|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Cantor Fitzgerald Launches $3 Billion Bitcoin Acquisition Company Backed by SoftBank and Tether

Apr 23, 2025 at 02:50 pm

According to the report, the venture aims to create a publicly listed firm that can capitalize on the growing crypto market

This article reports on a partnership between Brandon Lutnick, chair of Cantor Fitzgerald, and SoftBank, Tether, and Bitfinex to launch a $3 billion Bitcoin acquisition company. The venture aims to create a publicly listed firm that can capitalize on the growing crypto market. The new firm, named 21 Capital, has already secured $200 million in funding from Cantor Equity Partners. In addition, Tether is contributing $1.5 billion in Bitcoin, SoftBank will add $900 million, and Bitfinex is investing $600 million. The plan includes raising another $350 million through convertible bonds and $200 million via private equity to buy more Bitcoin. As part of the deal, Tether, SoftBank, and Bitfinex's Bitcoin investments will be converted into shares of 21 Capital. The Bitcoin's value will be locked at $85,000 per coin, while shares will be priced at $10 each. However, the deal is still in progress, and some details may change.

This article is a summary of a report by Financial Times. The full article can be read on the Financial Times website.

This article is about a partnership between Brandon Lutnick, chair of Cantor Fitzgerald, and SoftBank, Tether, and Bitfinex to launch a $3 billion Bitcoin acquisition company as per the report by Financial Times on April 23.

The venture aims to create a publicly listed firm that can capitalize on the growing crypto market in the US, mirroring the success of Michael Saylor’s company, Strategy.

The new firm, named 21 Capital, has already secured $200 million in funding from Cantor Equity Partners. In addition, Tether is contributing $1.5 billion in Bitcoin, SoftBank will add $900 million, and Bitfinex is investing $600 million. The plan includes raising another $350 million through convertible bonds and $200 million via private equity to buy more Bitcoin.

As part of the deal, Tether, SoftBank, and Bitfinex’s Bitcoin investments will be converted into shares of 21 Capital. The Bitcoin’s value will be locked at $85,000 per coin, while shares will be priced at $10 each. However, the deal is still in progress, and some details may change.

Cantor Fitzgerald has been active in the crypto space for several years. It has been operating Tether’s Treasury since 2021 and directly owns 5% of the stablecoin issuer. It also entered the Bitcoin financing with a $2 billion fund to facilitate institutions to finance against their digital assets.

This has brought a new advancement between the modern financial system and the blockchain.

The article also mentions that Paul Atkins, a commissioner at the US Securities and Value Commission, has spoken about the need for regulations in the crypto sector. He believes that clear and consistent rules will encourage more participation in the market.

The article concludes by stating that the partnership is a testament to the growing interest in cryptocurrency and its potential to disrupt traditional financial institutions. It remains to be seen whether 21 Capital will be successful in launching its Bitcoin acquisition company and becoming a major player in the crypto space.

output: Chair of Cantor Fitzgerald, Brandon Lutnick, is partnering with SoftBank, Tether, and Bitfinex to launch a $3 billion Bitcoin acquisition company, according to a report by Financial Times on April 23.

The venture aims to create a publicly listed firm that can capitalize on the growing crypto market in the US, mirroring the success of Michael Saylor’s company, Strategy.

The new company, named 21 Capital, has already secured $200 million in funding from Cantor Equity Partners. In addition, Tether is contributing $1.5 billion in Bitcoin, SoftBank will add $900 million, and Bitfinex is investing $600 million. The plan includes raising another $350 million through convertible bonds and $200 million via private equity to buy more Bitcoin.

As part of the deal, Tether, SoftBank, and Bitfinex’s Bitcoin investments will be converted into shares of 21 Capital. The Bitcoin’s value will be locked at $85,000 per coin, while shares will be priced at $10 each. However, the deal is still in progress, and some details may change.

Cantor Fitzgerald has been active in the crypto space for several years. It has been operating Tether’s Treasury since 2021 and directly owns 5% of the stablecoin issuer. It also entered the Bitcoin financing with a $2 billion fund to facilitate institutions to finance against their digital assets.

This has brought a new advancement between the modern financial system and the blockchain.

Speaking at the V Bank Innovation Summit in April, commissioner at the US

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

- Bitcoin (BTC) Faces Critical Test: Will the Yearly Open Flip from Support to Resistance?

- Apr 24, 2025 at 03:00 am

- Bitcoin's price has recently found itself near a critical juncture, as it trades close to its yearly open. This level, which was once a robust support, could now play a pivotal role in determining the next phase of Bitcoin's market trajectory.

-

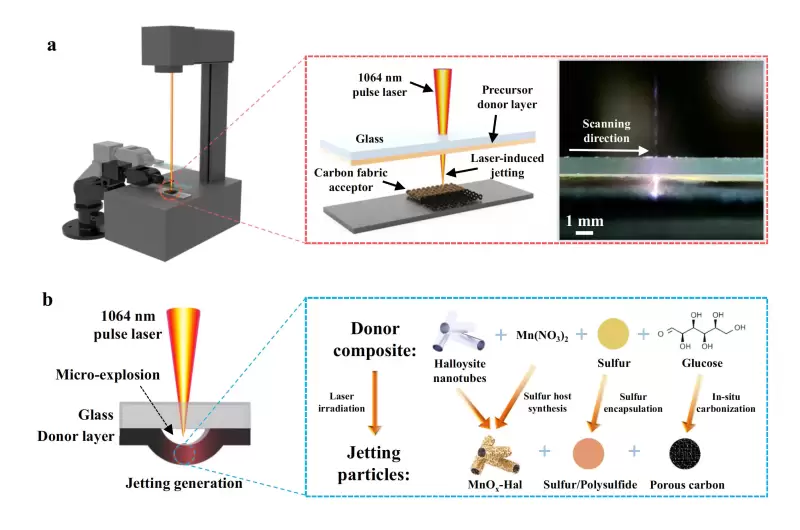

- A research team has developed an innovative single-step laser printing technique to accelerate the manufacturing of lithium-sulfur batteries.

- Apr 24, 2025 at 02:55 am

- Integrating the commonly time-consuming active materials synthesis and cathode preparation in a nanosecond-scale laser-induced conversion process, this technique is set to revolutionize the future industrial production of printable electrochemical energy storage devices.

-

-