"I don't understand how can anyone think BTC is not a bargain at these prices...," Andre Dragosch, head of research - Europe at Bitwise

Andre Dragosch, head of research - Europe at Bitwise, said on Monday that he does not understand how anyone could think BTC is not a bargain at current prices, as the token fell below $90,000.

While the comment may appear overly optimistic to macro bears, it is not without justification. Even as the DXY, Treasury yields, and Fed rate expectations look to destabilize risk assets, corporate and institutional demand for BTC continues to strengthen.

Intesa Sanpaolo, Italy’s largest bank by market capitalization, has reportedly purchased BTC, snapping up 11 BTC for $1 million. That could accelerate crypto adoption in the European Union's third-largest economy, which already has 1.4 million citizens holding cryptocurrencies.

If that's not enough, corporate Treasury purchases of BTC have already reached 5,774 BTC in the first two weeks of January, outpacing the supply of new BTC.

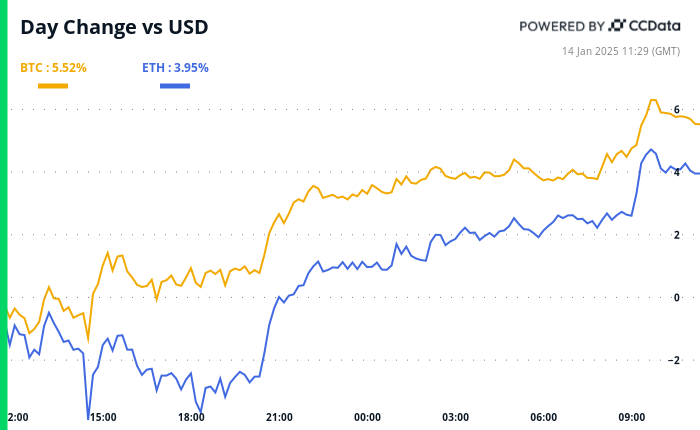

To Dragosch's credit, BTC has bounced to over $96K, hinting at an end of the price weakness that began a month ago at record highs above $108K. As usual, that has brought cheer to all corners of the crypto market, with AI, gaming and meme sub-sectors leading the charge.

The recovery, supported by ongoing institutional adoption and rumors of President-elect Donald Trump planning to issue an executive order addressing crypto-accounting SEC rules on day one, suggests that bears may find it difficult to assert their influence.

Prices may move into six figures if Tuesday's U.S. producer price index points to softer inflation in the pipeline, weakening the hawkish Fed narrative. Note that the dollar index's rally has already stalled amid reports that Trump's tariffs will be gradual and smaller than initially feared.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.