The emergence of Bitcoin ETFs has revolutionized access to digital assets, attracting traditional investors and igniting market growth. The approval of the Bitcoin ETF in January 2023 marked a turning point, triggering capital inflows and price surges. Key players like BlackRock and Fidelity Wise Origin Bitcoin Fund have consolidated their ETF leadership, reflecting the growing appetite for cryptocurrency investments.

The Dawn of Bitcoin ETFs and the Symbiosis of Artificial Intelligence in Reshaping the Financial Landscape

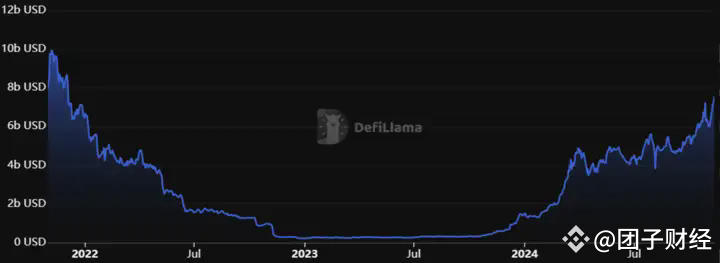

The advent of Bitcoin exchange-traded funds (ETFs) has ignited a surge of interest in the cryptocurrency realm during this calendar year, heralding a new era of accessibility for conventional investors seeking exposure to the burgeoning digital asset class. The long-awaited anticipation for a spot Bitcoin ETF last year served as a catalyst for the market's resurgence, propelling valuations to unprecedented heights not witnessed since the halcyon days of 2021.

The pivotal moment arrived on January 11, when the Bitcoin ETF received regulatory approval, triggering an unprecedented frenzy of activity characterized by substantial capital inflows and an extraordinary price surge during the opening quarter of the year. This development marked a profound shift in investor sentiment, with established market titans such as BlackRock, Vanguard, and State Street solidifying their dominance in the ETF arena. A notable exemplar is the Fidelity Wise Origin Bitcoin Fund, which has garnered an impressive $10 billion in assets under management, indicative of the robust appetite for novel investment opportunities within the thriving cryptocurrency market.

Concurrently with the ascent of ETFs, the burgeoning field of artificial intelligence (AI) is capturing the attention of investors, further diversifying investment strategies and contributing to the evolution of the financial markets landscape. The convergence of ETF innovation and AI-driven investment approaches underscores the overarching trend of technology integration that is reshaping traditional financial paradigms, positioning the industry for sustained growth and adaptation in the digital age.

As the cryptocurrency market continues to mature, fueled by the momentum of ETF adoption and technological innovation, analysts maintain a bullish outlook for the sector's prospects. They anticipate further market highs amidst unwavering enthusiasm and the impending Bitcoin halving event, which holds the potential to catalyze renewed market momentum and investor confidence.

The halving event, scheduled to occur in mid-2024, is a predetermined protocol upgrade in which the block reward for Bitcoin miners is halved. This event historically has coincided with significant price increases, as it reduces the supply of new Bitcoins entering the market, thereby increasing scarcity and potentially driving up demand.

The confluence of ETFs and AI in the financial markets represents a transformative era, characterized by increased accessibility, diversification, and technological sophistication. As these innovations continue to evolve, they are poised to reshape the way investors navigate the complex and ever-changing landscape of modern finance.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.