|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tech Report is one of the oldest hardware, news, and tech review sites on the internet. We write helpful technology guides, unbiased product reviews, and report on the latest tech and crypto news.

Tech Report is one of the oldest hardware, news, and tech review sites on the internet. We write helpful technology guides, unbiased product reviews, and report on the latest tech and crypto news. We maintain editorial independence and consider content quality and factual accuracy to be non-negotiable.

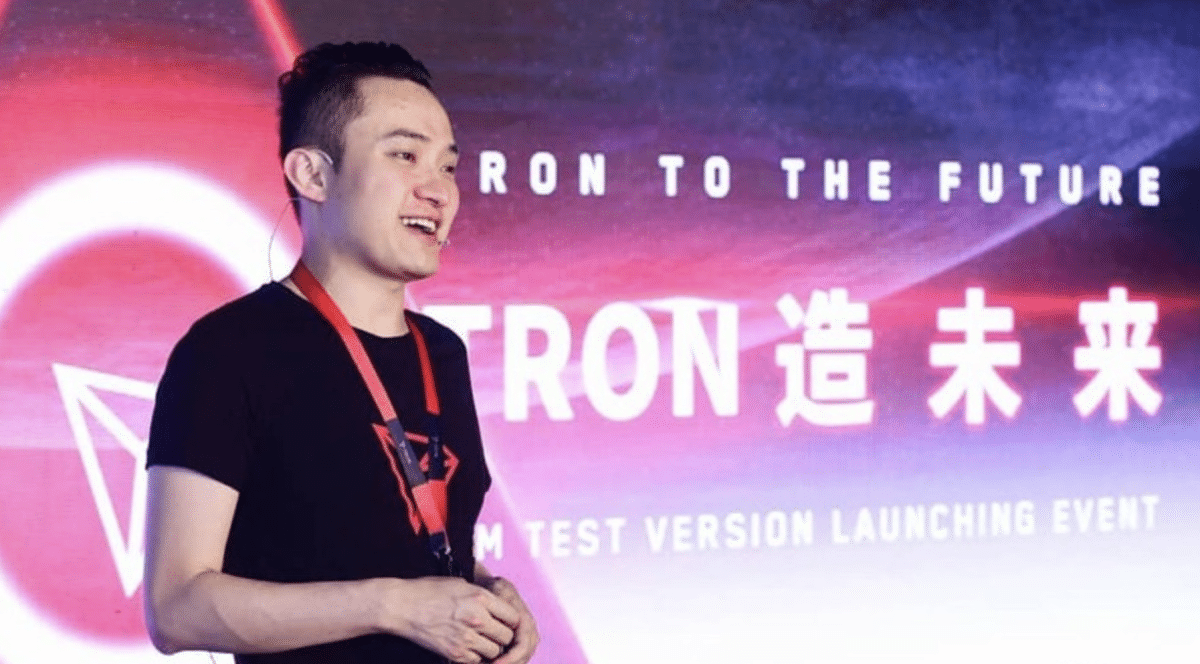

Tron’s founder, Justin Sun, dismissed concerns following the removal of 12,000 Bitcoin BTC backing USDD, a stablecoin governed by the Tron DAO Reserve.

12,000 BTC, valued at approximately $729 million, was moved from an address previously linked to USDD collateral.

Some community members reacted to the withdrawal, claiming Justin Sun was behind the move. Others queried why Bitcoin was moved without a vote from the Tron DAO Reserve.

DAODictatorShip. This is completly theft. If you remove the warranty without consensus and voting, then cover the damages. For us USDD full backed by TRX worths ZERO. And I am opening now my short position at TRX and USDD, also to @justinsuntron

Good move to sell the warranty…

— Hector Alvarado – ATIPE⚡ (@Atipe_Computers) August 23, 2024

USDD Collateral Removal Sparks Reactions from Community

Data from the Tron governance page reveals that the only question presented for a community vote was for burning TRX tokens. However, this question on token burns dates back to May 2023, meaning there was no recent proposal.

According to crypto skeptic Symbio, Justin Sun silently removed 12,000 BTC from USDD collateral. Consequently, the stablecoin is now 100% collateralized by TRX, except for the 20 million USDT collateral.

lmao @justinsuntron silently removed the 12.000 btc as USDD collateral recently and it's now 100% backed by tron (except for 20mil. usdt).

This was the address: 1KVpuCfhftkzJ67ZUegaMuaYey7qni7pPj

— Symbio (@NoCryptFish) August 21, 2024

However, Justin Sun reacted to these concerns, calling for calm. He noted that the USDD stablecoin’s mechanism is similar to Maker DAO’s DAI and is not a new procedure.

Further, Sun stated that a collateral holder can withdraw any amount if the collateral is above the required amount. The collateral amount is between 120% and 150%, depending on the vault used.

The Tron founder further explained that it must be topped up if the collateral drops below a certain level (usually under 110%). Failure to top it may trigger liquidations.

Sun noted that USDD’s long-term collateralization rate is above 300%, making its capital utilization inefficient. He said TronDAO plans to upgrade USDD and make it more competitive and decentralized.

Bitcoin no Longer Backs USDD

Interestingly, the Bitcoin address holding the collateral is no longer visible on the USDD transparency page.

You've provided a good overview of how decentralized stablecoins like USDD operate, drawing parallels with MakerDAO's DAI. Here's a bit more context and analysis:

1. **Collateralization**: – The high collateralization rate of over 300% for USDD indeed suggests a very…

— B7ELEPHANT (@B7Elephant) August 22, 2024

USDD’s transparency page reveals that stablecoin is backed by tether (USDT) and TRX. Data from the page shows that over 744.33 million USDD tokens are circulating in the market.

The total collateral for USDD now stands at approximately $1.72 billion worth of USDT and TRX in reserves, with the collateralized ratio above 230%. This implies that USDD has more assets than most stablecoins in the market.

For instance, DAI has a collateralization of 120%, while USDC and USDT are 100% collateralized.

USDD launched in 2022, competing with Terra’s defunct stablecoin UST and others for market share. Although USDD’s value was pegged to the US Dollar, price volatility forced it to an all-time low of $0.92.

However, the USDT and TRX reserves are robust enough to sustain USDD despite the withdrawal of its BTC collateral. Crypto enthusiast B7ELEPHANT believes that USDD’s high collateralization rate helps to maintain stability.

He stated that a level of over-collateralization ensures that the stablecoin is backed by more assets than its circulating supply. Also, over-collateralization likely reduces the risk of USDD de-pegging from the value of the US Dollar.

B

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- Crypto Exchange Backpack Eyes Unicorn Status Amidst Token Launch and Quantum Defense Concerns

- Feb 10, 2026 at 05:16 pm

- As Backpack exchange prepares for its token launch, the crypto landscape grapples with both rapid innovation and the looming threat of quantum computing, sparking interest in next-gen security solutions like BMIC.

-

-

-

-

- Big Apple Beat: Delisting, Coin Stocks, and a Sweeping Market Reorganization

- Feb 10, 2026 at 05:00 pm

- Global markets are tightening up. From stricter delisting rules for low-priced 'coin stocks' to sweeping regulatory overhauls, a significant market reorganization is underway, aiming for healthier, more robust financial ecosystems.

-

-

-

- Cathie Wood's Ark Invest Rebalances Crypto Bet as LiquidChain L3 Solves Industry's Liquidity Puzzle

- Feb 10, 2026 at 04:22 pm

- Cathie Wood's Ark Invest rebalances crypto holdings, pivoting to institutional-grade platforms. Meanwhile, LiquidChain L3's innovative approach tackles the crucial challenge of blockchain liquidity fragmentation.