|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Coinbase (COIN) Stock Is a Good Time to Buy the Dip, Rosenblatt Analysts Say

Mar 27, 2025 at 04:03 am

Good news for investors in cryptocurrency stock Coinbase (COIN), as new word from Rosenblatt analysts suggests that it is a good time to get in.

Good news, investors: Coinbase (COIN) stock is still a good time to buy, according to analysts at Rosenblatt.

Thanks to a shifting market in general, and a growing focus on stablecoin, there is a mounting value in Coinbase that is worth considering. However, Rosenblatt’s assessment cut little ice with shareholders, and shares slid over 4% in Wednesday afternoon’s trading.

Light Up your Portfolio with Spark:

While Coinbase’s primary trading operations have been a bit light, there is one facet that many are not considering, Rosenblatt analyst Chris Brendler noted. Specifically, that market is stablecoin, the kind of cryptocurrency pegged to a stable asset. USDC (USDC-USD) is one of the biggest—second-largest at last report—such cryptocurrencies around, pegged to the United States dollar. And Coinbase gets a 50% revenue-sharing deal for USDC trade.

Brendler points out that USDC is up 36% in a year-to-date measure, and Coinbase is also making strides in revenue sharing as well. Thus, between the gains Coinbase is seeing in general, and the rising move toward stablecoin, Coinbase is likely to draw in more investors who are “…more comfortable with COIN’s business mix,” Brendler noted.

Not Standing Still

Further, Coinbase is not just counting on crypto trade to push it through. Coinbase is currently in “advanced” stages of buying Deribit, a derivatives platform. Deribit also happens to be the largest platform around for options contracts in several different cryptocurrencies, which would likely make it attractive to Coinbase if for no other reason.

While exact details on the deal are not yet available, earlier reports suggest that Deribit could be valued between $4 billion and $5 billion dollars. This move comes not long after one of Coinbase’s biggest competitors, Kraken, picked up NinjaTrader, a futures platform that offered commodity futures trading options. The move thus allows Coinbase to keep pace with its biggest competitors and keep its edge in the market.

Is Coinbase a Buy, Sell or Hold?

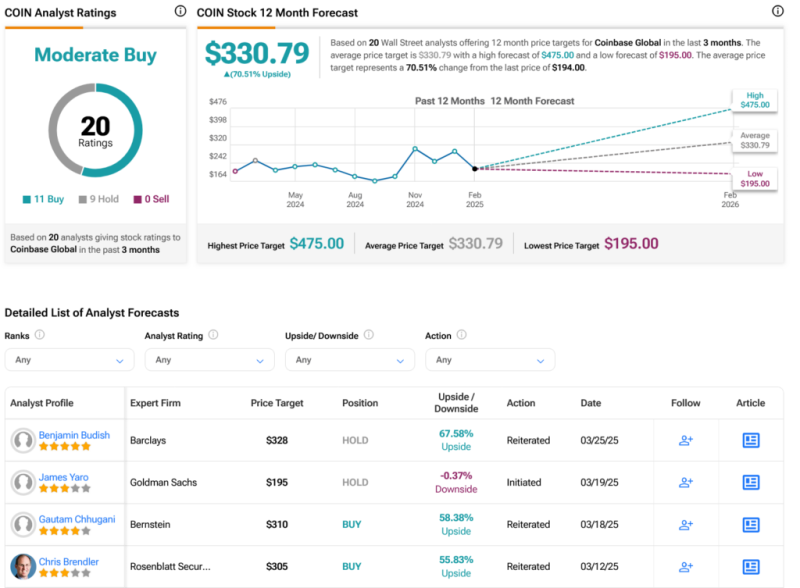

Turning to Wall Street, analysts have a Moderate Buy consensus rating on COIN stock based on 11 Buys and nine Holds assigned in the past three months, as indicated by the graphic below. After an 23.84% loss in its share price over the past year, the average COIN price target of $330.79 per share implies 70.51% upside potential.

See more COIN analyst ratings

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

- Bitcoin (BTC) Could Be Integrated With Cardano (ADA) Network, Opening the Door for a Price Breakout

- Apr 17, 2025 at 06:10 am

- Cardano (ADA) could be on track for a price breakout as the network prepares for a major integration with Bitcoin. The project, often labeled a “ghost chain,” is aiming to prove its critics wrong

-

-

- Mutuum Finance (MUTM) Surges as Investor Interest Grows, Targeting to Reach $0.75 Before Dogecoin

- Apr 17, 2025 at 06:05 am

- Mutuum Finance has emerged as one of the rapidly rising top decentralized lending platforms thanks to its distinctive dual lending structure which attracts extensive investor interest. By [A. R. M. Kayalvisuals]

-

-

-