|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

BlackRock’s Ethereum-backed BUIDL tokenized fund has quietly surged in assets under management (AUM)

Apr 17, 2025 at 03:50 pm

Despite Ethereum’s dramatic price decline, BlackRock’s Ethereum-backed BUIDL tokenized fund has quietly surged in AUM

Ethereum may be facing a brutal start to 2025, dropping more than 52% year-to-date, but not everyone is bearish. Institutional giants like BlackRock are doubling down, and their moves are sparking a wave of speculation and renewed optimism across the crypto space—especially among Ethereum-linked AI tokens.

While retail traders typically focus on Bitcoin, BlackRock has made a bullish bet on Ethereum with its BUIDL tokenized fund, which saw AUM increase from $100 million to over $464.65 million since the start of the year—a 364.65% rise as of April 16, 2025.

This staggering surge comes despite ETH continuing to battle volatility and a prevailing bearish trend, dropping 52.38% YTD, currently trading around $1,340.

The divergence between Ethereum’s falling price and rising institutional investment raises big questions: Is Ethereum massively undervalued, or are institutions positioning ahead of a larger shift in market dynamics?

As ETH/USD and ETH/BTC trading pairs showed increased volatility and a 30% spike in volume from the previous day, retail traders are beginning to take notice. The rise in activity suggests that smaller investors may be starting to align with institutional signals—potentially setting the stage for a rebound play based on BlackRock’s long-view thesis.

Furthermore, Ethereum’s market behavior isn’t just affecting ETH holders—it’s rippling out to the broader ecosystem, especially AI-focused tokens. Following news of BlackRock’s fund success, SingularityNET (AGIX) and Fetch.ai (FET) saw price gains and surges in trading volume.

With Ethereum’s foundational role in powering AI-related decentralized applications, positive sentiment in ETH is bleeding into AI tokens, reinforcing the emerging correlation between these sectors.

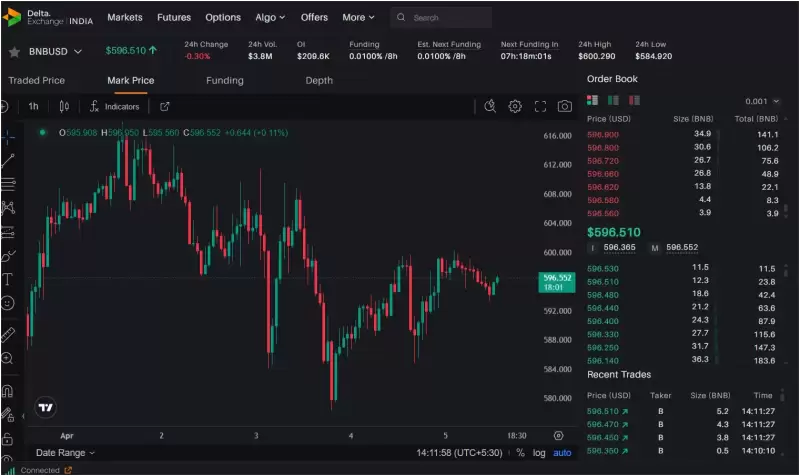

ETH Price Action: April 16th Breakdown

On the technical front, Ethereum’s short-term price chart reveals a turbulent structure. Over a 5-minute timeframe, ETH navigated through:

* A descending channel, with lower highs and lower lows, indicating a sustained bearish pressure.

* The 50-EMA acted as immediate support, while the 100-EMA provided resistance, highlighting the shifting balance between buyers and sellers.

Traders are watching closely for signs of a breakout from the descending channel, as institutional accumulation could eventually trigger a sentiment shift—if supported by technical confirmations.

Would you like this article formatted for publishing on a blog or crypto news site, or would you prefer some social media snippets too?

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- The evolving relationship between Bitcoin and gold: A regime shift analysis

- Apr 20, 2025 at 09:50 pm

- This study explores the relationship between Bitcoin and gold, finding that they operated almost independently before 2017, but after a defined series of events, they began to exhibit mutual response dynamics.

-

-

- MetaPlanet, a Japanese company listed on the Tokyo Stock Exchange, is proving to be one of the most active players in the Bitcoin space.

- Apr 20, 2025 at 09:45 pm

- The world of cryptocurrency is no stranger to big moves, and MetaPlanet, a Japanese company listed on the Tokyo Stock Exchange, is proving to be one of the most active players in the Bitcoin space.

-

-

-

-

-

-

- XYZVerse (XYZ) Captures the Attention of Cryptocurrency Analysts By Cointelegraph

- Apr 20, 2025 at 09:30 pm

- A digital token costing just $0.003 is capturing the attention of cryptocurrency analysts. Some believe this undervalued asset could outperform major cryptocurrencies like Bitcoin, Ethereum, and XRP.