|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Emerges as a Bastion of Resilience in Market Turmoil, Bolstered by Institutional Adoption and Long-Term HODLing

Apr 05, 2024 at 05:01 pm

Bitcoin has experienced a recent price increase, rising between $65,402.37 and $69,291.25. This upturn is driven by factors such as the DWS Group's introduction of exchange-traded commodities backed by Bitcoin, boosting investor trust. Additionally, the surge in Bitcoin transfers to accumulation addresses, reflecting long-term investments by "HODLers," has reduced market supply, leading to increased demand and price appreciation.

Amidst the recent market turbulence that sent shivers down the spines of crypto investors, Bitcoin has emerged as a beacon of resilience, demonstrating its enduring strength and unwavering appeal. While its price has undergone significant fluctuations, analysts remain optimistic, viewing the current correction as a necessary precursor to further bullish momentum.

Bitcoin's Market Performance: A Rollercoaster Ride with a Glimmer of Hope

In the past 24 hours, Bitcoin has embarked on a modest recovery, climbing by 2.07% to momentarily touch $67,112. This uptick, albeit small, has provided a glimmer of hope amidst the recent market turmoil. Bitcoin's market dominance remains unyielding, as it continues to reign supreme with a market capitalization of approximately $1.32 trillion. Its trading volume has also witnessed a surge of 8.33%, reaching $36.21 billion over the past day.

The Allure of Bitcoin: Scarcity and Resilience in a Volatile Market

Since its inception, Bitcoin has weathered countless storms, proving its resilience in the face of market volatility. Its scarcity, with a limited supply capped at 21 million BTC, has played a pivotal role in its allure, contributing to its significant market value. This inherent scarcity has created a sense of urgency among investors, who recognize the finite nature of this digital asset.

Driving Forces Behind Today's Bitcoin Price Surge

The recent uptick in Bitcoin's price can be attributed to a confluence of factors that have instilled renewed confidence among investors.

1. DWS Group Partnership: Paving the Way for Institutional Adoption

A strategic partnership between DWS Group and Galaxy Digital Holdings Ltd. has paved the way for the introduction of two novel exchange-traded commodities (ETCs): the Xtrackers Galaxy Physical Bitcoin ETC securities and the Xtrackers Galaxy Physical Ethereum ETC securities. These ETCs, listed on Deutsche Börse, are backed by Coinbase and Zodia Custody, providing investors with added layers of protection.

This partnership is a testament to the growing recognition of Bitcoin and other digital assets among institutional investors. The launch of these ETCs has opened up new avenues for investors seeking exposure to Bitcoin without the complexities associated with direct ownership.

2. Accumulating Addresses: A Vote of Confidence for Bitcoin's Long-Term Prospects

A surge in the accumulation of Bitcoin into long-term storage addresses has also played a significant role in the recent price increase. These addresses, owned by investors known as "HODLers," represent a strong belief in Bitcoin's long-term value proposition. By continuously purchasing more Bitcoin and refraining from selling, these investors are effectively reducing the supply available in the market, thereby driving up demand and, consequently, price.

Conclusion: Bitcoin's Enduring Appeal in a Dynamic Market

The current volatility in the Bitcoin market is a natural part of its evolutionary journey towards becoming a more established asset class. While corrections are an inherent part of any market, Bitcoin has repeatedly demonstrated its resilience and ability to bounce back stronger. Today's price increase, fueled by strategic partnerships and a surge in accumulation addresses, underscores the ever-growing appeal of this transformative digital asset.

As the crypto landscape continues to evolve, Bitcoin remains a beacon of innovation and disruption. Its enduring appeal, coupled with its scarcity and resilience, positions it as a formidable force in the global financial arena, with the potential to revolutionize the way we perceive and interact with value.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

- Bitcoin and Ethereum in Trouble, Ripple Going Against the Tide

- Nov 18, 2024 at 09:40 pm

- The crypto market experienced a widespread decline at the end of the week. Bitcoin fell by 2%, Ethereum dropped by 4%, and Solana by 3%. This weakness among the leaders was accompanied by an uncertain macroeconomic context, marked by regulatory pressures and massive BTC sales by miners. Despite this gloomy atmosphere, Ripple (XRP) surprised with a spectacular increase of over 20%. Investors remain alert and are looking to adapt to this extreme volatility.

-

-

- Big Time Studios Announces New Marketplace Utility Token $OL

- Nov 18, 2024 at 09:35 pm

- The token won't be sold or distributed to investors or even the Big Time Studios team. Instead the fair launch will be distributed via a points system that users of Big Time's Open Loot marketplace will earn as they complete various activities on the platform.

-

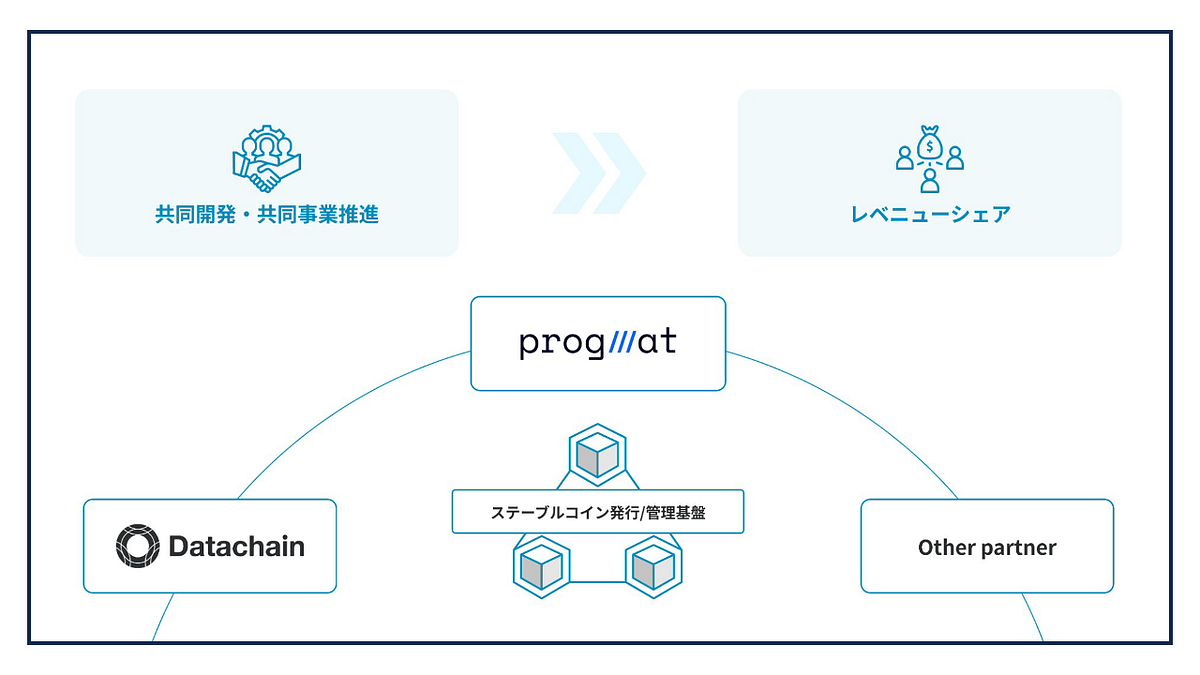

- Datachain & Progmat agree on revenue share for stablecoin business

- Nov 18, 2024 at 09:35 pm

- Datachain Corporation has reached an agreement with Progmat on a revenue sharing contract in the stablecoin business. Under this contract agreement, Datachain will receive a portion of the revenue generated from stablecoins issued through “Progmat Coin,” Progmat’s stablecoin issuance management platform.