|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitwise Dogecoin ETF Filing Ignites Mixed Market Reactions

Mar 05, 2025 at 03:20 am

The cryptocurrency market presented a mixed picture following a significant development: NYSE Arca, associated with the New York Stock Exchange, submitted a filing to the SEC to list a Bitwise Dogecoin ETF.

NYSE Arca, an exchange that is part of the New York Stock Exchange, has submitted a filing to the SEC for a Bitwise Dogecoin ETF.

The ETF could provide both institutional and retail investors with a way to gain regulated exposure to Dogecoin. However, the cryptocurrency market reacted negatively to the news.

What Happened: NYSE Arca filed a 19b-4 form on Thursday with the SEC for the launch of the Bitwise Dogecoin ETF. The ETF will be funded through cash creation and redemption, and it will not directly buy and sell Dogecoin.

Coinbase (NASDAQ:COIN) will be the fund’s digital asset custodian for Dogecoin, while the Bank of New York Mellon (NYSE:BNY) will provide cash custody, transfer agency and administrative services.

Bitwise also filed an S-1 registration statement in January for the purpose of launching the ETF.

The ETF could be a significant step towards the integration of memecoins into mainstream financial markets. It is also part of a broader trend that has seen financial institutions applying for regulatory approval for crypto-related investment products.

Earlier this year, Circle and Coinbase announced their intent to list their shares on the Nasdaq in a move that could open up opportunities for retail investors to invest in crypto companies through their preferred brokerage firms.

Dogecoin Price Reacts: Despite the ETF filing, Dogecoin’s price fell more than 12% on Friday.

The cryptocurrency slid to $0.193588, erasing gains made following Donald Trump’s crypto reserve announcement on Thursday.

The broader cryptocurrency market was also down, with Bitcoin (CRYPTO: BTC) and Ethereum (CRYPTO: ETH) trading lower, contributing to Dogecoin’s price decline.

The SEC is also currently reviewing an application from Grayscale for a Grayscale Dogecoin Trust, with a decision potentially coming by mid-October.

Recently, there has been an increasing interest from institutions in Dogecoin, with several institutions applying for the listing of various altcoin ETFs.

Earlier this week, Nasdaq filed an application with the SEC for the listing and trading of shares of the Grayscale Hedera Trust, which will track the price of HBAR.

Nasdaq previously submitted an application for a similar Hedera-based product from Canary Capital, and several other issuers have filed applications for ETFs that will track the price of Cardano, Solana, Polkadot, Litecoin and XRP.

These applications come as the SEC appears more open to approving crypto-related financial products. However, the ultimate decision by the SEC on these ETFs will determine the direction of the market in the coming months.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- The Lazarus Group has already laundered all the unfrozen funds it stole from the recent Bybit hack

- Mar 05, 2025 at 10:25 am

- Arkhaim Intelligence, the blockchain analytics platform, revealed a new development in the recent Bybit hack. The firm posted a bounty for information about the incident, discovering that the Lazarus Group was responsible.

-

-

-

![Bitcoin's [BTC] price has been 'extremely' volatile lately, and exchange flows reveal why Bitcoin's [BTC] price has been 'extremely' volatile lately, and exchange flows reveal why](/assets/pc/images/moren/280_160.png)

- Bitcoin's [BTC] price has been 'extremely' volatile lately, and exchange flows reveal why

- Mar 05, 2025 at 10:25 am

- Bitcoin's [BTC] price has been 'extremely' volatile lately, and exchange flows reveal why. On the 25th of February, approximately 8.4K BTC moved into exchanges, signaling sell pressure.

-

-

-

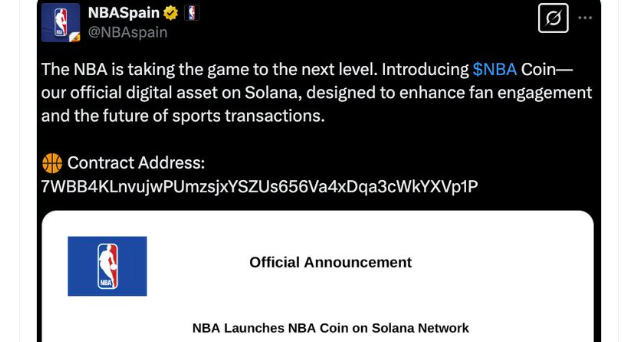

- NBA and NASCAR Coins Were Red Hot, but Buzz About New Coins Was Quickly Attributed to Hacked Social Media Accounts

- Mar 05, 2025 at 10:25 am

- Crypto coins and digital currency are red-hot, but buzz about new NBA and NASCAR coins Tuesday was quickly attributed to their respective social media accounts being hacked.

![Bitcoin's [BTC] price has been 'extremely' volatile lately, and exchange flows reveal why Bitcoin's [BTC] price has been 'extremely' volatile lately, and exchange flows reveal why](/uploads/2025/03/05/cryptocurrencies-news/articles/bitcoin-btc-price-extremely-volatile-exchange-flows-reveal/img-1_800_480.jpg)