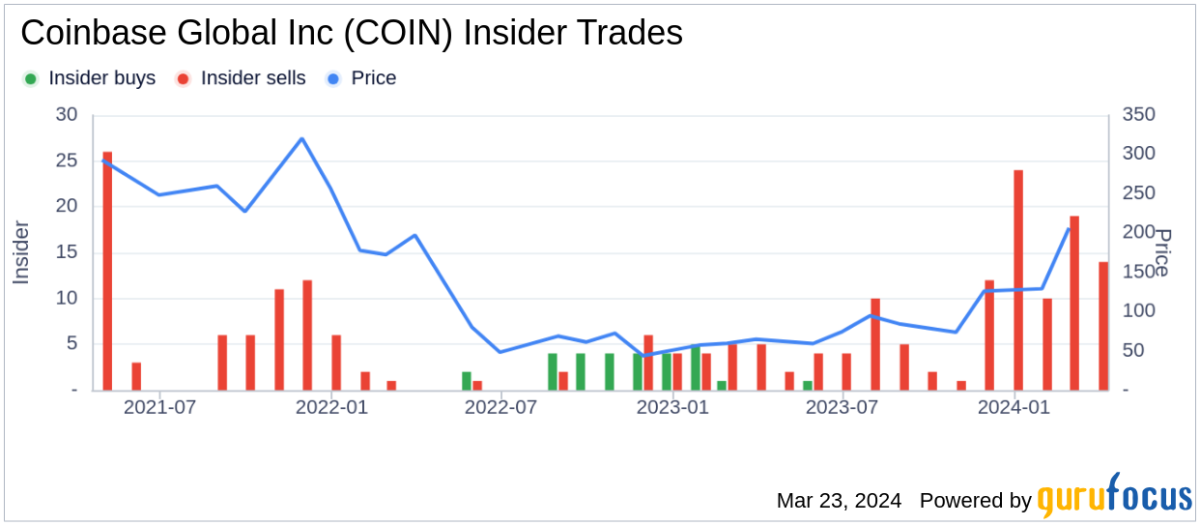

This sale is part of a broader trend of insider transactions at Coinbase Global Inc. Over the past year, insiders have sold a total of 108,366 shares of the company's stock, while only one insider purchase has been recorded. This high ratio of insider sales to insider purchases raises concerns about the company's long-term prospects.

The sale by Rajaram follows the recent release of a GuruFocus report that identified eight warning signs associated with Coinbase Global Inc. These warning signs include a decline in profitability, increasing debt levels, and a recent spike in stock-based compensation. GuruFocus also notes that the company's price-earnings (P/E) ratio of 709.75 is significantly higher than the industry median of 17.93, and that the stock's price-to-GuruFocus-Value (GF-Value) ratio is 3.35, indicating that the stock is significantly overvalued according to GuruFocus's valuation model.

Coinbase Global Inc is a digital currency exchange platform that allows users to buy, sell, and store cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. The company also provides a suite of services that enable users to invest, spend, save, earn, and use cryptocurrencies.

Despite its status as a major player in the cryptocurrency market, Coinbase Global Inc has faced challenges in recent months due to declining cryptocurrency prices and increased regulatory scrutiny. The company's revenue fell by 12% in the fourth quarter of 2023, and its net income declined by 66%.

Analysts are divided on the future prospects of Coinbase Global Inc. Some believe that the company is well-positioned to benefit from the growing adoption of cryptocurrencies, while others are concerned about the company's ability to navigate the challenges posed by regulatory uncertainty and competition from other exchanges.

In conclusion, the sale of shares by Rajaram, coupled with the recent GuruFocus report and the company's declining financial performance, raises questions about the long-term viability of Coinbase Global Inc. Investors should carefully consider these factors before making any investment decisions.

![MakerDAO [MKR] Token Underperforms Rivals Despite Growing Utility MakerDAO [MKR] Token Underperforms Rivals Despite Growing Utility](/uploads/2024/11/23/cryptocurrencies-news/articles/makerdao-mkr-token-underperforms-rivals-growing-utility/image-1.jpg)