|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Could Flip Gold as the Premier Store of Value, Says Jurrien Timmer, Fidelity's Director of Global Macro

Mar 30, 2025 at 09:37 am

Jurrien Timmer, the director of global macro at Fidelity, has weighed in on the Bitcoin vs. gold debate, stating that the premier asset could come out tops soon.

Jurrien Timmer, the director of global macro at Fidelity, has weighed in on the Bitcoin (BTC) vs. gold debate, stating that the premier asset could come out tops soon.

Both Bitcoin and gold are considered stores of value due to their scarce nature and have continued to thrive in harsh market circumstances, with Bitcoin outperforming in the last decade.

While the difference in valuation between gold and Bitcoin is miles off in the current market, analysts believe the pioneering cryptocurrency will catch up due to its impressive growth pace. Timmer shares this sentiment as he shared his thoughts on the topic yesterday.

Bitcoin Flipping Gold Is Much Possible

In an X post on March 28, Timmer highlighted the possibility of Bitcoin outperforming gold. The Fidelity executive insisted that the digital asset could accomplish the daunting feat but admitted it would not happen anytime soon.

Timmer shared a permutation on the possible timeline for Bitcoin to match and disrupt gold’s supremacy. He highlighted that the precious metal’s valuation has appreciated at a compound annual growth rate (CAGR) of 8% since 1970, with the asset up 17% already this year.

His analysis suggested that if gold grows at this rate and Bitcoin follows either the power law curve or the internet S-curve model, the cryptocurrency could catch up in ten to twenty years. An accompanying chart shows that following the power curve model would see Bitcoin match gold’s valuation by 2035.

Bitcoin vs Gold Valuation Curve

However, the internet S-curve model, which indicates Bitcoin’s price correlation with its adoption rate, would take much longer, with Timmer suggesting a 20-year timeframe for Bitcoin to match gold using the metric. Nonetheless, the Fidelity executive noted that gold may always be “Bitcoin’s quieter older sibling” if it accelerates its growth past the 8% CAGR.

Bitcoin’s Price Based on This Theory

Meanwhile, if gold grows hypothetically at 8% per annum from its current price of $3,085 (leaving behind its 17% rally so far this year), the asset will trade at $6,660 per ounce in 2035. Assuming its above-ground stock remains at approximately 6.7 billion ounces, gold’s market cap would hit $44.62 trillion, nearly 116% up from its current valuation of $20.67 trillion.

From Timmer’s assertion, Bitcoin would match gold’s valuation in 2035 using the power law projection. This means that the pioneering cryptocurrency would hypothetically hit a market cap of $44.62 trillion a decade from now.

Hence, with a hypothetically unchanged Bitcoin supply of 19.84 million and a market cap of $44.62 trillion, the crypto leader would reach $2.25 million per coin by 2035.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- Binance and Kraken Delisted Tether's USDt (USDT) Spot Trading Pairs in the EEA to Comply with Markets in Crypto-Assets Regulation (MiCA)

- Apr 02, 2025 at 03:55 am

- The European cryptocurrency market is undergoing a profound transformation as major exchanges, led by Binance and Kraken, implement significant changes

-

-

-

-

-

- Bitcoin (BTC) price breaks above $85,000 as institutional investors continue to accumulate the digital asset

- Apr 02, 2025 at 03:45 am

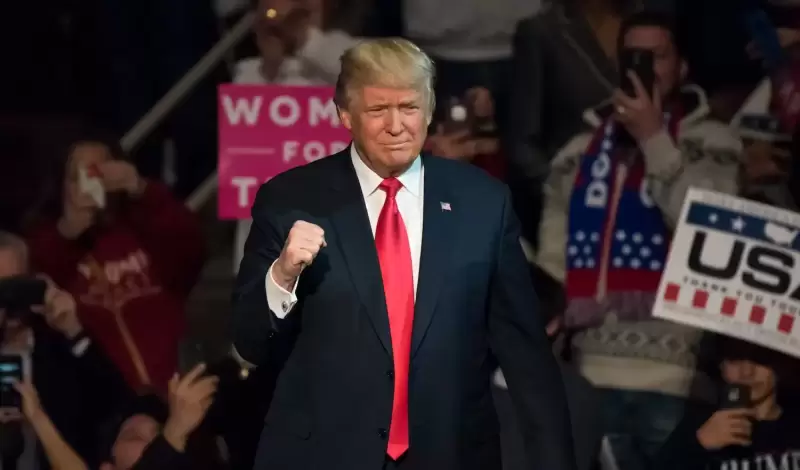

- The price movement comes as markets anticipate President Donald Trump's upcoming tariff announcement, with some reports suggesting the measures may be less severe than initially feared.

-