Last week, crypto assets recorded nearly 10% inflows to recover initial losses due to President Trump's tariffs.

Crypto whales are gaining momentum following a decline in selling pressure. Last week, crypto assets recorded nearly 10% inflows to recover initial losses due to President Trump’s tariffs. A look at centralized exchange trader balances shows a bullish pattern as macro tensions drop. However, many analysts say the prolonged United States-China trade war will have a longstanding effect on the market.

Bitcoin Whales Spark Stronger Sentiments

On-chain data shows that Bitcoin whales are bullish amid present macro uncertainties. Last year, large BTC holders increased their activities on Binance, making the exchange useful for institutional data. The 365-day moving average is rising, indicating a longer bull trend in the Binance whale ratio.

Figures also show reduced sell pressures from large addresses on Binance. The impact weakened retail outflows as bulls looked set for a complete rebound. According to CryptoQuant’s researchers, these holders might be stabilizing and backing up the dataset.

“… the greater the whale involvement, meaning their inflows represent a larger part of the total inflows. Then, when looking at the 30DMA, we can see that in the short term, whale involvement is decreasing, and the ratio has now returned to levels seen in September/October 2024. This could mean that the selling pressure from Binance whales is either decreasing or stabilizing.”

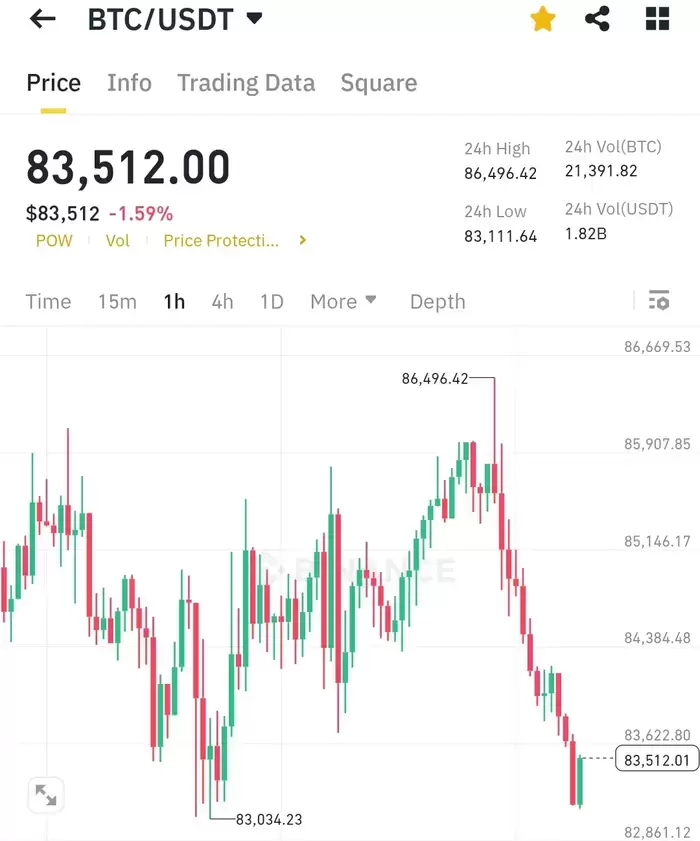

Within the past month, whale inflows to Binance plunged by over $3 billion, likened to a similar drop in 2024. This decrease triggered a jump in sentiments lowering initial panic as the asset’s price declined $84k. Inflows to centralized exchanges typically show a high selling probability, so a trend reversal points to long-term holdings.

Aside from reduced exchange inflows, Bitcoin whales made large accumulations over the past seven days. The wider market also jumped based on heightened Bitcoin activity.

Traders Tip Growth In Institutional Demand

Crypto trading in recent shows a decline in volumes still linked to macro markets. A core reason is Bitcoin’s sharp decline to $84k from an all-time high above $108k this year. Altcoin prices slumped along the same lines, with many crashing below multiple support levels.

However, optimism is gradually recovering with several outperforming cryptocurrencies notching up double-digit gains last week.

These investors are known for buying the dips leading to several growth projections. Last week, Bitcoin jumped 9.8%, while Ethereum and XRP soared 9.9% and 20%, respectively, on institutional volume.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.