|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Consolidation: A Golden Opportunity for Accumulators

Aug 17, 2024 at 04:00 pm

Bitcoin recently crossed the $50,000 mark in early August, marking an impressive 20% increase. However, since this price surge, the cryptocurrency seems

Bitcoin price recently crossed the $50,000 mark in early August, notching up an impressive 20%. However, following this price surge, the cryptocurrency seems trapped in a narrow range, oscillating between $57,000 and $63,000. For many, this stagnation is synonymous with boredom.

But, while some traders yawn in boredom observing this consolidation, others see a golden opportunity. These individuals, whether they are large investors or convinced HODLers, continue to accumulate Bitcoin.

A tedious consolidation? At first glance, Bitcoin’s lateral evolution may seem monotonous. After reaching some peaks, the cryptocurrency settled into a narrow price range, which can give the impression that the momentum has slowed.

Impatient traders may feel frustrated, waiting for a spectacular breakout that, for now, remains elusive. But behind this apparent stagnation, intense activity is unfolding.

Data from Glassnode reveals that, despite the consolidation, addresses accumulating bitcoin are on the rise. The accumulation trend score (ATS) for Bitcoin recently reached the maximum value of 1.0, indicating a massive return to accumulation.

Who are these accumulators? Essentially, large entities such as institutions and whales, who are taking advantage of this period of low prices to strengthen their positions. Far from being bored, these players see this phase as a strategic buying opportunity.

The true winners of the consolidation HODLers, those long-term investors who hold onto their Bitcoins despite market fluctuations, are rejoicing in this consolidation phase.

While short-term speculators grow weary and abandon their positions, HODLers continue to accumulate. According to the latest analysis, over 300,000 BTC have been added to long-term holders’ (LTH) wallets in the past three months.

This massive movement towards accumulation shows renewed confidence in Bitcoin’s future. The ratio between long-term holders and short-term holders has increased by 8.7% over the past month, indicating that LTHs now hold an increasing share of the market.

This dynamic has a stabilizing effect on Bitcoin’s price by reducing the volatility caused by short-term speculators’ quick sales. Thus, this tedious phase for some turns out to be a period of strengthening for those who believe in Bitcoin’s long-term potential.

A consolidation that could precede a Bitcoin explosion As Bitcoin continues to move laterally, investors wonder what lies ahead.

For aggressive traders, this phase is an invitation to buy the dip, betting on an imminent price surge. For the more conservative, patience is key, waiting for clear signals before jumping in. A breakout above $63,000 could trigger a new bullish wave, pushing Bitcoin towards the multi-month resistance zone between $70,000 and $72,000.

The increased demand from HODLers, combined with the continued accumulation by large entities, could well be the catalyst for a new price explosion. The accumulation signals are strong, and once conditions align, the market could experience a spectacular rally.

But in the meantime, patience remains key. This consolidation could last a while longer, but for those accumulating, boredom is just a necessary step towards potential gains.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

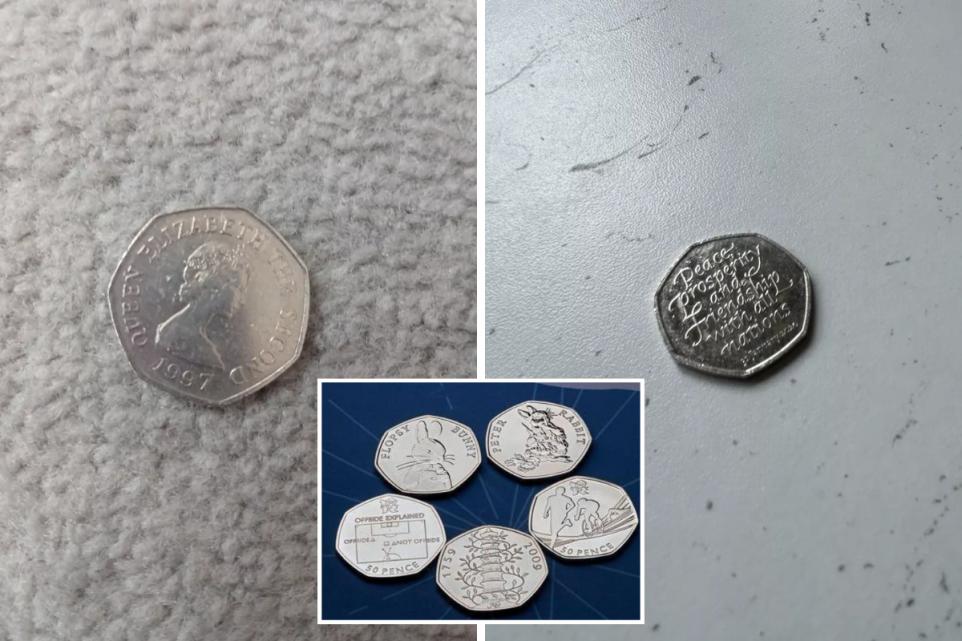

- The Fascinating World of Rare British 50p Coins: From Benjamin Bunny to Kew Gardens

- Nov 23, 2024 at 04:25 am

- The world of coin collecting has seen a surge in interest over the years, with certain rare coins fetching eye-watering prices at auctions and on marketplaces like eBay. Among the most sought-after coins in the UK are 50p pieces, particularly those that feature unique designs or commemorate significant national events.

-

- The King Charles III 50p Coin: A New Era of Collectibles

- Nov 23, 2024 at 04:25 am

- The Royal Mint has released a series of 50p coins featuring the portrait of King Charles III, but one particular coin has quickly surpassed even the iconic Kew Gardens 50p coin in terms of desirability. With the growing interest in coin collecting, it’s now more important than ever to check your change — you may be holding onto a hidden treasure that could be worth much more than its face value.

-

-

-

- XRP (XRP) Keeps Attracting Interest With Its Increasing Price Trajectory as Rexas Finance (RXS) Emerges a Possible Rival

- Nov 23, 2024 at 04:25 am

- XRP has increased 4.34% over the previous 24 hours, raising its market capitalization above $65 billion. With analysts speculating about the likelihood of a major price breakout, this little movement has driven forecasts that XRP might shortly break $1.50. But another growing star in the crypto scene while the globe observes XRP’s every action is Rexas Finance (RXS). A Ripple millionaire sees this coin as a major rival to XRP’s supremacy since he believes it might soar by an amazing 19,900% to $16 in the next 70 days or less.