|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Halving: Historical Perspective and Impending Event

Mar 23, 2024 at 05:10 pm

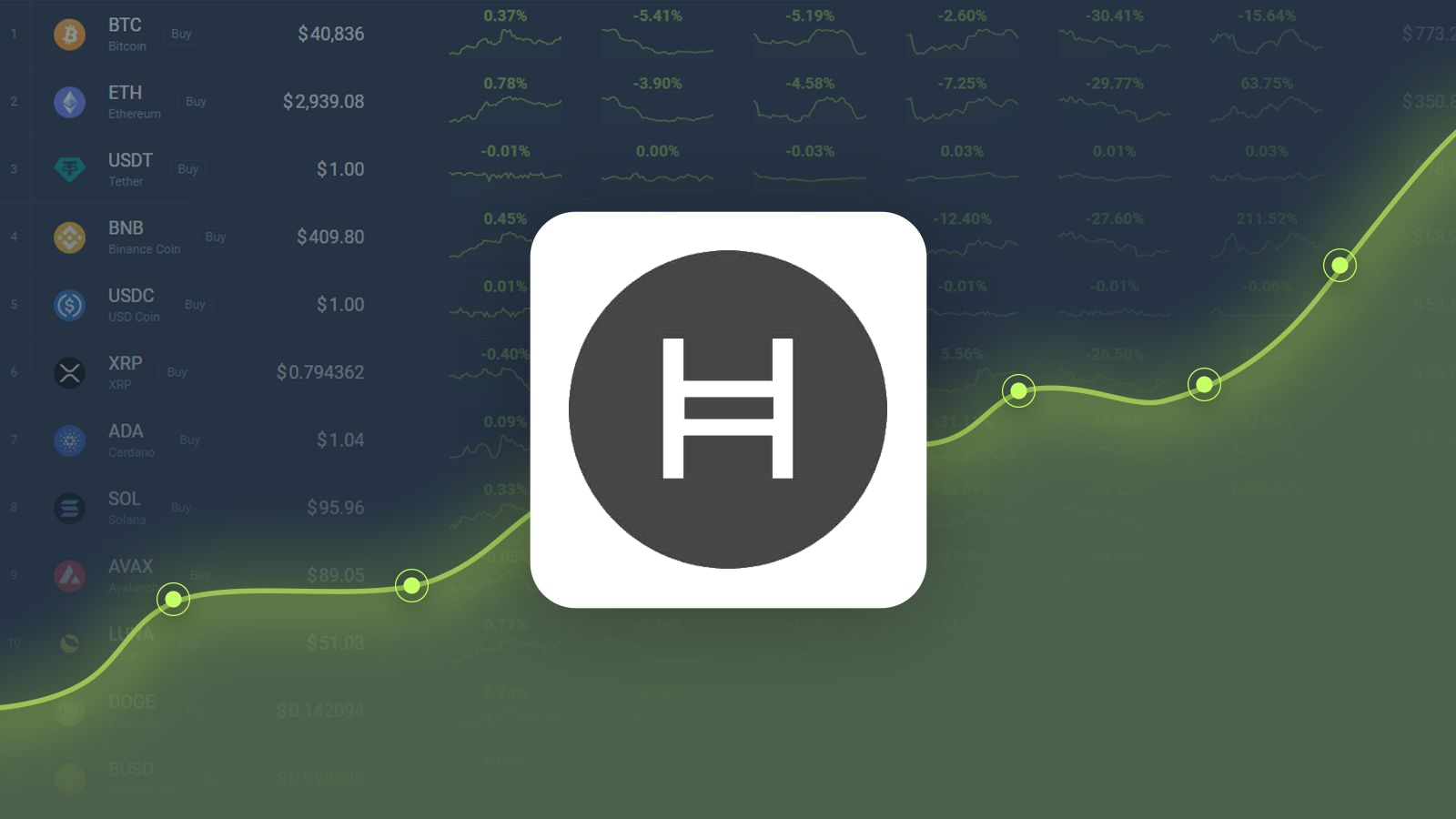

Every four years, the Bitcoin supply undergoes a "halving," where block rewards get halved. This pivotal event directly impacts the rate of new Bitcoins entering circulation. The Bitcoin Halving History Chart provides a visual representation of these halvings, displaying the dates, reward adjustments, and price fluctuations to help comprehend the cyclical patterns that may influence the cryptocurrency market.

