|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin ETPs Lit Up 2024, but How Long Will This Blaze Burn?

Jan 13, 2025 at 11:39 pm

The launch of spot exchange-traded products (ETPs) for Bitcoin (BTC) in 2024 had a transformative impact on the crypto market, leading to institutional adoption and market expansion.

According to JPMorgan analyst Kenneth B. Worthington, in a year that saw the total market cap for crypto nearly double, ETPs played a crucial role in boosting accessibility and lending legitimacy to digital assets.

"The institutional interest in crypto was palpable in 2024, and ETPs served as a gateway for traditional finance to enter the crypto arena," Worthington said.

The entry of crypto ETPs into the scene saw hedge funds, pension managers, and wealth advisors flocking to Bitcoin ETPs, driving up market confidence and highlighting the merging of TradFi and crypto.

With an impressive flow of around $36 billion in net new assets into Bitcoin ETPs in just a year, the IBIT from BlackRock (NYSE:BLK) led the pack, generating an incredible $38 billion in net sales.

On the other hand, Grayscale had a bumpier ride, shedding $22 billion after converting its Bitcoin Trust into an ETP. However, its new retail-friendly BTC vehicle managed to attract around $900 million.

The entry of crypto ETPs in 2024 had a significant impact on the financial landscape, with a few key players reaping the rewards of this merging landscape.

"BlackRock, Coinbase, and Virtu emerged as the clear winners, reaping the benefits of a crypto renaissance," Worthington added.

Among them, BlackRock saw an estimated $54 million revenue boost, thanks to its iShares lineup of Bitcoin ETPs. At the same time, Coinbase (NASDAQ:COIN) thrived as a custodian and trading partner, riding high on increased token volumes.

Meanwhile, Virtu (NASDAQ:VIRT) capitalized on its role as a market maker across all 11 Bitcoin ETPs, a strategy that paid off handsomely.

"As we look ahead to 2025, the future of crypto ETPs will be largely determined by regulatory dynamics," Worthington said.

While new products, such as those featuring tokens like Solana (SOL) and Ripple (XRP), await SEC approval, the analyst anticipates that investor demand may be tepid.

"The next wave of crypto ETPs might be less about introducing new assets and more about refining the crypto infrastructure itself," he concluded.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- The Lazarus Group has already laundered all the unfrozen funds it stole from the recent Bybit hack

- Mar 05, 2025 at 10:25 am

- Arkhaim Intelligence, the blockchain analytics platform, revealed a new development in the recent Bybit hack. The firm posted a bounty for information about the incident, discovering that the Lazarus Group was responsible.

-

-

-

![Bitcoin's [BTC] price has been 'extremely' volatile lately, and exchange flows reveal why Bitcoin's [BTC] price has been 'extremely' volatile lately, and exchange flows reveal why](/assets/pc/images/moren/280_160.png)

- Bitcoin's [BTC] price has been 'extremely' volatile lately, and exchange flows reveal why

- Mar 05, 2025 at 10:25 am

- Bitcoin's [BTC] price has been 'extremely' volatile lately, and exchange flows reveal why. On the 25th of February, approximately 8.4K BTC moved into exchanges, signaling sell pressure.

-

-

-

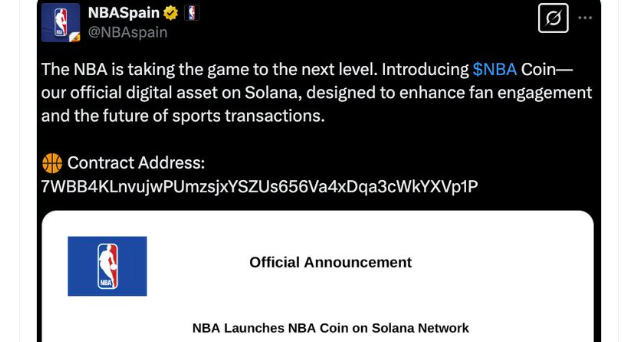

- NBA and NASCAR Coins Were Red Hot, but Buzz About New Coins Was Quickly Attributed to Hacked Social Media Accounts

- Mar 05, 2025 at 10:25 am

- Crypto coins and digital currency are red-hot, but buzz about new NBA and NASCAR coins Tuesday was quickly attributed to their respective social media accounts being hacked.

![Bitcoin's [BTC] price has been 'extremely' volatile lately, and exchange flows reveal why Bitcoin's [BTC] price has been 'extremely' volatile lately, and exchange flows reveal why](/uploads/2025/03/05/cryptocurrencies-news/articles/bitcoin-btc-price-extremely-volatile-exchange-flows-reveal/img-1_800_480.jpg)