|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Halving Incoming: Market Turbulence Looms

Apr 15, 2024 at 08:32 pm

As the highly anticipated Bitcoin halving approaches, analysts express caution, foreseeing a turbulent aftermath. Markus Thielen of 10x Research predicts a potential flood of Bitcoin into the market as miners sell their newly minted digital assets, possibly causing a $5 billion sell-off and a prolonged period of uncertainty for Bitcoin's trajectory.

Bitcoin Halving: Analysts Brace for Market Turbulence

As the highly anticipated Bitcoin halving draws near, analysts are sounding the alarm, predicting a potential storm in the cryptocurrency markets. The halving, scheduled to occur in early April 2024, marks a significant event where the block reward for Bitcoin miners will be reduced by half.

Historical Patterns Fuel Uncertainty

Markus Thielen, head of research at 10x Research, has conducted thorough analysis and foresees a post-halving landscape rife with uncertainty. He warns that Bitcoin miners, flush with freshly minted Bitcoin, may opt to cash in on their digital assets, triggering a mass exodus of BTC onto the market. Thielen estimates that this could amount to a staggering $5 billion, sending shockwaves through the crypto universe.

Prolonged Aftermath and Market Stagflation

The fallout from this miner selling, Thielen predicts, could reverberate for four to six months, casting doubt over Bitcoin's trajectory. This period of uncertainty could usher in a "summer lull," where Bitcoin prices stagnate, mirroring the post-halving slumber observed in previous years.

Historical Precedents and Market Psychology

Thielen draws parallels to the 2020 halving, where Bitcoin prices languished between $9,000 and $11,500 in the aftermath. If his predictions hold true, a similar fate may befall Bitcoin enthusiasts in the coming months.

Pre-Halving Rally and Market Volatility

However, prior to the halving, miners often hoard Bitcoin, creating a supply/demand imbalance that fuels a pre-halving rally. This phenomenon, Thielen notes, has already manifested in the form of a 74% surge in Bitcoin prices in 2024, culminating in an all-time high of $73,734. However, the subsequent correction to below $63,000 serves as a stark reminder of the inherent volatility in the cryptocurrency markets.

Altcoin Impact and Market Correlation

Thielen warns that altcoins may bear the brunt of the post-halving fallout. With many altcoins plummeting in recent weeks, a resurgence seems unlikely in the near term. Even if a correlation between the halving and an altcoin rally exists, Thielen asserts that historical evidence suggests the rally typically kicks off almost six months later.

Miners' Inventory and Market Liquidity

As the countdown to the halving ticks away, Marathon, a leading Bitcoin mining behemoth, has made strategic preparations. Thielen suggests that Marathon has stocked its inventory in anticipation of the storm ahead, planning a gradual liquidation post-halving to maintain financial stability. Other miners are expected to follow suit, offloading their inventory to prevent a revenue cliff.

Break-Even Rates and Market Dynamics

Marathon CEO Peter Thiel has revealed the company's break-even rate post-halving to be $46,000 per BTC. This suggests that miners will need to sell Bitcoin at or above this price to remain profitable. Such an influx of Bitcoin onto the market could counteract the supply/demand dynamics that fueled the pre-halving rally.

Unpredictability and Market Uncertainty

As the cryptocurrency world braces for the halving, one thing remains certain: uncertainty reigns supreme. While Thielen provides valuable insights based on historical patterns, the cryptocurrency markets are notoriously unpredictable. Whether Bitcoin will emerge from the storm unscathed or succumb to market forces remains to be seen.

Conclusion

The Bitcoin halving is an event that has historically caused significant market volatility and uncertainty. While analysts like Thielen provide valuable insights, it is important to remember that the cryptocurrency markets are unpredictable. Investors should exercise caution and conduct thorough research before making any investment decisions, especially during periods of heightened uncertainty.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

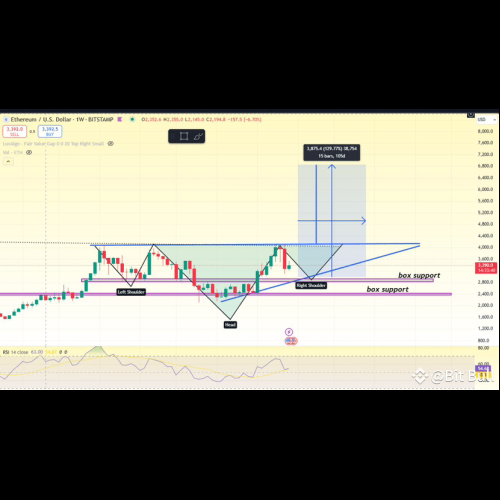

- Ethereum (ETH) Forms Bullish Inverse Head and Shoulders Pattern, Targeting $6,800–$7,000

- Dec 29, 2024 at 09:10 pm

- This chart shows an inverse head and shoulders pattern for Ethereum (ETH) on the weekly timeframe. The pattern is a bullish reversal signal, typically indicating that the price may rise significantly after completing the formation.

-

-

-

-

-

-

-

- ChatGPT Picks Remittix (RTX) As The Next Crypto Gem

- Dec 29, 2024 at 09:05 pm

- In the cryptocurrency market, identifying the next big mover is not a small task. That is why we decided to use ChatGPT, the AI that is famous for its analytical capabilities, to find a low market cap token that can surpass giants such as Solana (SOL) and Ripple (XRP).

-