|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

BlackRock's Bitcoin ETF Sees Largest-Ever Single-Day Outflow as Ether ETFs Gain Traction

Dec 25, 2024 at 06:01 pm

BlackRock's iShares Bitcoin Trust ETF (IBIT) saw its largest single-day outflow on December 24, with $188.7 million withdrawn, according to CoinGlass data.

BlackRock’s iShares Bitcoin Trust ETF (NYSE: BITO) saw its largest-ever single-day outflow as Bitcoin funds notched a fourth straight trading day of outflows totaling more than $1.5 billion.

What Happened: BlackRock's IBIT hit $188.7 million in outflows on December 24, CoinGlass data showed. The previous record was set on December 20 with outflows of $72.7 million.

On the same day, U.S.-based spot Bitcoin ETFs collectively recorded outflows totaling $338.4 million. Since December 19, these funds have experienced net outflows of $1.52 billion.

The Fidelity Wise Origin Bitcoin Fund (NYSE: FBTC) and ARK 21Shares Bitcoin ETF (NYSE: BITO) also posted significant outflows of $83.2 million and $75 million, respectively.

In contrast, the Bitwise Bitcoin ETF (NYSE: BIT) was the sole fund to see inflows, amounting to $8.5 million.

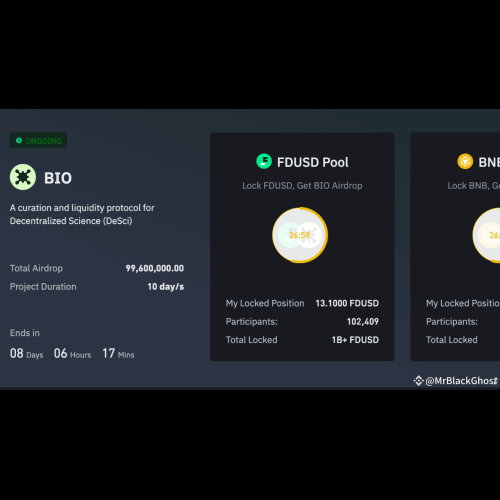

Ether ETFs Gain Traction Late November: In contrast to Bitcoin, Ether ETFs witnessed inflows for two consecutive days before Christmas.

U.S. spot Ether ETFs recorded $53.6 million in inflows on December 24, following $130.8 million the previous day.

Launched in July, Ether ETFs initially lagged behind Bitcoin ETFs, which debuted in January. However, Ether ETFs gained traction in late November, marked by an 18-day inflow streak that ended on December 18.

Ether May Outperform Bitcoin In 2025: As of December 24, Bitcoin was trading at $98,035, up 4.59% in the last 24 hours, while Ether reached $3,420, up 3.28%, according to CoinMarketCap.

Analysts suggest Ether may outperform Bitcoin in early 2025.

BlackRock's Bitcoin ETF, $IBIT, is now worth nearly double BlackRock's gold ETF, $IAU. which was launched in 2005 👀 pic.twitter.com/jAiCKmPsN7

Notably, on December 16, U.S. Bitcoin ETFs surpassed gold ETFs in assets under management for the first time, reaching $129 billion.

This figure includes spot ETFs and those tracking Bitcoin performance through derivatives. Gold ETFs held slightly less, according to K33 Research and Bloomberg.

BlackRock Recommends Bitcoin Allocation For Portfolios: Meanwhile, BlackRock has recommended that investors consider allocating up to 2% of their portfolios to Bitcoin, citing its potential as a diversifying asset due to its historically lower correlation with other major asset classes.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

-

-

- Bitcoin Surges Amidst Holiday Spirit

- Dec 26, 2024 at 06:55 am

- As the festive season unfolds, the cryptocurrency sphere has experienced a notable upswing, reminiscent of the traditional “Santa Claus Rally” often seen in stock markets. Bitcoin, the flagship digital currency, showcased significant upward movement during the Christmas period.

-