|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Rebounds, but Can It Break $69,000 Resistance?

Mar 25, 2024 at 11:12 pm

On March 25, Bitcoin (BTC) surged past the crucial $69,000 mark during the Wall Street opening, fueled by a resurgent rally. The 3% daily gain erased the losses incurred in the previous week. However, the psychologically significant $69,000 level continues to serve as a resistance barrier.

Bitcoin Rebounds, But Can It Hold Above $69,000?

As the stock market opens on Wall Street, Bitcoin (BTC) has surged past the crucial $69,000 mark, buoyed by a strong rebound. BTC/USD has climbed nearly 3% on the day, swiftly recovering from last week's losses.

Can Bitcoin Break Resistance and Stay Above $69,000?

Despite the recent gains, $69,000 remains a psychologically significant resistance level for Bitcoin. "Structurally, price needs to close a higher high above $69K with bullish momentum," notes popular trader Skew.

Significant buy liquidity is located at $60,000, while major resistance lies above current all-time highs near $74,000. "Smaller spot bids" are now moving closer to spot price, indicating potential buying pressure.

Conservative Outlook: Will Liquidity Hold?

Keith Alan, co-founder of Material Indicators, cautions that the lack of nearby bid liquidity could undermine the current BTC recovery. "Last month, Bitcoin closed around $61.1k. If bulls can close above that level this month, it would be an unprecedented seventh consecutive green M close for #BTCUSDT," he says.

Alan remains "fairly bullish" long-term, but anticipates a potential retracement before the monthly close. "With less than a week to go for the Monthly close and less than a month to go for the Halving, I'm watching to see if bids start moving up or if they continue to thin out in the range," he writes.

Liquidation Risk Mounts for Shorts

Liquidation data highlights the risks for those betting against Bitcoin. Over $50 million in BTC shorts have been liquidated in the past 24 hours. A break above $70,600 would trigger an additional $500 million in short leverage liquidation.

Conclusion

Bitcoin's rebound has gained momentum, but it remains to be seen whether it can sustain above $69,000. Liquidity and resistance levels will play a crucial role in determining the direction of the price in the coming days. Investors should exercise caution and conduct thorough research before making any trading decisions.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

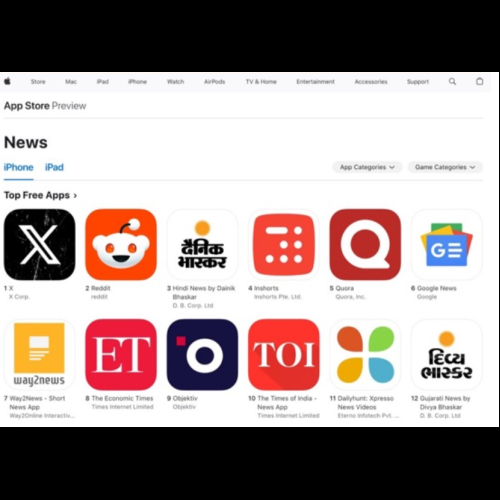

- Reddit’s Personalization Model: A Deep Dive

- Dec 28, 2024 at 06:25 pm

- In the previous post, we discussed how X or Twitter’s Personalization Model works. This post will attempt to juxtapose Reddit’s personalization model against X’s so that we develop a coherent understanding of personalization models.

-

-

- Major Investors Remain Optimistic About Bitcoin (BTC) Even Though Its Value Has Fallen Far From the Psychological Level of US$100,000

- Dec 28, 2024 at 06:25 pm

- or investors remain optimistic about Bitcoin even though its value had fallen far from the psychological level of US$100,000 (Rp1.62 billion). Anthony Pompliano, founder of Pomp Investments, revealed in an interview with FOX 5 on December 21 that Bitcoin's prospects remain bright, especially in 2025.

-

-

-

-

- The US Government Will Not Buy Bitcoin in 2025, but May Explore New Reserve Strategies

- Dec 28, 2024 at 06:25 pm

- While speculation is rife about institutional adoption of bitcoin, Galaxy Research tempers expectations. According to the report published on December 27, the U.S. government will not buy bitcoin in 2025 but may explore new strategies regarding its existing reserves.

-

-