|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Halving Triggers Volatility and Drives Market Speculation

Apr 22, 2024 at 10:09 pm

On April 19, 2024, Bitcoin experienced its fourth halving, reducing the block reward for miners by half. This significant event, which occurs approximately every four years, has historically influenced market speculation and volatility. Despite the halving, Bitcoin's price remained relatively stable, with experts expressing optimism about long-term upward pressure due to the asset's deflationary mechanism. The halving also led to a surge in transaction fees, with users spending over $2.4 million to secure transactions within the halving block.

Bitcoin Halving: Historical Event Triggers Market Volatility and Speculation

On April 19, 2024, Bitcoin underwent its fourth halving, a landmark event that reduced the block reward for miners by half, from 6.25 BTC to 3.125 BTC. This reduction in supply has historically had significant implications for the cryptocurrency market.

Market Speculation and Volatility Surge

"Less than 48 hours since the halving, we are witnessing a critical moment in the cryptocurrency market," said Ryan Lee, Chief Analyst at Bitget Research. "Historically, halving events have spurred intense market speculation and volatility, as the event regulates Bitcoin's supply."

Industry experts believe that the reduced supply could drive long-term upward pressure on Bitcoin's price due to its built-in deflationary mechanism.

Surge in Transaction Fees and Market Corrections

The halving coincided with a surge in transaction fees, as users competed for limited block space. The halving block itself witnessed a record-high fee of 37.6 BTC, equivalent to over $2.4 million.

Recent market corrections have also presented challenges for investors, but analysts predict significant opportunities ahead. "The investment logic remains sound, with a focus on BTC ETF fund flows in the short term, stablecoin market value in the medium term, and the Federal Reserve's Monetary Policy in the long term," added Lee.

Impact on Bitcoin Miners

The immediate impact of the halving is felt primarily by Bitcoin miners, whose profitability is affected by the reduction in block rewards. This could lead to changes in the cryptocurrency mining industry.

Bitcoin Price Remains Stable

Despite the significant event, the price of Bitcoin remained relatively stable at around $64,000, trading above the $65,000 mark. This could indicate the market's anticipation of the potential long-term benefits of the reduced supply.

Industry Reactions

"The halving event's consequences will extend beyond Bitcoin's price, representing an important turning point in the ecosystem," said Shivam Thakral, CEO of BuyUcoin. "Indian investors are closely monitoring the situation, as Bitcoin's gains and substantial market capitalization solidify its significance as an investment vehicle."

Parth Chaturvedi, Investments Lead at CoinSwitch Ventures, commented on the market trends: "The overall crypto M.Cap. is slightly below $2.5 trillion, with BTC's MVRV ratio falling below its 90-day average, suggesting a potential buying opportunity for investors. Whales have also accumulated a significant amount of BTC recently."

Historical Trends and Future Expectations

Historically, Bitcoin has rallied post halving. However, the relationship between halving events and price appreciation is not always straightforward and can be influenced by other market factors.

As the cryptocurrency market observes the aftermath of the Bitcoin Halving 2024, only time will tell if the historical trends will continue and what impact it will have on the broader market.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- Bonk Coin (BONK) Price Prediction 2023-2025: Will BONK Crypto Skyrocket Soon?

- Dec 24, 2024 at 12:55 am

- The Bonk price has performed positively and recorded a new all-time high (ATH) in November. After reaching an ATH, the Bonk coin price displayed a slow and steady fall and underwent a correction phase.

-

- Top 5 Meme Coins to Buy and Hold for Long-Term Gains

- Dec 24, 2024 at 12:55 am

- While traditional markets grapple with uncertainty, meme coins are proving their resilience and excitement. From established players like Dogecoin and Shiba Inu to rising stars like Pepe Coin and Bonk, there’s plenty to explore. But the showstopper right now is BTFD Coin (BTFD), whose presale is not just making waves but also turning back the clock to offer Stage 7 pricing, a rare opportunity for investors seeking substantial returns.

-

-

- Memecoin HAWK, Tied to Internet Celebrity “Hawk Tuah Girl” Haliey Welch, Sued by Investors for Alleged Securities Law Violations

- Dec 24, 2024 at 12:50 am

- The team behind the memecoin HAWK, tied to internet celebrity Haliey “Hawk Tuah Girl” Welch, has been sued by a group of investors for alleged violations of securities laws.

-

-

- 3 Altcoins That Will Explode in 2025, According to a Crypto Billionaire

- Dec 24, 2024 at 12:46 am

- The young investors are wary of the tokens that have the possibility of making them a fortune, especially as all signs seem to be pointing towards a huge bull run for the crypto market in 2025. Although Bitcoin (BTC) and Ethereum (ETH) are usually the safe bets, a crypto billionaire has found three altcoins that will take the front stage and provide significant gains: Rexas Finance (RXS), Sui (SUI), and Jupiter (JUP).

-

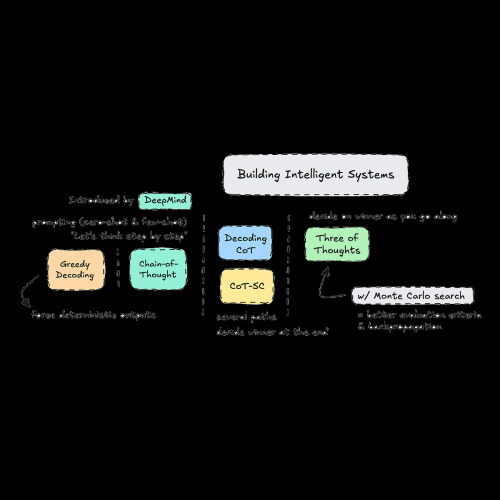

- Advanced Prompt Engineering: Chain of Thought (CoT)

- Dec 24, 2024 at 12:45 am

- Comparing different techniques for reasoning

-