|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Investors in Limbo Following Jim Cramer's Ominous Remarks

Apr 02, 2024 at 01:34 am

Amidst Bitcoin's unprecedented bullish streak, reaching its highest monthly close since 2012, Jim Cramer's cryptic statement on the market being "overbought" has sparked concern among BTC holders. With Bitcoin's price hovering around $68,000, analysts speculate a potential drop to $63,000. Cramer's comment aligns with the overbought signals observed in major US stock indices, raising the possibility that Bitcoin's growth may mirror stock market trends and remain susceptible to corrections.

Bitcoin Holders Grapple with Jim Cramer's Ominous Remarks

Amidst the recent surge in Bitcoin's value, Bitcoin (BTC) enthusiasts have been buoyed by the cryptocurrency's ascent to uncharted heights. However, the optimism may be waning as renowned financial commentator Jim Cramer has cast a shadow over the digital asset's trajectory.

Cramer's Cryptic Warning

Cramer, the host of CNBC's "Mad Money," has historically maintained a bearish stance towards Bitcoin, frequently criticizing it publicly. His recent tweet, published on April 1, 2024, has sent shockwaves through the cryptocurrency community:

"Coming in the most overbought we've been in a while, .Better seller than buyer…"

This enigmatic statement, posted on April Fool's Day, has left many wondering if it is a mere joke or a serious warning.

Bitcoin's Bull Market Under Scrutiny

Bitcoin's recent rally has been nothing short of remarkable, with the cryptocurrency posting seven consecutive months of gains for the first time since 2012. It closed the month of March above the peak of the previous cycle, reaching a new all-time high of $73,000.

However, the market has since cooled, with Bitcoin currently trading at $68,391.81, down approximately 2.95% in the past 24 hours. Analysts have speculated that the price could further decline to $63,000.

Cramer's Interpretation

Cramer's tweet suggests that he believes Bitcoin is currently "overbought," a technical indicator that signals a potential reversal in the market's trend. He implies that it may be more prudent to sell Bitcoin now rather than buy, as he believes the market may be poised for a correction.

BTC's Correlation with Stock Indices

Notably, Cramer's views align with observations from the Bespoke Investment Group, which recently noted the emergence of overbought signals across all index-based exchange-traded funds (ETFs) in the United States.

The S&P 500 index, which tracks the performance of major U.S. companies, recently reached a new annual high of 5,250, an increase of 22% over the past six months. Despite being in its most overbought state since December 2020, the index has continued to rise.

Since the launch of spot Bitcoin ETFs, BTC has partially decoupled from its historical correlation with technology stocks. However, there remains a high probability that the largest cryptocurrency may still be influenced by broader market dynamics.

Consequently, a potential stock market correction could have a negative impact on Bitcoin's price, as investors may seek to reduce risk across all asset classes.

Uncertain Future for Bitcoin

Cramer's remarks have cast a pall over the Bitcoin community, raising concerns about the sustainability of the recent rally. Whether his prediction holds true remains to be seen, but it has undoubtedly raised questions about the future trajectory of the leading cryptocurrency.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

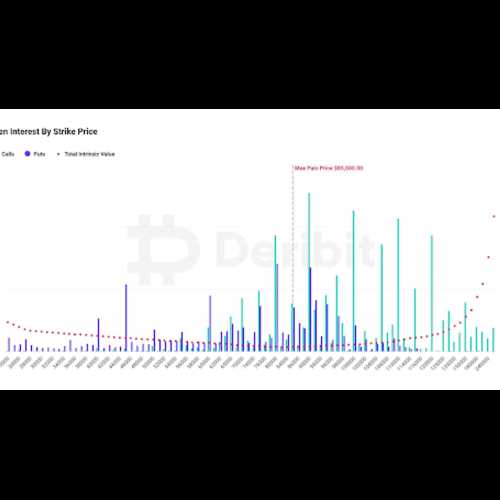

- Bitcoin (BTC) Price Analysis: BTC Options Expiration Coincides With Decline as Resistance Forms on the 4-Hour Chart

- Dec 28, 2024 at 07:05 am

- Bitcoin closed down -3.63% on yesterday's candle after its promising recovery bounce earlier this week. This decline coincides with the expiration of $14.5 billion in BTC options on Deribit

-

-

-

- Tether’s USDT Stablecoin Faces Regulatory Uncertainty as EU’s MiCA Regulation Takes Effect

- Dec 28, 2024 at 07:00 am

- Amid this uncertainty, many on crypto Twitter have been spreading FUD (fear, uncertainty, and doubt) about Tether, speculating on its compliance and future stability under the new rules.

-

-

-