Bitcoin Halving: A Historical Perspective and Upcoming Event

Every four years, the Bitcoin network undergoes a significant event known as "halving." This event marks a reduction in the block reward granted to miners, which has a direct impact on the issuance rate of new bitcoins. The halving day is a pivotal occurrence in the cryptocurrency landscape, influencing market dynamics and investor sentiment.

Historical Bitcoin Halvings

The Bitcoin Halving History Chart provides a visual representation of the chronological sequence and impact of halving events. It typically displays the dates of halvings, the accompanying changes in mining rewards, and often incorporates historical Bitcoin price fluctuations. These charts offer valuable insights into the cyclical patterns of Bitcoin's supply and its potential impact on the market.

First Halving

The inaugural Bitcoin halving took place on November 28, 2012, after the network verified 210,000 blocks. The block reward for miners was slashed in half from 50 to 25 bitcoins. At the time of the halving, Bitcoin traded at approximately $12.20. Notably, the halving triggered a bull market, with Bitcoin prices surging to $1,000 by the end of 2013.

Second Halving

Four years later, on July 9, 2016, the second halving occurred at block 420,000. This event resulted in a further reduction in mining rewards, from 25 to 12.5 bitcoins per block. While there was initial uncertainty surrounding Bitcoin prices ahead of the halving, the asset was trading at $650.3 during the event. In May 2017, BTC gained significant traction, eventually reaching a peak of $19,188 by December of the same year.

Third Halving

The third halving took place on May 11, 2020, following the processing of 630,000 blocks. The reward for miners was halved from 12.5 to 6.25 bitcoins per block. This occurrence coincided with Bitcoin's increasing recognition and adoption within the financial industry. BTC began trading at $8,821.42 and quickly rallied to $10,943 within 150 days. In November 2021, the asset reached its all-time high of $69,000.

Upcoming Fourth Halving

According to CoinMarketCap, the next Bitcoin halving is anticipated to occur on April 17, 2024, after 840,000 blocks have been processed. Miners can expect their rewards to be reduced further from 6.25 to 3.125 bitcoins per block. This event has garnered significant attention and speculation among enthusiasts and investors, who are eagerly awaiting its potential impact on the market.

Potential Impact of the Upcoming Halving

Experts anticipate that the upcoming halving could diverge from historical trends due to the emergence of spot Bitcoin ETFs. These financial instruments provide greater accessibility and ease of investment for a wider range of participants, including investors, financial advisors, and capital allocators.

The approval of US spot Bitcoin ETFs resulted in $1.5 billion in net inflows within the first 15 trading days, representing a three-month equivalent of sell pressure post-halving. This suggests that continued net inflows could potentially offset the sell pressure from mining issuance and positively influence Bitcoin's market structure.

Historical Trend Analysis

Throughout history, Bitcoin halvings have typically led to price increases, although the magnitude and timing have varied. Halvings effectively reduce the issuance rate of new bitcoins, leading to a decrease in supply and potentially triggering bullish market responses. However, it is important to note that a variety of factors, including market sentiment, investor behavior, and global economic conditions, can influence the precise outcome.

Conclusion

The Bitcoin halving is a significant event that has played a pivotal role in the asset's history. By reducing the block reward, halvings impact the supply of new bitcoins and have historically led to price fluctuations. The upcoming halving in 2024 is particularly noteworthy due to the potential impact of spot Bitcoin ETFs. While past halvings provide valuable insights, it remains crucial to consider the unique circumstances and market dynamics that may shape the outcome of this upcoming event.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- Guardarian Now Supports Direct $USD to $XEC ($eCash) On-Ramps, Targets Global Accessibility

- Nov 24, 2024 at 08:45 am

- Guardarian, a trusted name in the crypto ecosystem, now supports direct $USD to $XEC on-ramps. This advancement in the field of crypto simplifies the process of acquiring eCash ($XEC).

-

-

- The Best Color Combinations for Elf Decks in Magic: The Gathering

- Nov 24, 2024 at 08:25 am

- Elves are one of the quintessential creature types in Magic: The Gathering. With thousands of creatures out there that all share the same creature typing, across all colors in the game, you might be wondering which color or combination of colors you'll want to land on when building your deck.

-

-

- Bitcoin (BTC) Price Prediction: CUTO Token Outperforms BTC as Gold ETFs See Largest Outflows in Years

- Nov 24, 2024 at 08:20 am

- Top gold ETFs are seeing their largest outflows in years; meanwhile, Bitcoin (BTC) is inching closer to the prophesied $100,000 mark and the entire crypto market is trembling in anticipation.

-

-

-

-